Ethereum Rises As Altcoin Season Fear Eases And Select Tokens Join The Move

Ethereum shakes off the altcoin anxiety—and a handful of other tokens are catching the updraft.

The Fear Subsides

Remember the chatter about a brutal altcoin season? That noise is fading fast. The market's collective sigh of relief is palpable, shifting sentiment from defensive to cautiously opportunistic. It's not a free-for-all, but the door is cracking open for selective moves.

Ethereum Leads the Charge

All eyes are on ETH. It's not just holding ground; it's pushing upward, acting as the tide lifting a select few boats. This isn't a broad-based rally fueled by memes and blind hope—it's a more calculated climb, with capital flowing toward established projects with clear utility.

The Selective Surge

Don't call it a comeback for every token on the list. This move is picky. A curated group of assets is joining Ethereum's ascent, their gains reflecting specific catalysts and renewed developer activity. The rest? They're watching from the sidelines, a reminder that in crypto, fundamentals can still matter—occasionally.

The New Calculus

The playbook is changing. Traders are bypassing the scattergun approach, targeting protocols with proven networks and tangible roadmaps. It's a shift from gambling on hype to assessing actual throughput and adoption—a novel concept for an industry that sometimes confuses a Twitter thread with a business model.

The rally feels different this time. More deliberate, less manic. Whether it's sustainable or just another setup for the usual Wall Street rug-pull masquerading as innovation remains the billion-dollar question. For now, the momentum is building, one verified contract at a time.

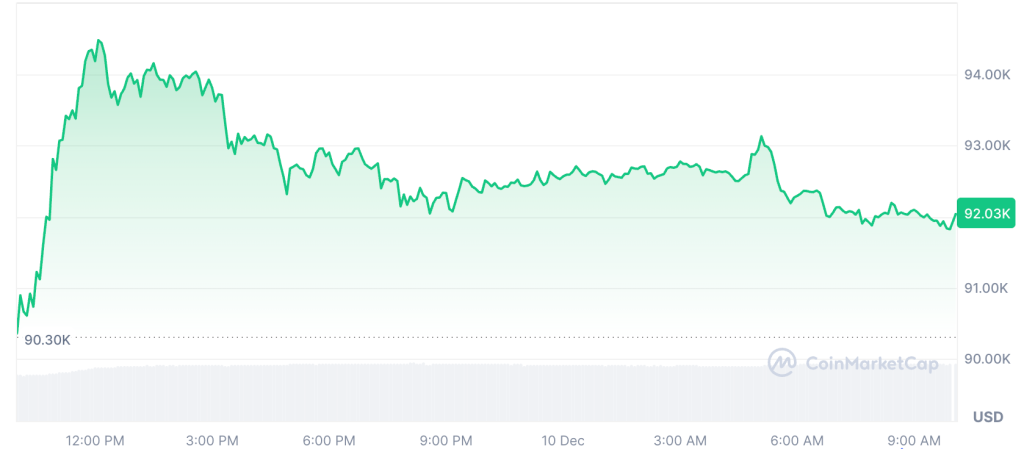

Bitcoin Price (Source: CoinMarketCap)

Ethereum sits at the center of that shift as its performance often sets expectations for how much risk the market is willing to take.

Ethereum Extends Its Climb On Firmer Market Structure

Ethereum (ETH) is currently trading around $3,330, up by about 7% over 24 hours, and the increase is supported by an improvement in both spot and derivatives participation, with deeper books and steadier bidding in ranges that had previously struggled to hold during last week’s retreat.

Activity across major venues indicates that traders who had reduced exposure during the November drawdown are gradually re-entering positions, not because sentiment has shifted dramatically, but because the asset’s day-to-day usage and continued demand for block space provide a degree of stability even when the wider environment remains cautious.

This pattern allows ethereum to function as an early gauge of whether the current relief has staying power, since its liquidity and scale often give it the ability to recover before smaller assets regain enough confidence to follow.

Monero Gains As Privacy Demand Holds Steady

Monero (XMR) is trading near $404, up by roughly 12% in 24 hours, and the climb aligns with periods in which privacy-oriented tokens receive renewed attention from communities that maintain consistent usage regardless of broader sentiment shifts.

The MAGIC Monero Fund has started a second fundraiser to further increase Monero's fuzzing harnesses!

'The goal of this proposal is to continue working with AdaLogics to improve the overall code coverage of Monero in general.' https://t.co/8QMBp9XeVm

Depth across several exchanges shows more orderly conditions than last week, with a distribution of bids that implies steady interest rather than isolated buying, which is notable because privacy assets often strengthen when markets search for tokens with established user bases and reliability rather than speculative catalysts.

Mantle Tracks Layer 2 Engagement As Liquidity Improves

Mantle (MNT) is trading near $1.20, up by about 7% in 24 hours, supported by consistent throughput and engagement across the LAYER 2 ecosystem that underpins its value.

The token has climbed back above ranges that came under pressure during last week’s downturn, and turnover now sits noticeably higher than the levels seen during the most severe portion of the recent selloff.

This behavior aligns with the tendency for infrastructure and scaling tokens to recover earlier than many smaller assets when sentiment begins to ease, because they rely on live activity and measurable network growth rather than short-term narrative swings.

Altcoin Season Still Out Of Reach Despite Signs Of Relief

The rise in the market sentiment and today’s scattered gains among Ethereum, Monero, and Mantle demonstrate that the market is willing to experiment with selective positioning, yet the structure of flows suggests that a broad altcoin season remains distant.

Bitcoin continues to anchor sentiment near $92,000, and most major tokens remain confined to narrow ranges while participants wait for clearer macro signals, steadier global liquidity conditions, and confirmation that the recent improvement does not fade with the next shift in funding or equities.

For now, the recovery resembles the early-stage attempt to stabilize rather than the altcoin season ready for wide rotation, although the presence of consistent activity in a few established networks shows that the market has not fully retreated from altcoin exposure even as caution remains the prevailing influence.