Whale Alert: Massive Bitcoin Transfers Trigger Market Jitters - Will Prices Plunge?

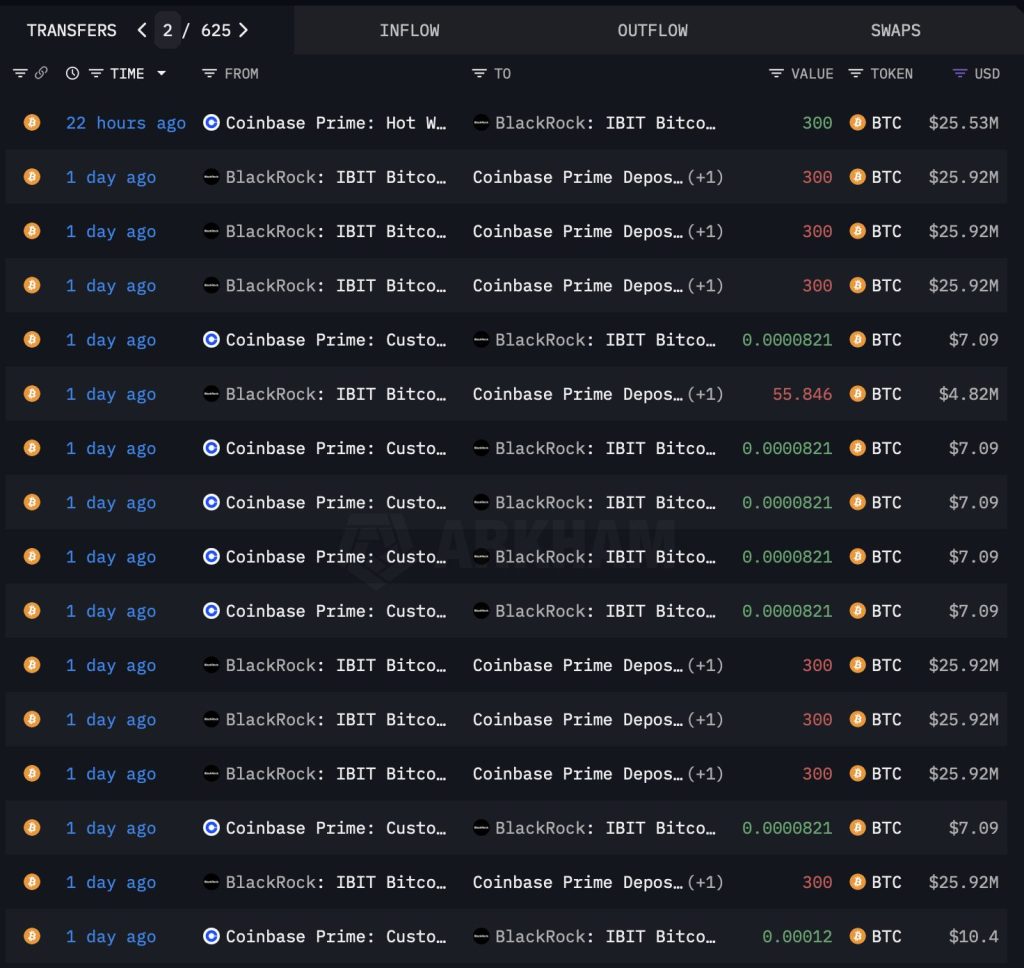

Bitcoin's price faces a fresh wave of selling pressure as crypto whales move mountains of digital gold. On-chain data reveals a series of massive transfers hitting exchanges—classic signals that big players might be preparing to cash out.

The Whale Watch

Tracking these movements isn't just speculation—it's market intelligence. When wallets holding thousands of Bitcoins suddenly wake up and send funds to trading platforms, traders pay attention. These aren't retail investors moving pocket change; these are institutional-scale transactions that can swamp order books and shift momentum overnight.

Liquidity vs. Leverage

The crypto market thrives on fragile equilibrium. Whale selling injects sudden liquidity that can overwhelm buy-side demand, especially in leveraged markets where margin calls cascade. Remember—what looks like orderly profit-taking to a whale feels like a tsunami to overextended traders.

