XRP ETF: The Next Market Shaker Following Bitcoin and Ethereum?

Wall Street's crypto obsession hits its next frontier—XRP joins the ETF race.

The Regulatory Gauntlet

SEC approval remains the billion-dollar question mark. While Bitcoin and Ethereum ETFs smashed through regulatory barriers, XRP faces its own unique legal battlefield. The same institutional machinery that propelled BTC to $100K and ETH to $8K now eyes Ripple's digital asset.

Market Impact Potential

Traditional finance veterans are circling—BlackRock and Fidelity could launch the first wave. An XRP ETF would unlock billions in institutional capital currently sidelined by custody concerns. Market makers anticipate liquidity surges that could dwarf current altcoin volumes.

The Institutional Calculus

Pension funds and endowments crave regulated exposure. An approved ETF would legitimize XRP in ways that even the most bullish retail trading can't match. Though let's be honest—Wall Street only cares about assets it can package and fee-ify.

Prepare for volatility either way. Regulatory green lights could trigger altcoin renaissance—rejections might send XRP back to the crypto wilderness.

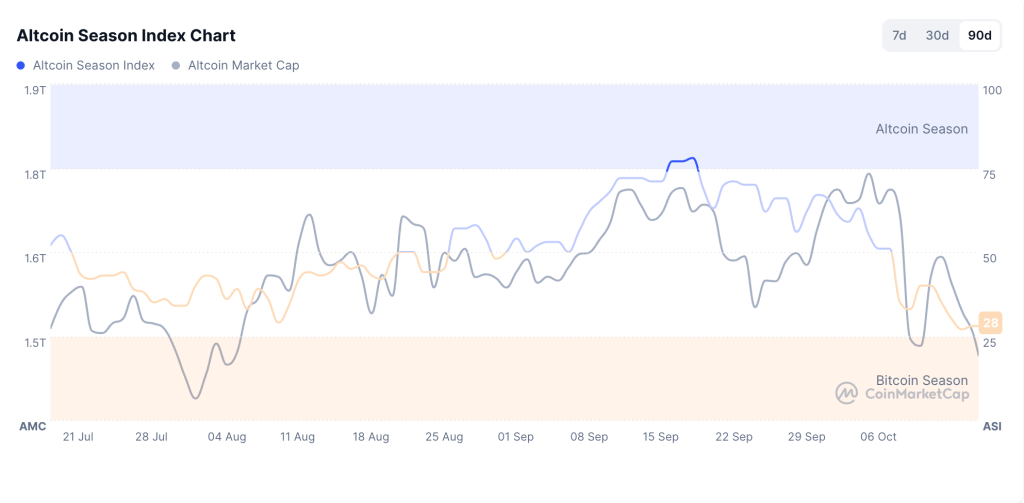

Altcoin Season Index (Source: CoinMarketCap)

BNB: Heavy Turnover Into Layered Bids

BNB price slipped while volume expanded, a pattern that often represents larger orders executed into resting demand. Reports point to funding turning negative on several venues and basis compressing, two markers of forced positioning rather than steady accumulation.

Short-term traders will watch spreads during the next session. Tighter spreads with calmer funding often precede stabilization. Persistent negative funding with fading spot leadership can extend pressure.

![]() Binance launches the Together Initiative, a $400M recovery and confidence-rebuilding plan to support users and institutions during this volatile period.

Binance launches the Together Initiative, a $400M recovery and confidence-rebuilding plan to support users and institutions during this volatile period.

Read more![]() https://t.co/35cSkYkTGg

https://t.co/35cSkYkTGg

Sui: Fastest Volume Growth and Sharpest Reset

Sui’s largest volume jump of 80% is an outlier in this group. Data indicates rapid repositioning from short-horizon accounts after crowded longs earlier in the week.

Intraday ranges widened, then narrowed during the final hours, which suggests early attempts at absorption. A practical approach favors patience NEAR yesterday’s low. The market is looking for smaller wicks, balanced funding, and a session that holds above its own volume-weighted average price before sizing into weakness.

Solana: Rotation, Not Strength

Solana’s price drop alongside higher trading volume points to risk rotation rather than renewed interest. Data shows that much of the recent activity came from traders unwinding Leveraged positions and shifting exposure into more liquid assets.

This is a flow-driven session with most movement confined to intraday trading ranges. Large transfers between spot and derivatives venues suggest rebalancing across accounts rather than new accumulation. Until volume normalizes and volatility narrows, Solana’s price action reflects redistribution of positions, not directional conviction.

How to Approach This Phase Without Forcing Trades

Start with liquidity, not predictions. Identify where depth clusters on books and stage entries near those bands rather than reaching for mid-range quotes. Ladder orders to reduce slippage when conditions are thin.

Fear and Greed Index (Source: CoinMarketCap)

Let volatility cool before leaning in. A session that holds above its own volume-weighted benchmark with declining realized volatility offers cleaner entries than a chase into expanding ranges. Many desks wait for that setup during heavy weeks.

Use position sizing that respects uncertain breadth. The index of 25 implies narrow participation. That favors scaling rather than all-or-nothing bets. Concentrate on pairs showing stable spreads and consistent depth. Avoid thin offshoots until funding normalizes.

Track rotation indicates instead of headlines. If bitcoin steadies and the index remains in the high 20s, selective bids often appear in liquid DeFi or exchange-linked names first. If Bitcoin loses nearby support, defense takes priority, and rallies often fade at prior intraday highs.

Bottom Line for a Dark Day

This sell-off carries high participation, not apathy. BNB shows heavy turnover into layered bids. Sui registers the fastest reset with signs of early absorption. Solana prints large tickets without a major collapse in price.

None of that cancels the risk message from the index, yet it outlines a playbook: wait for stabilization markers, respect depth, and let funding tell the story before committing fresh risk.