Saylor’s $2.45B Bitcoin Exodus: Strategic Restructuring or Impending Liquidation?

Massive Bitcoin movement sparks market speculation as MicroStrategy executes unprecedented wallet transfers.

The $2.45 Billion Question

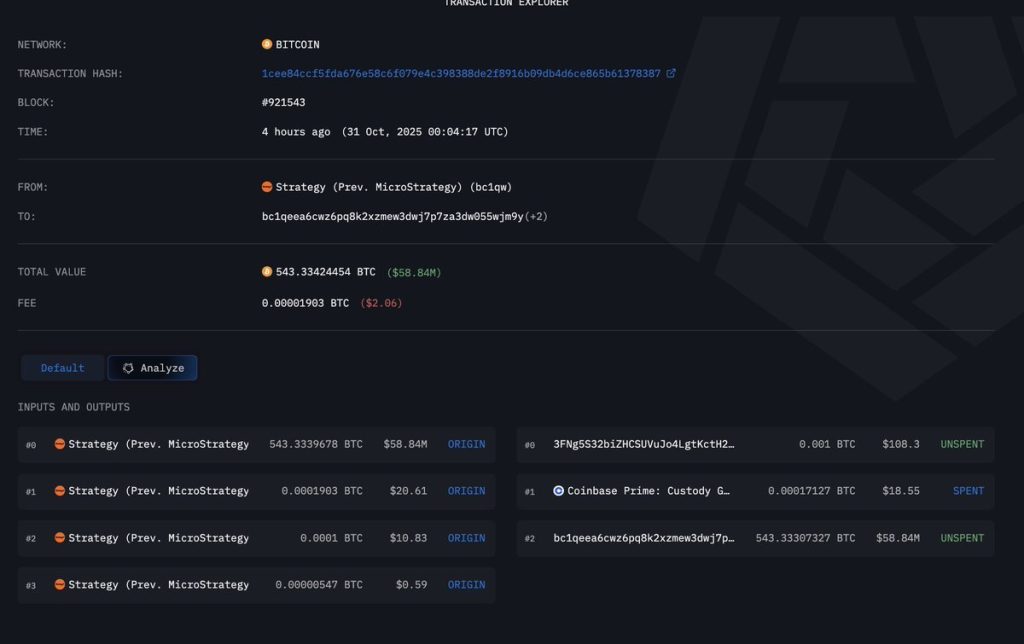

Michael Saylor's Bitcoin empire just shifted fortunes—literally. MicroStrategy's treasury strategy transferred $2.45 billion worth of BTC to new wallets, triggering immediate market analysis and trader anxiety. The sheer scale suggests either sophisticated restructuring or potential liquidation preparations.Strategic Masterstroke or Warning Signal?

Industry observers split instantly—some see this as Saylor's next-level custody optimization, others detect potential distress signals. The timing couldn't be more provocative, coming amid renewed institutional Bitcoin interest and regulatory clarity developments.Market Impact Assessment

Trading desks immediately adjusted positions while crypto Twitter erupted with theories. The move demonstrates either extreme confidence in Bitcoin's future or preparation for significant portfolio rebalancing—nobody knows which narrative will prevail.Because nothing says 'financial innovation' like moving digital assets between digital wallets while traditional finance still struggles with basic settlement times.

Source: Arkham

Source: Arkham

Strategy BTC Transfers Trigger Market Speculation: Is Liquidation Likely?

The recent consecutive mass Bitcoin transfers from the Strategy wallet to various new addresses have triggered market speculation. crypto analyst Emmett Gallic said that the transactions could be related to a “custody switch.”

Strategy tested 9 new addresses (other than change addresses).

My guess is that this related to a custody switch.

ScriptHash address types (starting with 3) are the same as Coinbase Prime Deposits but that is not the case here because the test funds were not swept. pic.twitter.com/bbsOQlliz1

Mass transfers by large holders often align with custody restructuring or internal security upgrades, and not liquidation. The clue lies in the movement patterns – if assets stay offline, it’s probably housekeeping.

Besides, Saylor is betting big on Bitcoin, predicting that the asset will reach $150,000. Speaking with CNBC at the Money 20/20 fintech conference in Las Vegas, he said that the Bitcoin bull run seems optimistic for a clear market structure.

“I think Bitcoin is going to continue to grind up,” Saylor noted. “Our expectation right now is [at the] end of the year it should be about $150,000.”

Further, the Strategy frontman reiterated that regardless of price, the company will be “buying the top forever.”

That said, the transfers confirm an internal restructuring rather than a massive selloff, at a time when the Strategy has achieved a 26.0% BTC yield in 2025 YTD and $12.9 billion BTC $ gain.

“We generated BTC yield of 26% and BTC $ gain of $13 billion, year-to-date, and we are reaffirming our full-year guidance for operating income of $34 billion, net income of $24 billion, and diluted EPS of $80 per share, based on a BTC price outlook of $150,000 at the end of the year,” said Andrew Kang, Strategy’s Chief Financial Officer.