Wall Street Goes Crypto: Sygnum Warns of 2026 Reckoning Despite Institutional Frenzy

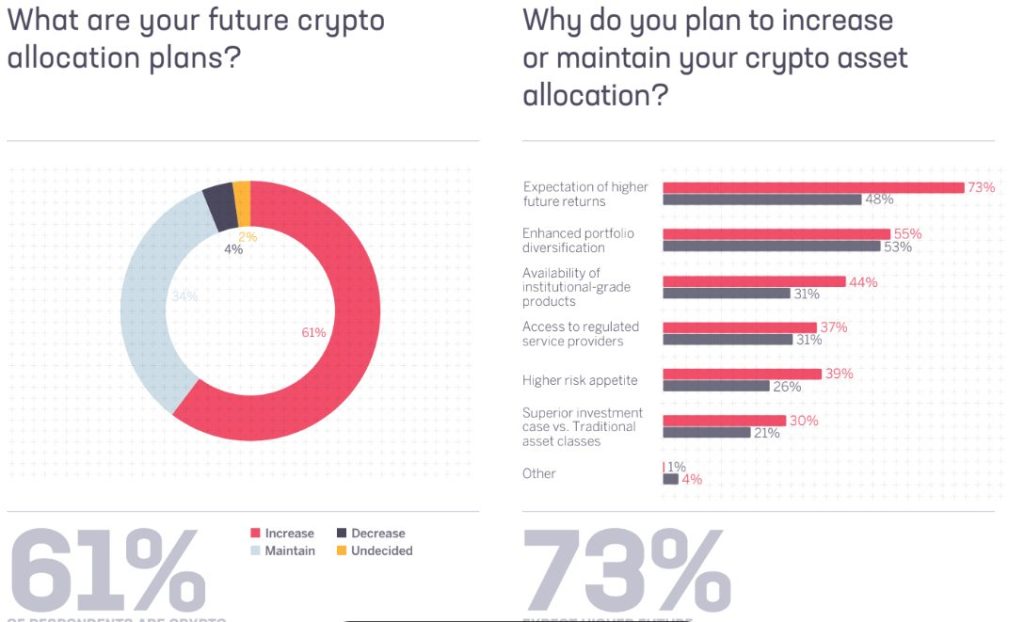

Big money is flooding into crypto—but the party might not last. Sygnum’s latest analysis reveals institutional investors are piling into digital assets at a record pace, only to face a predicted downturn by 2026.

Why the rush? Institutions are chasing alpha in a low-yield world, betting crypto’s volatility will juice their portfolios. Yet Sygnum’s crystal ball shows a looming correction—because when Wall Street finally ‘gets it,’ you know the top is near.

Timing the market is a fool’s errand, but one thing’s clear: the suits are here, and they’ve brought their leverage. Brace for impact—or another ‘learning opportunity’ in finance’s never-ending hype cycle.

Has Institutional Confidence Peaked in Crypto, or Is This Just the Beginning?

Sygnum said the shift marks a transition from speculative trading to strategic diversification. “Institutions are thinking less about crypto as defense and more about participation in the structural evolution of global finance,” said report author Lucas Schweiger.

The survey covered over 1,000 professional and high-net-worth investors across 43 countries.

While the short-term outlook remains strong, Sygnum’s data suggests the rally may cool in 2026 as liquidity slows and macroeconomic tailwinds fade.

“The story of 2025 is one of measured risk, pending regulatory decisions, and powerful demand catalysts,” Schweiger wrote. “Discipline has tempered exuberance, but not conviction, in the market’s long-term growth trajectory.”

About 55% of institutions remain short-term bullish, expecting further upside driven by ETF approvals and policy clarity.

However, investor sentiment turns neutral to bearish beyond year-end, with slower growth expected by mid-2026 as rate cuts plateau and regulatory progress stalls.

A major factor behind this shift is the growing concentration of Bitcoin holdings among large entities and regulated funds.

CryptoNews analysis of CryptoQuant and Dune Data shows institutional and entity-scale holders have steadily absorbed more supply since spot ETF approvals in January 2024.

Retail investors, who once owned 17% of Bitcoin’s circulating supply in 2020, have reduced their holdings by roughly 20% over the past year, while ETF-related and institutional wallets now control over 7 million BTC.

This reflects a broader structural change as large holders MOVE funds into regulated ETFs for tax and compliance benefits, signaling deeper integration into traditional finance.

Sygnum’s report also found that institutional interest in tokenized real-world assets like bonds and funds ROSE from 6% to 26% year-over-year.

The bank said tokenization is becoming the gateway for conservative investors seeking regulated on-chain exposure.

Coinbase, Sygnum Reports Show Institutions Holding Steady Despite Policy Delays

Interest in crypto ETFs beyond bitcoin and Ether is expanding rapidly. Over 80% of respondents said they want broader ETF access, and 70% indicated they would increase allocations if staking rewards were offered.

Sygnum suggested that staking-enabled ETFs could be the next major driver of institutional inflows once regulatory conditions allow.

Still, delays in key U.S. policy developments, including the Market Structure bill and approval of altcoin ETFs, have introduced uncertainty.

The ongoing U.S. government shutdown, now entering its 41st day, has postponed at least 16 pending crypto ETF applications, dampening short-term momentum.

Despite these headwinds, institutional conviction remains firm. Coinbase’s latest Navigating Uncertainty survey found that 67% of large investors remain bullish on Bitcoin heading into 2026, even as some acknowledge the market is entering the late stage of its bull cycle.

![]() @Coinbase found that 67% of institutional investors are bullish on Bitcoin, even as some believe market is nearing the end of its bull run.#Crypto #Bitcoinhttps://t.co/FdLD8DMMco

@Coinbase found that 67% of institutional investors are bullish on Bitcoin, even as some believe market is nearing the end of its bull run.#Crypto #Bitcoinhttps://t.co/FdLD8DMMco

Coinbase researchers noted that supportive macro factors, including expected Federal Reserve rate cuts and fiscal stimulus in China, could extend market strength into 2025.

However, analysts warn that as liquidity tightens and long-term holders take profits, market growth could slow by mid-2026.

Sygnum’s report described 2025 as a year of “powerful demand catalysts” tempered by regulatory caution.

The bank expects institutional participation to deepen through ETF adoption, tokenized assets, and diversification but said the next phase of the cycle will likely test investor discipline rather than exuberance.