Bitcoin ETFs See $870M Exodus in 24 Hours – Second-Largest Bloodbath Ever Recorded

Wall Street's crypto experiment hits turbulence as Bitcoin ETFs hemorrhage $870 million in a single trading session. The stampede marks the second-worst outflow since these instruments launched—just when institutions swore they'd 'bring stability' to digital assets.

Market makers scramble to rebalance exposure while crypto Twitter erupts in schadenfreude. 'TradFi always late to the party,' quips one decentralized finance developer. 'First they ignore the revolution, then they try to bottle it—now they're getting rinsed.'

The outflow comes amid a broader risk-off sentiment, though Bitcoin maximalists counter that spot ETF flows represent paper Bitcoin rather than the real asset. As one trader puts it: 'When the suits panic-sell IOUs, we accumulate actual sats.'

Liquidations Hit Over $300M Amid BTC ETFs Selloff

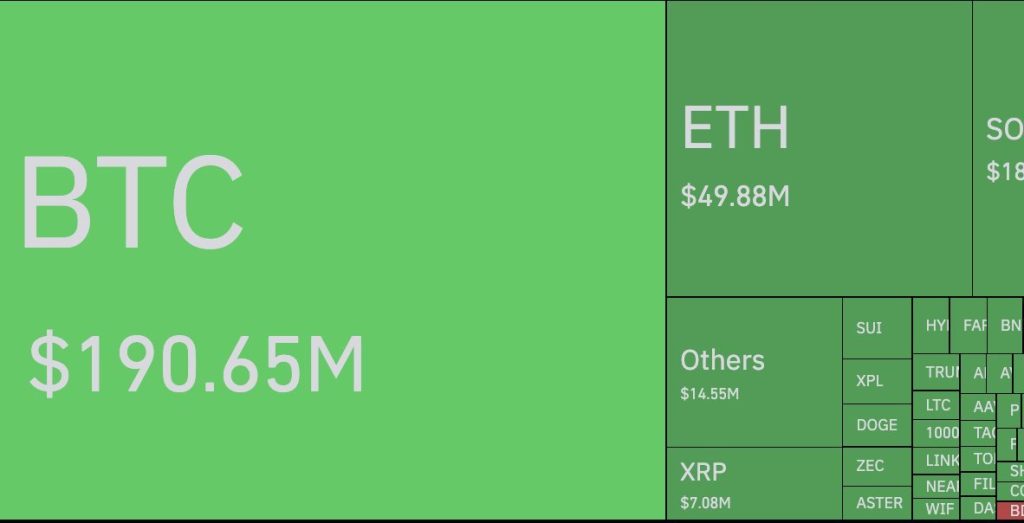

The total amount of liquidations in the cryptocurrency market reached $316 million in leveraged long positions, Per Coinglass data. This prompted several traders to exit their positions.

Liquidations in crypto are primarily tied to long positions that are Leveraged bets that anticipate price increases.

Data noted that Bitcoin liquidations amounted to $190.65 million in one hour, while ethereum liquidations reached $49.88 million.

Meanwhile, Ether ETFs also registered an outflow of $259.72 million, the highest since Oct. 13.

Bitcoin Plunge – Lowest in Over 6 Months

Bitcoin slumped below $100K on Friday, reaching its lowest in over six months. The largest crypto by total market value dropped to $96,682.00 during Asia hours, and is currently trading at $96.94K at press time.

BTC fell 6.2% over the past 24 hours, underperforming the broader crypto market’s 6.15% drop. BTC broke below critical Fibonacci retracement levels of 23.6% at $111,958.

Meanwhile, the Fear & Greed Index (22/100) suggests sentiment remains fragile.

Investors have noted that the slip below $100K “has erased weeks of optimism.”

“Unless institutional buyers step back in, we could be stuck moving sideways… or sliding lower,” wrote one user.

Tim Enneking, managing partner of Psalion, said that several contributing factors have pulled down the BTC price. This includes continued skepticism in many quarters, the ‘bubble’ feeling from all the treasury companies, the predicted end of the bull market in the current four-year cycle and concerns about a macroeconomic slowdown.

Enneking told Forbes that investors need to adjust to just how much the digital asset’s value has climbed all these years.