Senate’s Crypto Market Structure Bill Turbocharges CFTC — But Glaring Loopholes Linger

The Senate just dropped a bombshell on crypto regulation—supercharging the CFTC with fresh authority. But hold the applause.

Power Shift or Paper Tiger?

The bill hands the Commodity Futures Trading Commission (CFTC) new teeth to bite into crypto markets. Yet critics spot gaping holes—like a Swiss cheese regulatory framework.

The Fine Print Nobody’s Reading

While DC pats itself on the back, traders whisper: 'Same circus, different clowns.' The bill’s vague definitions and carve-outs could let crypto’s wild west ride continue—just with better paperwork.

Wall Street’s Already Gaming It

Bankers reportedly love the loopholes—nothing like regulatory ambiguity to keep those bonus-fueled innovation engines humming. After all, why kill the golden goose when you can just tax the eggs?

One thing’s clear: The crypto rollercoaster isn’t getting safety rails anytime soon. Buckle up.

Senate’s Crypto Framework Draft Puts CFTC in Charge and Pressure on Lawmakers to Define DeFi Rules

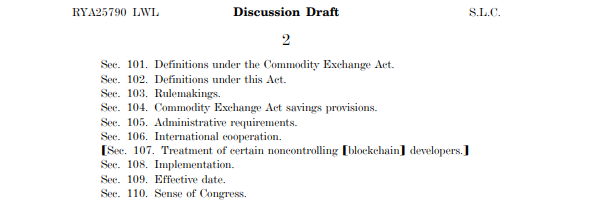

Under the draft, the CFTC would become the primary regulator of digital commodities like Bitcoin and Ether, defining clear rules for exchanges, brokers, and intermediaries operating in the space.

The legislation seeks to register centralized trading platforms as Digital Commodity Exchanges (DCEs) with new operational standards.

Boozman said the goal is to “establish clear rules for the emerging crypto market while protecting consumers.”

Booker added that the bill would “create new protections for retail customers” and ensure the CFTC has the resources needed to oversee the growing market.

The proposal also includes safeguards on fund segregation, disclosure standards, and affiliated trading.

It calls for stronger coordination between the CFTC and the Securities and Exchange Commission (SEC) to clearly define roles, with the SEC overseeing digital assets classified as securities.

However, despite bipartisan momentum, key issues remain unresolved. Key sections still leave disputes over decentralized finance (DeFi) regulation and anti–money laundering (AML) provisions.

Democrats have pushed for stronger guardrails on DeFi, while industry groups and many Republicans argue that excessive oversight could stifle innovation.

Another major challenge is the CFTC’s staffing, as the five-member commission currently has only one active member.

The bill calls for the commission to be “fully constituted” and properly staffed before assuming expanded authority. President Trump’s nominee, Mike Selig, is expected to take over once confirmed, with Democrats involved in at least two appointments.

With Time Running Out, Can the Senate Turn Crypto Optimism Into Law?

Boozman emphasized that the CFTC must be “appropriately staffed with enough expertise and enforcement readiness to carry out the duties of any law.”

Booker echoed those concerns, saying more work is needed to address resource shortages and prevent “regulatory arbitrage.”

The bill arrives amid a prolonged government shutdown, now in its 41st day, which has stalled progress on major legislative priorities. A Senate vote on a funding proposal this week could determine when Congress resumes work on the crypto bill.

Still, Optimism remains within the industry. Coinbase CEO Brian Armstrong, who met with lawmakers last month, said momentum for market structure legislation is “at an all-time high.”

He said that “90% of the issues have already been resolved,” describing the bipartisan cooperation as “a rare and encouraging sign.”

Still, time is running short. Senator Thom Tillis (R-NC) warned that Congress has only a narrow window to act before election-year politics take over.

SEC Chair Paul Atkins also urged Congress to move quickly, saying the agency is coordinating with the CFTC to align oversight frameworks. The WHITE House has reportedly set a deadline for the crypto market structure legislation to reach President Trump’s desk by the end of 2025.

Data from the decentralized platform Polymarket shows traders see a 25% chance the CLARITY Act becomes law this year.