Ethereum Whales Propel ETH Past $3.4K Support – $4,500 ATH in Sight for 2025 Rally

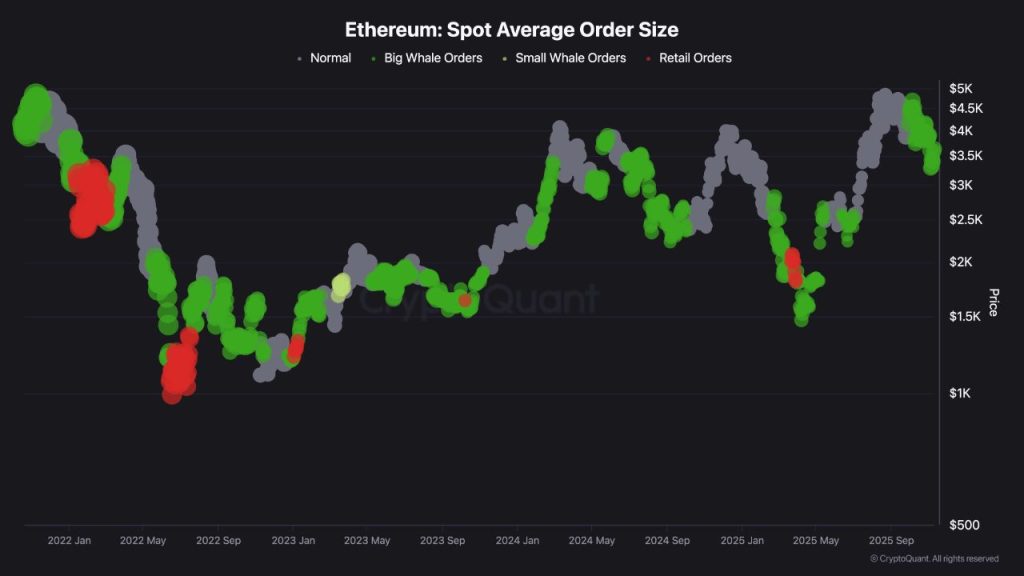

Ethereum's price floor just got reinforced by deep-pocketed investors. Whales are accumulating at $3,400, setting the stage for a potential 30% surge toward $4,500.

Why the bid matters: When crypto's institutional players start stacking ETH, retail traders usually follow. This time? The smart money's betting against the SEC's attempt to classify ETH as a security.

Technical breakout incoming: The $3.4K support level has held through three major sell-offs this quarter. Chartists see clear runway to test all-time highs—assuming Wall Street doesn't 'discover' blockchain again and ruin the party.

Last laugh goes to: Crypto degens who ignored the 'ETH is dead' FUD during the 2024 regulatory crackdown. Meanwhile, traditional finance still can't decide if they want to ban Ethereum or charge 2% management fees on it.

Ethereum Whale Bid Flashes Local Bottom

Across previous cycles, analysts point out that similar whale accumulation has marked the start of trend reversals or late-stage compression phases before major upswings.

“If this behavior persists and the $3-$3.4K region holds as structural support, Ethereum may be entering a low-volatility accumulation zone, setting up for a potential final bullish impulse toward the upper range of $4.5K–$4.8K.”

Ethereum treasury companies have topped the list of institutional whales accumulating Ether to keep its bullish structure intact.

In a recent company report, leading Ethereum treasury firm Bitmine Immersion Technologies revealed that it now owns 2.9% of the ETH token supply.

The company’s Ethereum holdings now stand at 3,505,723 ETH, worth approximately $12 billion.

![]()

BitMine provided its latest holdings update for Nov 10th, 2025:

$13.2 billion in total crypto + "moonshots":

-3,505,723 ETH at $3,639 per ETH (Bloomberg)

– 192 Bitcoin (BTC)

– $61 million stake in Eightco Holdings (NASDAQ: ORBS) (“moonshots”) and

– unencumbered…

Other publicly listed companies are also accumulating Ethereum.

On November 10, Canadian-listed company Republic Technologies announced a $100 million convertible note financing, intended to expand its Ethereum staking and reserve operations.

Other Nasdaq-listed companies like Sharplink Gaming, The Ether Machine, Bit Digital, and ETHZilla all hold over $6 billion worth of Ethereum, per CoinGecko

Tom Lee Says “Best of Ethereum About to Come” as Q4 Momentum Builds

Thomas “Tom” Lee of Fundstrat, chairman of BitMine, said that “The recent dip in ETH prices presented an attractive opportunity and BitMine increased its ETH purchases this week.”

Tom Lee believes that the best of Ethereum is about to come as the company keeps accumulating what it believes is the “tokenization layer” for Wall Street’s transition from TradFi to the on-chain economy.

Bitmine acquired 110,288 $ETH in the past week![]()

![]()

![]()

![]() https://t.co/c176vY9GsR

https://t.co/c176vY9GsR

“The fourth quarter is seasonally strong for crypto and equity prices, and historically encourages investors to increase ‘open interest.’ Therefore, associated trading volumes should improve in coming weeks,” he added.

Ethereum whales are now entering long setups in anticipation of a massive rally.

An insider whale known for his 100% win rate is now adding more to his ETH long position, with order size now worth $194.3 million.

This adds to the conviction from other bulls that ETH is heading to the $4,500-$4,800 range.

ETH Eyes $5,058 if $3,520 Support Holds

The Ethereum (ETH/USD) daily chart shows the formation of a potential double-bottom pattern, a classic bullish reversal sign.

The two labeled lows (“Bottom 1” and “Bottom 2”) suggest that buyers have defended the $3,500–$3,520 region twice, indicating strong demand at that zone.

The neckline of the pattern aligns NEAR the descending trendline resistance, which ETH appears to be testing after a brief breakout attempt.

The ascending green trendline from the previous rally acts as structural support, and price reclaiming this level reinforces bullish sentiment.

Additionally, the Fibonacci retracement levels show multiple resistance targets at $3,888, $4,069, and $4,261, with a broader breakout target projected toward $5,058 if momentum sustains.

Volume activity shows accumulation near the second bottom, a typical sign of buyers stepping back in after exhaustion of selling pressure.

Overall, the chart setup leans bullish. If Ethereum can hold above $3,520 and break decisively above $3,800, it could confirm the double-bottom breakout and aim for the $4,200–$5,000 range.