Tether Freezes $3.3B USDT as New Data Reveals 30x Gap With USDC

Tether just pulled the plug on a staggering $3.3 billion in its own stablecoin. The move drops as fresh data exposes a chasm between the two stablecoin giants—one that’s now 30 times wider.

The Freeze Heard 'Round the Crypto World

Forget gentle taps on the shoulder. This was a full-scale asset lockdown. The company behind the world's largest stablecoin executed a massive freeze, targeting a sum that would make most traditional banks blink. It’s a stark reminder of the centralized power lurking behind a supposedly decentralized ecosystem—a classic case of 'do as we say, not as we do' in the wild west of digital finance.

Reading the Gap

The timing isn't coincidental. This freeze coincides with new metrics that paint a brutal picture of market divergence. While both tokens promise a peg to the almighty dollar, the data now shows a gulf between them measured by a factor of thirty. That’s not a gap; it’s a canyon. It speaks to shifting trust, liquidity preferences, and the brutal efficiency of a market that votes with its wallet every second.

What the Numbers Really Mean

Forget the hype. This 30x differential isn't just a vanity metric. It translates directly into liquidity depth, exchange dominance, and which stablecoin developers and institutions actually build upon. One is becoming the entrenched highway; the other risks becoming a scenic backroad. In a world where speed and reliability are everything, the market is ruthlessly picking its winner.

The Bottom Line

Tether’s billion-dollar freeze is a power play wrapped in a risk management memo. Coupled with a 30x lead over its nearest rival, it signals a market consolidating around a single, formidable—and sometimes heavy-handed—liquidity giant. For the crypto ecosystem, it means deeper pools but also a single, bigger point of potential failure. For traditional finance watching from the sidelines? Just another day of 'innovative' asset management they’ll pretend to understand at the next board meeting.

Tether: Proactive, High-Velocity Freezing

Slava Demchuk, CEO of AMLBot, said the massive gap in blocked funds should not be seen as a measure of relative compliance rigor.

“Freeze volume is not a direct proxy for ‘better’ or ‘worse’ compliance,” he told Cryptonews in an interview, adding:

“USDT’s numbers are larger because more illicit and high-risk activity is denominated in USDT, especially on Tron. And [because] Tether has chosen a more interventionist enforcement model that leaves an evident on-chain footprint.”

On the other hand, USDC’s “smaller footprint reflects both lower exposure to those flows and a narrower, court-driven intervention policy.”

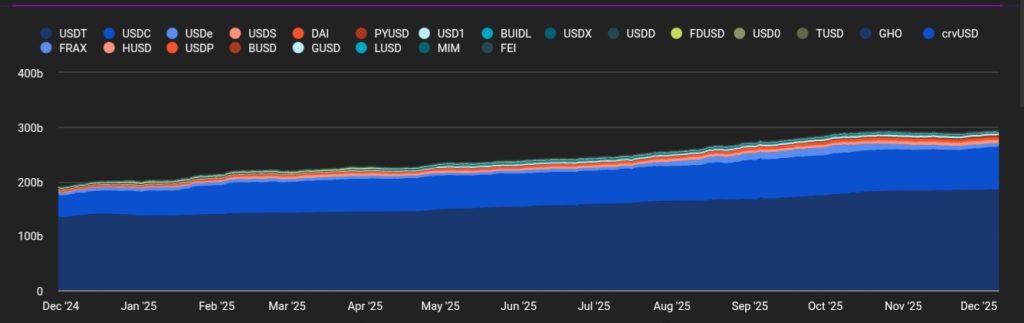

USDT supply surpassed $191 billion in 2025, with its user base reaching 500 million for the first time in October. Circle has around $78 billion of USDC in circulation, according to data from The Block.

As Demchuk explained,

“The most important insight from our data is simple: USDT isn’t frozen 30 times more often because Tether is stricter. It’s because USDT is the asset that criminals choose the most.”

He said Tron-based USDT “dominates high-risk corridors,” putting Tether directly in the FLOW of illicit transactions and prompting a more “proactive freeze model.”

AMLBot’s data shows that more than 53%, or $1.75 billion, of the USDT Tether blocked was issued on Tron, a low-cost blockchain popular with both legitimate and scam users in Africa, Asia and Eastern Europe.

Tether has long been dogged by questions of transparency over its reserves and compliance operations. The El Salvador-based company, which is reportedly raising $20 billion at about $500 billion valuation, has in recent years recast itself as an ally to global law enforcement agencies.

