Michael Saylor’s Mysterious ’Green Dots’ on Bitcoin Chart Spark Frenzy — Decoding the Bullish Signal

Michael Saylor just dropped a cryptic chart that's setting crypto Twitter ablaze. Those glowing green markers on Bitcoin's price trajectory aren't just pixels—they're a loaded message from one of the asset's most vocal billionaires.

The Anatomy of a Saylor Signal

Forget traditional technical analysis. When the MicroStrategy chairman highlights specific points on a chart, the market leans in. These 'green dots' likely represent more than price levels—they're visual anchors for his long-term accumulation thesis. It's a masterclass in narrative-building, bypassing complex indicators for simple, shareable conviction.

Why the Timing Isn't Random

The tease lands as institutional adoption hits escape velocity. Spot ETFs are sucking up supply, while macro uncertainty fuels digital gold arguments. Saylor's chart cuts through the noise, reminding speculators that Bitcoin's real story unfolds on logarithmic scales, not daily candles. It's a direct challenge to short-term thinking.

The Subtext Every Trader Missed

Beneath the surface, this is about psychological warfare. Each green dot reinforces a buy-and-hold mantra that's crushed skeptics for years. While traditional finance obsesses over quarterly earnings—a system where companies optimize for ninety-day windows instead of decade-long visions—Saylor frames time differently. His chart screams patience.

So what's the real takeaway? When a man who turned corporate treasury strategy into a Bitcoin acquisition engine points at something, it pays to look. The 'green dots' aren't a trading signal; they're a belief system plotted on a chart. And right now, that belief system is looking very, very bullish—much to the annoyance of Wall Street analysts still waiting for that 'imminent' collapse.

Analysts Clarify MicroStrategy’s ‘Green Dot’ Metric

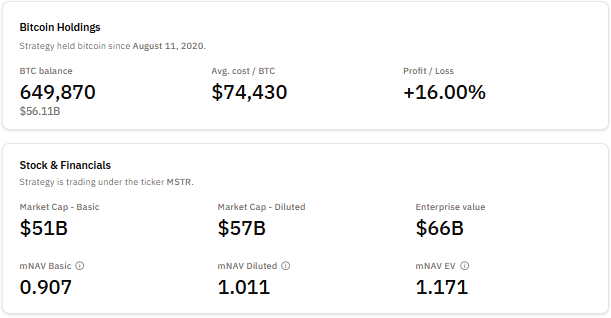

Analysts later clarified that the green dotted line represents Strategy’s average purchase price, a rolling figure that updates only when new Bitcoin is acquired.

It reflects the company’s dynamic cost basis rather than Bitcoin’s price or any FORM of prediction.

With each new buy, the line shifts depending on whether Bitcoin was purchased above or below the previous average.

Because Strategy’s positions are large, some buying events have pushed the line sharply higher, especially between 2024 and 2025, when the firm accelerated accumulation during Bitcoin’s run toward the $100,000 region.

The chart confirmed that Strategy’s portfolio remains profitable, with the Bitcoin stack up 22.9% as of Nov. 30.

Bitcoin has been trading in the $95,000 to $110,000 range in late 2025, keeping the company comfortably above its $74,433 average cost.

Yet while the holdings show gains and the “green line” hints at more aggressive buying according to some analysts, Strategy’s stock has fallen more than 60% from recent highs, and this disconnect is feeding new questions about the long-term sustainability of Saylor’s strategy.

Strategy Signals It May Sell Bitcoin if Market Pressures Mount

In a development that marks a shift from years of strict “never sell” messaging, Strategy quietly acknowledged that Bitcoin sales are now possible under specific stress conditions.

CEO Phong Le said the company WOULD consider selling some of its holdings only if two events occur at once: if Strategy’s market-to-net-asset-value ratio falls below one and if the company cannot raise new capital.

Le noted that he does not want to be the executive who sells Bitcoin but added that financial discipline must take priority in a hostile market.

He described a scenario where selling a portion of the treasury becomes mathematically justified to protect what he calls “Bitcoin yield per share,” especially if issuing new equity becomes more dilutive than liquidating a small fraction of BTC.

The company’s mNAV is currently 1.01, but this level has been unstable throughout 2025.

Earlier in the year, the ratio traded as high as 3.3, but by mid-November it slipped under 1.0 for the first time since Strategy began acquiring Bitcoin.

A drop below one means the market values the company at less than the worth of its Bitcoin holdings, undermining the premium that allows Strategy to raise capital cheaply.

Le warned that if the company cannot access cash while operating below that threshold, selling becomes an option of last resort.

Strategy’s $21B Fundraising Stands Firm as Bitcoin Drops 32% From All-Time High

Despite these risks, Strategy has raised $21 billion so far in 2025, nearly matching its 2024 total.

The company secured $11.9 billion through common equity, $6.9 billion through preferred equity, and $2 billion via convertible debt across seven different securities.

Investor appetite remains strong, even as the firm faces roughly $800 million in annual dividend obligations tied to its preferred shares.

Le said the plan is to maintain these payments using capital raised at a premium, adding that consistent dividend performance helps strengthen market confidence.

Strategy also introduced a new “BTC Credit” dashboard last week to reassure investors amid volatile market action.