Analyst’s $21 XRP Prediction Triggers Regulatory Red Flags - Here’s Why Markets Are Skeptical

Another day, another crypto price prediction that's raising eyebrows at the SEC.

The Bold Forecast That Got Flagged

When an analyst publicly projected XRP would hit $21—a staggering 3,500% increase from current levels—regulators wasted no time slapping warnings on the prediction. The massive price target represents one of the most aggressive crypto forecasts since the 2021 bull run, drawing immediate scrutiny from financial watchdogs who've grown weary of moon-shot predictions that rarely materialize.

Pattern Recognition: Déjà Vu All Over Again

Market veterans recognize this script—overly optimistic price targets followed by regulatory intervention. The $21 prediction puts XRP at a market capitalization that would dwarf most traditional financial institutions, a mathematical reality that had compliance departments reaching for their red flag forms faster than you can say 'pump and dump.'

The Compliance Conundrum

Financial authorities globally have tightened surveillance on crypto price predictions, particularly those lacking substantive technical analysis or fundamental justification. The flagged prediction joins a growing list of analyst calls that regulators argue could manipulate markets or mislead retail investors chasing unrealistic gains.

Meanwhile, traditional finance veterans chuckle into their morning coffee—because nothing says 'serious asset class' like wild speculation that needs adult supervision.

From Wall Street to Bitcoin Meetups

Namdar’s career began in traditional finance, trading global markets at UBS Hong Kong and Millennium Management in New York. But in 2011, while working across currencies and equities, he stumbled upon bitcoin — a discovery that altered his trajectory.

“I started going to the earliest Bitcoin meetups in New York,” he recalls. “The idea of a currency born from the internet completely opened my mind.”

By 2014, Namdar co-founded SolidX Partners, one of the first institutional crypto firms. “We were the second group in the world to try to do a Bitcoin ETF, just two weeks after the Winklevoss twins,” he says. SolidX produced one of the earliest institutional research reports on Bitcoin and helped draw major Wall Street names like Goldman Sachs and BlackRock deeper into the space.

“It was very early — maybe too early — but it set the foundation for everything that followed,” he says.

Building BNB Network Company

After co-founding Galaxy Digital and investing in prominent crypto projects like SharpLink Gaming and Strategy, Namdar turned his focus to the growing field of digital-asset treasury management — companies holding and deploying crypto as strategic reserves.

“I’ve always been more of a buy-side investor,” he explains. “This year, I was advising several treasury companies and had friends telling me: ‘You’re better at this than the bankers running them — you should lead one.’”

That opportunity arrived when he helped raise $500 million to fund a new treasury initiative through CEA Industries, now rebranded as BNB Network Company (BNC). “We’ve accumulated 500,000 BNB so far — halfway to our goal of 1% of total supply,” he notes. “We’re buying every single day. This is an accumulation phase, and we’re building for the long term.”

Why BNB, Not Bitcoin or Ethereum?

Namdar’s decision to center BNC’s strategy on BNB rather than Bitcoin or ethereum is deliberate — and contrarian. “Everyone is telling the Bitcoin story already,” he says. “BNB is a massive ecosystem that’s completely misunderstood in the West because Binance isn’t accessible to U.S. customers and has no outside equity investors.”

He views BNB not just as a token, but as “digital infrastructure equity” — a stake in the operational backbone of Web3. “BNB powers exchanges, DeFi, and increasingly AI-driven applications. It’s the trading engine of Web3,” he explains.

Comparing it to other assets, he says: “Bitcoin is digital gold, Ethereum is digital oil — and BNB is the digital infrastructure equity that connects it all.”

The Regulatory Shift and Institutional Adoption

Despite market uncertainty, Namdar remains optimistic about crypto’s regulatory trajectory. “I wouldn’t be doing this now if I didn’t believe conditions were improving,” he says.

Having recently returned from Asia, he highlights how the region’s regulators are accelerating innovation. “When the U.S. over-regulated, other governments used that as cover to slow down. Now that Washington is showing progress toward sensible crypto regulation, it’s giving others the green light to innovate again.”

He adds that as more public companies hold crypto on their balance sheets, engagement between entrepreneurs, executives, and regulators is critical. “We’re seeing active advocacy in D.C. for fair accounting treatment of staking and digital assets. The conversation is moving in the right direction.”

Looking Ahead: The Convergence of Crypto and Capital Markets

For Namdar, BNB Network Company represents more than a corporate treasury — it’s a signal of where crypto is heading. “When I started in this industry, we imagined ETFs and governments buying Bitcoin,” he reflects. “But we never thought we’d see public companies formed solely to accumulate and manage crypto as treasury assets.”

He sees that convergence of crypto and capital markets as inevitable. “It’s exciting because it means digital assets are maturing into institutional infrastructure. This isn’t speculation anymore — it’s strategic capital management.”

As for the broader outlook, Namdar remains bullish: “BNB is undervalued, the regulatory winds are shifting, and the market is entering a new phase where treasuries and institutions will drive adoption. We’ve come a long way as an industry — but we’re just getting started.”

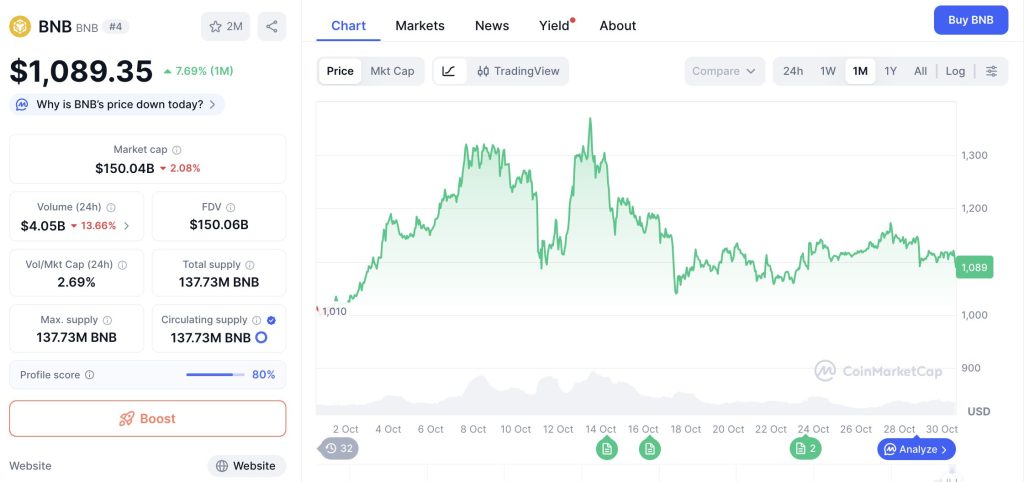

BNB Holds Firm Above $1K Amid Rising Institutional Interest

BNB is holding strong NEAR $1,089, up 7.69% over the past month, with a market capitalization of roughly $150 billion. The token’s stability amid broader market fluctuations reflects growing institutional confidence, particularly as projects like the BNB Network Company and expanding DeFi ecosystems continue to highlight its long-term potential.