Bitcoin Price Prediction: $200M in Leveraged Liquidations Pushes BTC Under $90K — Can It Avoid a Breakdown Below $84K?

Bitcoin's price gets squeezed as a massive wave of leveraged positions gets washed out.

The $90K Support Test

Liquidations north of $200 million have cut through the market, pushing the flagship cryptocurrency below a key psychological level. The move highlights the double-edged sword of leverage—it can amplify gains, but it also creates a cascade of forced selling when the tide turns. It's the market's way of reminding everyone that borrowed money comes with a very short leash.

The $84K Line in the Sand

All eyes are now on the next major support zone. A sustained hold above $84,000 could provide the foundation for consolidation and a potential rebound. A decisive break below, however, risks triggering another round of stop-losses and a deeper correction. The price action here is less about grand narratives and more about simple mechanics: too many traders bet the same way with money they didn't have.

Can Bitcoin Bounce Back?

The immediate future hinges on whether spot buying can absorb the selling pressure from the leverage unwind. History shows these liquidations often create local bottoms, as overextended positions are purged from the system. But in a market where sentiment shifts faster than a Wall Street analyst changes their price target, nothing is guaranteed. The coming sessions will reveal if this is a healthy shakeout or the start of something more significant.

$200M Wiped Out As Crypto Liquidations Trigger Market-Wide Selloff

Over the last four hours, more than $200 million in Leveraged positions have been liquidated across the crypto market.

Bitcoin is down over 3%, while ethereum has plunged over 4%. The bloodbath has wiped out over $100 billion in total market capitalization today.

![]() BREAKING:

BREAKING:

Crypto liquidations have resumed, sending Bitcoin back below $90,000.

Over the last 4 hours, more than $200 million in leveraged positions have been wiped out.

Volatility is back.![]()

![]() pic.twitter.com/YCmzcQdkab

pic.twitter.com/YCmzcQdkab

The carnage follows today’s massive options expiry event, which traders had been monitoring closely.

A staggering $3.357 billion worth of BTC options with a max pain point at $91,000 expired today, alongside $668 million worth of ETH options with a max pain at $3,050.

Prominent trader TraderThanos isas the 5-day candle closes below $93,000.

“Maybe we get another retest of 93k-93.2k. That WOULD align more perfectly with my current bias. The next leg down takes us to 76k,” he warned.

Thanos highlighted a critical technical breakdown: “This is the first time price is trading under those Moving Averages since June/July of 2023,” referring to the 100 EMA and 100 MA on the 5-day timeframe.

If price stays beneath these moving averages, he expects a drop to therange.

Adding to the bearish sentiment, the odds of bitcoin hitting $80,000 by year-end have now surpassed 40% on Polymarket.

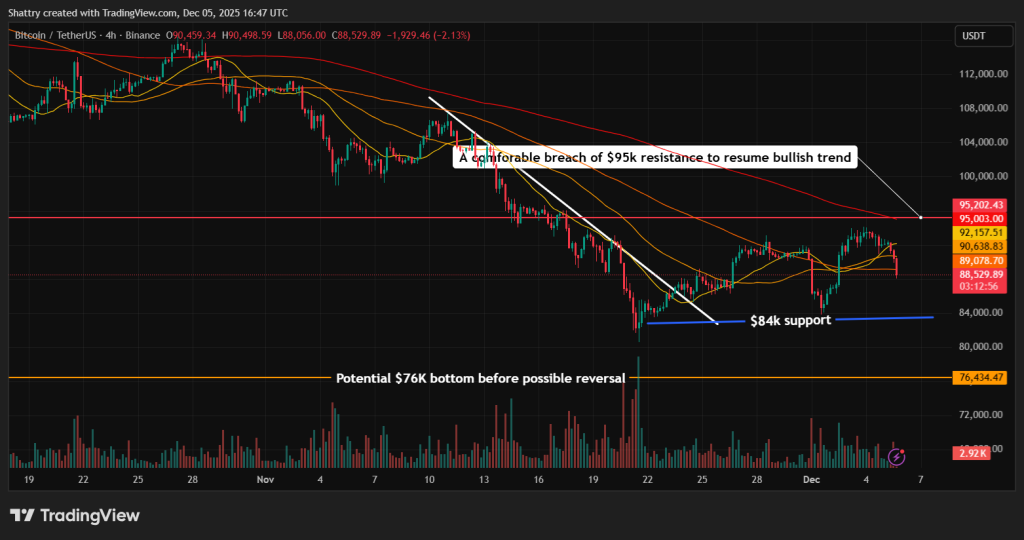

Bitcoin Price Prediction: Bulls Must Hold $84K or Face $76K

Bitcoin is trading below all major moving averages on the 4-hour chart, keeping the broader structure tilted bearish.

Theremains the key resistance that must be reclaimed to restore bullish momentum, but repeated rejections show sellers aggressively defending that zone.

Immediate support sits around $84,000, which stabilized the price during the last flush.

However, if Bitcoin fails to bounce strongly from this level, the broader corrective structure could extend toward deeper support NEAR $76,000, where a more meaningful reversal becomes likely.

Bitcoin’s direction remains biased lower as long as it stays capped under $95,000.

A reclaim of that level would signal trend restoration, but until then, indicators point toward continued weakness.

Bitcoin Hyper Presale Surges Past $29M Amid BTC Weakness

As Bitcoin struggles, investors are turning to Bitcoin Hyper ($HYPER), a project working on bringing speed and affordability to Bitcoin’s blockchain for decentralized applications.

Built on Solana-based architecture, Bitcoin Hyper accelerates transaction speeds while slashing network fees.

This enables developers to deploy DeFi platforms, meme coins, and payment solutions that Bitcoin holders can access without abandoning the original blockchain.

The presale has raised over $29 million, with tokens priced at $0.013375 and strong institutional interest driving momentum.

Early investors can benefit from presale pricing at the current $0.013385 price, with some analyses suggesting potential 10-15X ROI by 2026.

To buy $HYPER at its discounted presale price, head to the official Bitcoin Hyper website and LINK your wallet, such as Best Wallet.

Then connect a wallet (Best Wallet, MetaMask, or Coinbase Wallet) and select payment (ETH, USDT, BNB, SOL, or USDC).You can also use a bank card for instant access.

Visit the Official Bitcoin Hyper Website Here