Bitcoin Price Watch: Fed Decision Day — Powell’s Move Could Spark Crypto’s Next Big Rally

All eyes turn to the Fed today. The central bank's interest rate decision lands this afternoon—and the crypto market holds its breath.

Will Powell cut? Will he pause? The answer doesn't just move traditional markets anymore. It's become a direct signal for digital asset volatility.

The Crypto Catalyst

Forget the old playbook. Monetary policy now fuels crypto sentiment as much as tech adoption. A dovish shift could unleash a wave of institutional capital hunting for yield outside a declining-rate environment. A hawkish hold might trigger a short-term sell-off—but also reinforce Bitcoin's narrative as a hedge against fiat uncertainty.

Beyond the Headline Number

Traders aren't just watching the rate itself. They're parsing Powell's every word for hints about liquidity, balance sheet plans, and the long-term trajectory. The press conference commentary often moves markets more than the decision. Any mention of inflation 'progress' or economic 'headwinds' will be instantly dissected by algo-traders and crypto whales alike.

The connection is clear: easy money flows into risk assets. And in 2025, the ultimate risk-on bet isn't a tech stock—it's a digital bearer asset on a globally distributed ledger.

The Setup for Volatility

Expect whipsaws. Liquidity often thins ahead of major Fed announcements, amplifying price swings in both directions. Options markets are pricing in a big move. Whether it's up or down depends entirely on the tone from the podium.

For Bitcoin, this is another stress test of its maturity. Does it still trade like a speculative tech stock, or is it starting to decouple and act as the macro hedge its proponents claim? Today's price action will offer clues.

The decision drops soon. The market's verdict on Powell's wisdom—or lack thereof—follows in nanoseconds. After all, what's the Fed but a centralized oracle with a lagging data problem?

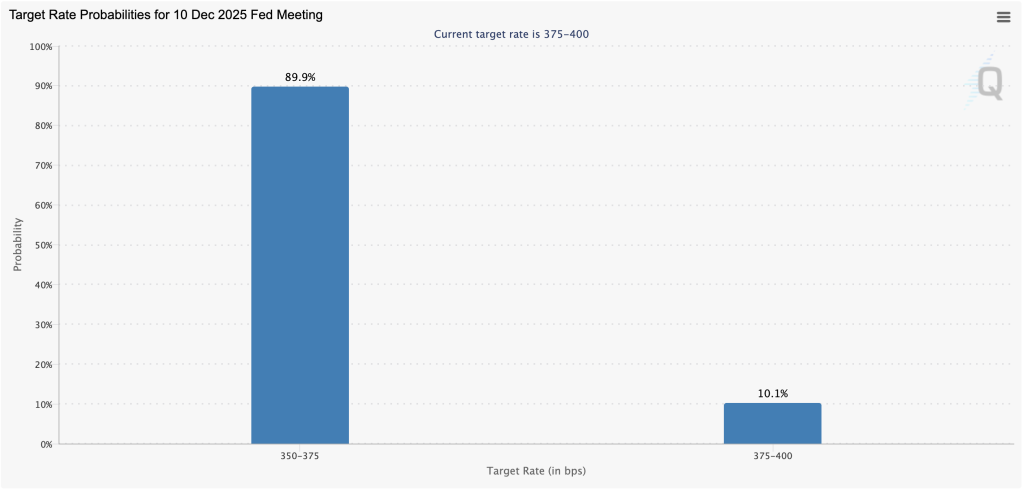

Source: CME FedWatch Tool

Source: CME FedWatch Tool

The decision comes after a week of conflicting economic signals, including shockingly strong jobless claims (191K vs 219K expected, lowest since 2022), cooling Core PCE inflation (2.8% from 2.9%), and yesterday’s JOLTS data showing job openings unchanged at 7.7 million with quits declining 276,000 year-over-year.

Thesupports the case for easing, but some Fed officials have expressed concern about cutting too aggressively, with employment still resilient.

This marks the Fed’s third policy meeting since beginning its easing cycle with a 50 basis point cut in September, followed by another 25 basis point reduction in October.

The central bank officially ended quantitative tightening on December 1, freezing its balance sheet at $6.57 trillion after draining $2.39 trillion from markets since June 2022.

Markets are focused not just on today’s decision but also on Powell’s guidance for 2025. The updated dot-plot projections could signal whether the Fed sees two, three, or four more cuts next year.

Any hawkish shift suggesting fewer cuts in 2025 would likely pressure Bitcoin and risk assets, while dovish guidance reinforcing the easing cycle could provide the catalyst for Bitcoin to break above $92,000 resistance.

Bitcoin’s technical setup shows critical resistance at $92,000 and the descending trendline that’s capped rallies since mid-November, with support holding at $88,000-$90,000. Total crypto market cap sits at $3.23 trillion.

The key risk for crypto is a “hawkish cut”—where the Fed reduces rates 25 basis points today but signals a slower pace of easing in 2025 due to sticky inflation or resilient employment.

Powell’s 2:30 PM press conference will be scrutinized for any hints about the January meeting and the overall trajectory of policy.

With the Fed’s liquidity pivot complete (QT ended) and inflation moving in the right direction, the path of least resistance for bitcoin is higher—but only if Powell doesn’t pour cold water on aggressive 2025 easing expectations.