FLOKI Soars, DASH Dominates Volume, FET Explodes: Altcoin Renaissance or Crypto Mirage?

Altcoins awaken from their slumber as three digital assets defy market gravity.

The FLOKI Frenzy

Memecoins roar back to life with double-digit percentage gains, proving once again that in crypto, sentiment often trumps fundamentals.

DASH's Liquidity Surge

Trading volume explodes across major exchanges as the privacy-focused coin attracts both retail and institutional attention—because nothing says 'private' like public blockchain transactions.

FET's AI Revolution

Artificial intelligence tokens lead the charge, demonstrating that when traditional markets wobble, crypto investors still chase the shiniest new narrative.

Is this the long-awaited altcoin season or just another head-fake before the next correction? History suggests both—and that most traders will guess wrong either way. After all, predicting crypto markets remains slightly more reliable than reading tea leaves, just with better graphics.

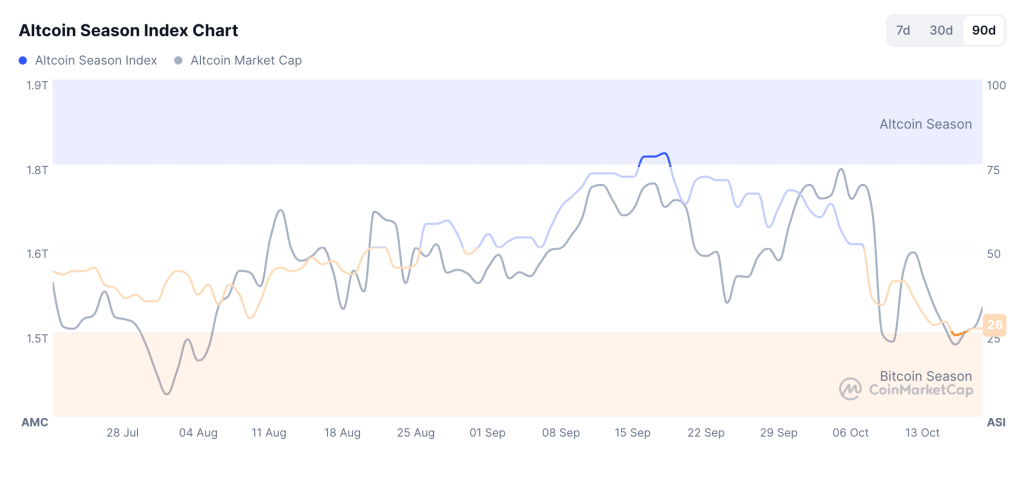

Altcoin Season Index (Source: CoinMarketCap)

FLOKI: Social Impulse Meets Deep Books

FLOKI is currently trading NEAR $0.000087, up by 28% in five hours. Reported volume is more than 600% higher. The driver is straightforward. A new post from Elon Musk promoted FLOKI with an AI-generated video and pushed the token into trend lists and brought momentum accounts back to meme pairs.

Community participants should monitor two indicators to gauge whether momentum can hold: the normalization of funding rates after the initial rush and the persistence of elevated trading volumes across multiple venues rather than a concentration on one.

If both measures remain steady, the surge may shift from a brief headline reaction into a sustained MOVE supported by liquidity. However, if either measure weakens, price movement often returns to earlier levels, suggesting the spike came from short-term sentiment instead of consistent participation.

Flōki is back on the job as 𝕏 CEO! pic.twitter.com/Zu29Dos24r

— Elon Musk (@elonmusk) October 20, 2025Dash: Quiet Advance Against a Heavy Market

Dash is trading around $45, up by about 8% in 24 hours, outperforming most large-cap peers despite a broadly weaker backdrop. The rise is attributed to increased spot turnover and stable liquidity on regional exchanges, suggesting more active rebalancing rather than fresh speculative inflows.

DASH Price (Source: CoinMarketCap)

Price charts show Dash holding above its short-term support near the mid-40s after weeks of compression. That stability has drawn some traders looking for rotational opportunities while other altcoin pairs remain volatile. The token’s modest supply structure and history in payment-based use cases also make it a familiar hedge during market pullbacks.

Funding rates and open interest remain flat, implying that the lift came from short covering and portfolio adjustments rather than long-term positioning. Whether Dash can sustain the rebound depends on broader sentiment and the next shift in liquidity toward older, high-float networks.

Artificial Superintelligence Alliance (FET): AI Basket Rotates Back In

FET is trading near $0.29 at press time with a higher volume of about 108%. AI-linked tokens often see renewed bids after macro relief in Bitcoin and Ethereum. Today’s uptick fits that pattern. Traders who want liquid exposure to agent, data, and compute themes lean on FET during risk-on hours because it clears size without large slippage.

For durability, watch whether volumes stay firm after the first burst and whether builders or partners add near-term deliverables. Without fresh cues, AI rotations can slip back into range trading once the initial push cools.

How to Approach an Anticlimactic October

Data still points to narrow participation, even with a few green screens. That argues for patience and process rather than chase. Use volume-weighted levels and recent session lows to stage entries. Favor pairs showing tight spreads and consistent depth across multiple venues.

Context matters for risk units: when the index sits in the high 20s, programs that add on confirmation rather than anticipation usually fare better. For FLOKI, the tell is whether funding and volume stabilize beyond the first news cycle.

Social impulse, supply absorption, and sector rotation can each be tracked through live data, giving traders a clearer view of market strength and timing. When those indicators begin to weaken, a defensive stance is usually more prudent, allowing positions to reset before liquidity thins.

If, however, these markers improve while the altcoin season index gradually climbs from the mid-20s, it may indicate that altseason is quietly rebuilding through selective pockets of activity rather than advancing through a single, broad market wave.