ZEC Price Prediction: Winklevoss Twins Disrupt Crypto With First-Ever Zcash DAT as Privacy Craze Goes Mainstream

Privacy coins roar back as regulators fumble surveillance overreach—and the Winklevii just lit the fuse.

Zcash surges 40% in a week as Gemini rolls out the world’s first ZEC-focused Digital Asset Trust. Institutional money floods in while bureaucrats scramble to 'understand the technology.'

Behind the surge: A perfect storm of Swiss bank leaks, CBDC protests, and that one hedge fund VP who finally realized Monero exists.

Bulls eye $300 by EOY—assuming the SEC doesn’t try to ban math again.

Privacy Demand Accelerates Institutional Adoption

Leadership changes come along with this rebrand, with Khing Oei appointed Chairman and Will McEvoy from Winklevoss Capital becoming Chief Investment Officer.

Oei founded Treasury, a Netherlands bitcoin company that raised $147 million in September through Winklevoss Capital and Nakamoto Holdings.

McEvoy noted other crypto treasuries faltered under “,” while Cypherpunk built a “” investor base focused on long-term privacy importance for the United States and world.

Galaxy Digital analyst Will Owens recently pointed out that Zcash is gaining traction as a Bitcoin alternative amid concerns about on-chain surveillance.

Owens described ZEC as “,” representing a return to cypherpunk principles that resonate during widespread surveillance.

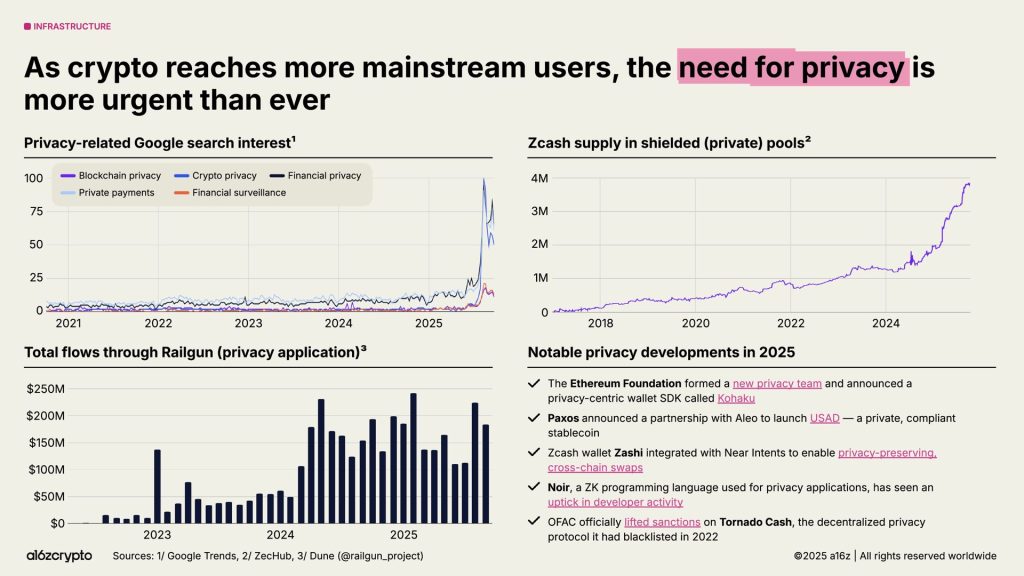

Amidst this booming adoption of privacy coins, A16z’s report recently documented a return to mainstream privacy adoption, with Google searches for crypto privacy surging in 2025.

Zcash’s shielded pool supply has grown to nearly 4 million ZEC, while Railgun’s transaction flows have surpassed $200 million per month.

Earlier today, BitMEX co-founder Arthur Hayes also warned ZEC holders to withdraw tokens from centralized exchanges or risk losing privacy protections.

Hayes emphasized that shielded addresses enable transaction obscurity that centralized custody undermines.

If you hold $ZEC on a CEX, withdraw it to a self-custodial wallet and shield it.

— Arthur Hayes (@CryptoHayes) November 12, 2025Zcash surged nearly tenfold in two months before peaking NEAR $735 on Friday, triggering $51 million short liquidations.

The token remains 85% below the 2016 high of $3,191 despite a recent explosive rally.

Analysts previously cautioned about overheating, with the RSI reaching overbought levels following a 1,700% rally since September.

Elliott Wave Structure Tests Support – What Happens to ZEC Next?

On the technical level, two-hour charts display a completed five-wave impulse from $300 to $750, followed by a three-wave ABC correction down to $429.

The structure suggests a potential new five-wave impulse, beginning with the current price sitting between 0.618 and 0.5 Fibonacci retracement levels at $483-$524, common areas for wave transitions.

RSI at 39.07 indicates oversold conditions following a correction, potentially supporting a bullish wave count if ZEC has completed its corrective structure.

Currently, Elliott Wave projection targets $1,000, representing a 112% gain from current levels if the count validates.

Zooming in closer, the one-hour charts reveal a descending trendline resistance converging with an ascending support, creating a compression apex around the current price.

Volume profile shows concentration around $480-520, suggesting a high-conviction zone.

The recent spike to $440, followed by an immediate recovery, could represent a capitulation wick before a reversal or a temporary bounce.

A breakout above descending resistance at $480-$500 with volume will validate Elliott Wave structure and could trigger short covering toward $520-$550.

Failure to breakout will maintain a corrective structure toward the $440-$420 support level, with a deeper correction toward the $342-369 range possible if selling pressure persists.

Virtual Mining Meets Meme Culture

Privacy coins are leading the altcoin opportunities, but this coin dominates the mining coin niche.

integrates VIRTUAL mining with gamified mechanics where users deploy Miner Nodes in customizable server rooms.

Players upgrade setups to maximize $PEPENODE rewards, which have PEPE and Fartcoin payouts.

The ecosystem burns 70% of tokens spent on upgrades, reducing supply through deflationary mechanics.

The presale has already surpassed $2 million, having passed smart contract audits.

The Token Generation Event and DEX listings are approaching next, with NFT upgrades and cross-chain rewards also set to launch soon.

The platform combines strategy, gaming, and DeFi, which is well-positioned for an altseason.

To join PepeNode, visit the official website and connect your wallet. Participate using crypto or a bank card.

Visit the Official Website Here