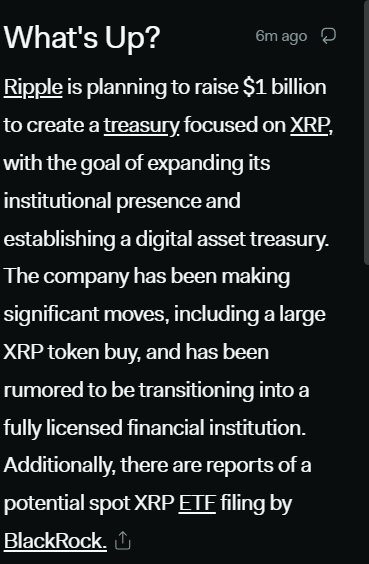

Ripple’s $1B XRP Treasury Move Ignites Social Media Frenzy - LunarCrush Data Reveals Explosive Metrics

Ripple just dropped a billion-dollar bomb on the crypto space—and social media is losing its mind.

The Social Surge

When Ripple moved $1 billion in XRP from its treasury, the digital equivalent of setting money on fire got everyone talking. LunarCrush metrics confirm what everyone's seeing—engagement numbers are shooting through the roof like a rocket-powered unicorn.

Market Impact

Treasury moves of this magnitude don't happen in a vacuum. They create waves that ripple through the entire ecosystem—pun absolutely intended. The social metrics aren't just numbers on a screen; they're the pulse of market sentiment beating faster by the minute.

Because nothing says 'we believe in our project' like moving nine figures worth of digital assets while traditional finance still struggles to spell blockchain correctly.

XRP Social Metrics

LunarCrush’s series shows rising mentions and engagement clustered around the treasury headline and its follow-ups. The AltRank swing from 667 to 32 suggests social and market factors briefly aligned before cooling to 177, which can happen when attention fades after the first wave.

A Galaxy Score near 56 indicates a stable blend of price action and quality of interaction rather than a frenzy. Continued elevation across several sessions WOULD strengthen the metric.

When conversation expands beyond one headline into product updates, liquidity conditions, and large wallet activity, social strength tends to last longer. Narrow discussion often fades once the initial impulse passes. Traders can use this distinction to set expectations for follow-through.

In practice, that means comparing day-over-day mentions with the mix of accounts driving engagement. Broader participation usually correlates with firmer spot turnover. A narrow spike often resolves quickly without leaving a footprint on price.

Price and Context

XRP is currently trading near $2.46 today, up about 2.5% over 24 hours, while still down by 17% on a 30-day view.

Intraday prints sit roughly between $2.36 and $2.48 with 24-hour volume near $4 billion, keeping price inside a developing range. The first upside checkpoint is $2.50 on rising spot volume. Losing $2.20 to $2.25 would shift focus back to $2.00.

The wider market shapes probabilities with the global crypto market cap tracks in the $3.7 trillion to $3.8 trillion band, and leaders remain sensitive to macro swings.

Bitcoin Price (Source: CoinMarketCap)

A steady tape in Bitcoin and ethereum while XRP holds gains tends to support extension. Relative underperformance by XRP on green sessions can keep rallies brief.

What to Watch Now

To connect social activity with trading flow, look at LunarCrush mentions, engagement, AltRank, and Galaxy Score across several sessions, then compare those trends with xrp price and spot volume during green days, while also monitoring any formal disclosures on the Evernorth raise, since concrete steps can convert a headline into steady demand.

The metric improves when elevated conversation persists beyond the initial surge, price closes hold their gains, and spot turnover expands rather than stalling.

Community often view closes above the prior day high accompanied by higher spot volume to be stronger confirmation, while repeated failures near $2.50 during light volume tend to suggest fading momentum.