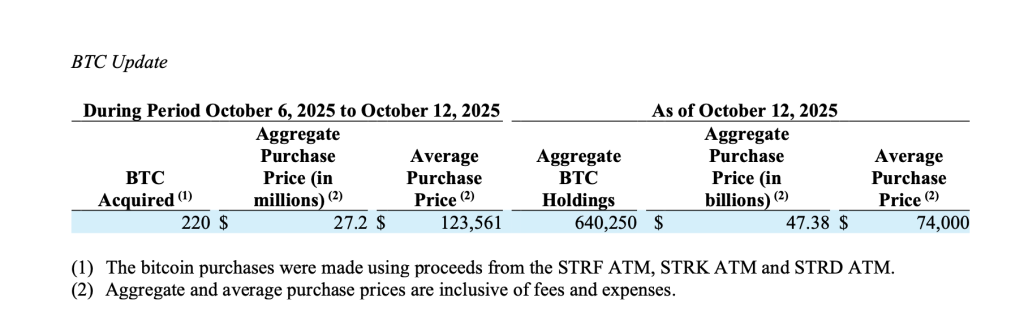

Crypto Giant Amasses 640,250 Bitcoin in Bold $27.2M Accumulation Strategy

Major player makes strategic Bitcoin acquisition—adding $27.2 million to holdings as confidence in digital gold surges.

The Big Bet

With this latest purchase, the institution's Bitcoin treasury now stands at a staggering 640,250 BTC. That's not just dipping toes in the water—that's building an ark while Wall Street still debates whether it might rain.

While traditional finance struggles with yield curves and inflation math, someone's stacking digital assets like they're going out of style—which, ironically, they're just getting started.

ATM Programs Fuel Bitcoin Accumulation

Strategy funded its most recent Bitcoin purchases using proceeds from its STRF ATM, STRK ATM, and STRD ATM programs. According to the company’s filing, these programs collectively raised around $27.3 million in total notional value during the reporting period.

The STRF ATM, tied to Strategy’s 10.00% Series A perpetual strife preferred stock, sold 170,663 STRF shares, generating $19.8 million in net proceeds.

Meanwhile, the STRK ATM, associated with its 8.00% Series A perpetual strike preferred stock, brought in $1.7 million from 16,873 shares. The STRD ATM, based on its 10.00% Series A perpetual stride preferred stock, contributed $5.8 million from 68,775 shares.

Collectively, these offerings have become key financing vehicles for Strategy’s ongoing Bitcoin accumulation strategy—mirroring the company’s long-standing practice of converting equity proceeds into digital assets.

Strategic Expansion Across Equity Classes

Beyond its active ATM programs, Strategy maintains substantial capacity for future issuances.

As of October 12, the company had $1.7 billion, $4.1 billion, $20.3 billion, and $15.9 billion available for issuance under its various preferred and common stock classes (STRF, STRD, STRK, and MSTR, respectively).

This provides a wide financial runway for further expansion of its Bitcoin reserves, signaling that additional purchases could follow as market conditions evolve.

Reinforcing Leadership in the Bitcoin Treasury Space

With 640,250 BTC now under management, Strategy remains among the world’s largest corporate holders of Bitcoin—alongside peers such as MicroStrategy and publicly listed digital asset firms adopting similar treasury models.

The company’s bold MOVE reflects growing institutional confidence in Bitcoin amid tightening monetary policy and increased regulatory clarity across major markets.

By blending creative capital-raising strategies with disciplined accumulation, Strategy continues to redefine how corporations integrate Bitcoin into their balance sheets—cementing its reputation as one of the pioneers in the digital-asset treasury landscape.