According to the AMLBot report, Tether operates a broad, rapid-response enforcement model, working with over 275 law enforcement agencies as well as blockchain intelligence firms in 59 jurisdictions.

Tether’s smart contracts allow it not only to freeze wallet addresses, but also to destroy, or ‘burn’, seized tokens and reissue “clean replacements” to victims, a system that has processed up to $2.7 billion in stolen funds.

For example, between September and November 2025, Tether burned up to 30M tokens. In July 2024, the firm froze $130 million in USDT, including $30 million linked to Cambodia’s Huione Group, which was blocked on Tron.

Circle: Freeze Only If Legally Required

Tether’s willingness to freeze funds without a court order, sometimes to protect users that have been hacked, is not without risk. The company needs approval from several Tether officials before it can freeze a wallet.

The process creates delays that cybercriminals have exploited, resulting in losses of about $78 million since 2017, per the AMLBot report. Privacy advocates have also criticized Tether for its “preemptive” freeze actions.

Centralized control has its moments. Quick response from Tether here saved 85k from disappearing into the void. But let's be real – this is why self-custody and proper security measures are non-negotiable. Not your keys, not your coins isn't just a catchy phrase.

— T (@agentic_t) July 20, 2025In April 2025, Texas-based firm Riverstone Consultancy Inc. sued Tether after it blocked nearly $45 million at the request of the Bulgarian Police Department, alleging the action bypassed required legal procedures.

Meanwhile, New York-based Circle takes a narrower, strictly legalistic approach. Under its Stablecoin Access Denial Policy, USDC can be frozen only to comply with court orders, sanctions, or regulatory mandates.

“This order-driven approach leads to activity appearing in tall but rare spikes (batch actions), in contrast to USDT’s more continuous daily Flow of enforcement,” the report said.

Unlike Tether, Circle does not burn or reissue frozen funds. Once a wallet address is blacklisted, it cannot send or receive USDC until the restriction is lifted. Circle also publicly reports all blacklisted addresses and their token balances, with audits intended to improve transparency.

The AMLBot report notes that stablecoin freezes have become a critical tool for investigators, allowing authorities to stop illicit flows that WOULD otherwise be hard to intercept in traditional cash-based systems.

But Demchuk warned that current practices remain patchy. “We see that today’s freeze and recovery mechanisms genuinely help law enforcement … but the system is still maturing,” he tells Cryptonews.

“What’s missing is stronger governance: clearer rules for cross-border requests, a transparent way for users to challenge mistaken freezes, and some independent oversight of issuer powers. Such improvements would protect users’ rights without taking away the tools investigators rely on.”

Companies freeze stablecoins – a type of cryptocurrency designed to maintain a fixed value, usually pegged to the U.S. dollar — when issuers blacklist an address, making the tokens stored in the wallet unusable.

Decentralization In Focus As Crypto Freezes Soar

AMLBot’s findings come as stablecoins face increasing scrutiny from policymakers. Regulators in the United States and European Union have revealed plans to tighten oversight around issuer compliance standards, real-time reporting and consumer safeguards.

Moreover, the growing scale of crypto asset freezes by the likes of Tether and Circle has stoked debate about the erosion of decentralization and privacy, core foundational principles of the crypto industry.

Dmytro Tarasiuk is the product director at self-regulatory crypto platform Core3. He told Cryptonews that it would be “misleading and unfair” to judge crypto’s ideological roots by examining the behavior of Tether and Circle, which he described as “inevitably centralized players.”

“Yes, the original idea of crypto was rebellious, bold, and revolutionary — money without a ‘big brother,’ without an authority capable of blocking or approving transactions. That ideal existed only briefly.”

Tarasiuk argued that as the crypto market grew, its unregulated nature became a magnet for both scammers and genuine innovators, pushing the sector toward traditional business models, including government engagement.

“Stablecoins have become the most important element of the entire crypto ecosystem,” Tarasiuk stated. “When we talk about adoption, we’re talking about stablecoin transactions. Nothing in crypto is as familiar to non-crypto people globally as USDT on TRC-20.”

“When we talk about institutional capital, stablecoins are the entry point for all tokenized assets and off-chain investment flows,” he added. “And when we talk about governmental interest, Circle and Tether, now the 8th largest holder of U.S. Treasury bills if compared to countries.”

In that context, says Tarasiuk, freezes and blacklisting “are not random or ideological betrayals, they are signs of the institutionalization of the market.”