The Bull Case Persists

Not every large transfer spells doom. Some represent internal wallet management, OTC desk preparations, or even accumulation through different channels. The fundamental adoption narrative—institutional acceptance, ETF flows, monetary debasement hedges—remains intact regardless of short-term volatility.

Market Mechanics 101

Crypto markets have always moved on whale activity. The difference now? More eyes watching, more algorithms trading, and more derivatives amplifying every move. Today's sell-off could be tomorrow's buying opportunity—if you believe the long-term thesis outweighs temporary technical pressure.

The cynical take? Watching whales move Bitcoin is like watching billionaires rearrange their offshore holdings—fascinating theater that mostly distracts from the real question: do you believe in the asset's future or not?

Bottom line: Whale movements create noise, but Bitcoin's signal remains its scarcity and growing adoption. Short-term turbulence doesn't rewrite long-term trajectories—though it certainly separates disciplined investors from emotional traders.

Source: Arkham

Source: Arkham

Whales Are Waking Up

November saw unusually large bitcoin movements, creating a mixed reaction across the market. Transfers worth more than $100 million were sent from cold wallets to exchanges. This usually signals a few potential scenarios. Big players may be preparing to sell, although it is unclear whether they are aiming for new lows or positioning ahead of another breakout.

These moves do not mean a sale will happen immediately. It could occur later.

Another possibility is simple portfolio rebalancing between internal wallets.

Some of the largest transactions were recorded between Nov. 21 and 23, during the weekend when markets are typically quiet. The timing makes it appear that someone wanted to MOVE funds discreetly, without drawing attention. For example, several cold wallets associated with Coinbase sent more than $300 million worth of BTC to exchanges, mainly Coinbase.

Arkham data also shows that one address (15tTqLLAEVyvdSZzSwKxaBm5HTKCi2ZyoY) had been inactive for a long time before suddenly transferring around $361 million in Bitcoin from cold storage to Coinbase.

Are Big Players Trying to Push Bitcoin Price Lower?

The crypto Fear and Greed Index is sitting at extremely low levels. Recently, it even hit 9, the lowest reading recorded in recent years. This shows deep mistrust among traders and retail investors. Huge transfers like these can easily add more uncertainty and fear.

According to experts, Bitcoin is unlikely to reclaim the $120,000 level before the end of December, although many remain optimistic about early 2026. At the same time, the crypto market can shift direction very quickly.

The reality is that Bitcoin is stuck in the $83,000 to $86,000 range, even though the price has already attempted to retest $90,000 twice. There is still a chance that BTC could move below $80,000. Despite short-term rebounds, the recent price action looks more like a technical recovery than a confirmed trend reversal.

If whales are indeed trying to pressure retail and shake out weak holders, this scenario becomes possible. Institutional players appear to be setting the pace of the market, while smaller investors have less influence.

Old whales are also becoming active again. One of them moved over $500 million worth of Bitcoin. Whether they are preparing to sell and buy lower or positioning for another rally remains unknown.

A whale with $3,300,000,000 in $BTC has transferred $527,650,000 in Bitcoin to Paxos today.

The last time he made any transfers was in December 2019.

Old whales are waking up now. pic.twitter.com/2wsnWIjbUR

Does Smart Money Move Quietly?

As the market tries to decide whether the current phase is bearish or bullish, whales are not only moving funds. Some appear to be buying the dip.

Glassnode data shows that the number of entities holding more than 1,000 BTC sharply increased in November. This metric had been declining since May 2025.

Another potentially bullish factor came from the Federal Reserve. The Fed injected around $13 billion into the banking system, which may indicate an effort to ease liquidity stress. If this leads to an increase in liquidity, Bitcoin could benefit. BTC is closely correlated with the Global Liquidity Index (GLI), and a rise in liquidity often precedes price recoveries.

Still, the crypto market sentiment remains mixed. The threat of Bitcoin dropping below $80,000 is not off the table. Whether this becomes an attractive accumulation zone for large players will depend on buyer reaction.

Ki Young Ju, founder and CEO of CryptoQuant, responded with a touch of irony to Arthur Hayes, who criticized Tether for taking risky positions in gold and Bitcoin ahead of expected rate cuts:

Translation: I am out of position now, and I want crypto prices to drop so I can buy at lower levels.