CoinStats Teams with Hexens to Uncover Token Smart Contract Risks for Traders

CoinStats just turbocharged its security game—partnering with blockchain security firm Hexens to sniff out smart contract threats before they bite traders.

How It Works

The collaboration layers Hexens' deep-dive audit tech onto CoinStats' portfolio tracker. Scans token contracts for backdoors, rug pulls, and other nasty surprises hiding in the code.

Why It Matters

Traders get real-time risk alerts while managing their portfolios—no more hopping between tabs to vet every new token. Cuts the 'trust me, bro' factor from DeFi investing.

The Fine Print

Hexens brings heavyweight cred—audited protocols you've actually heard of. CoinStats users now get that expertise baked into their daily workflow.

Bottom Line: Smarter security integrations might finally make 'do your own research' less of a full-time job—though Wall Street still thinks a smart contract is an IQ test for lawyers.

New integration brings advanced token analysis technology to cryptocurrency traders worldwide.

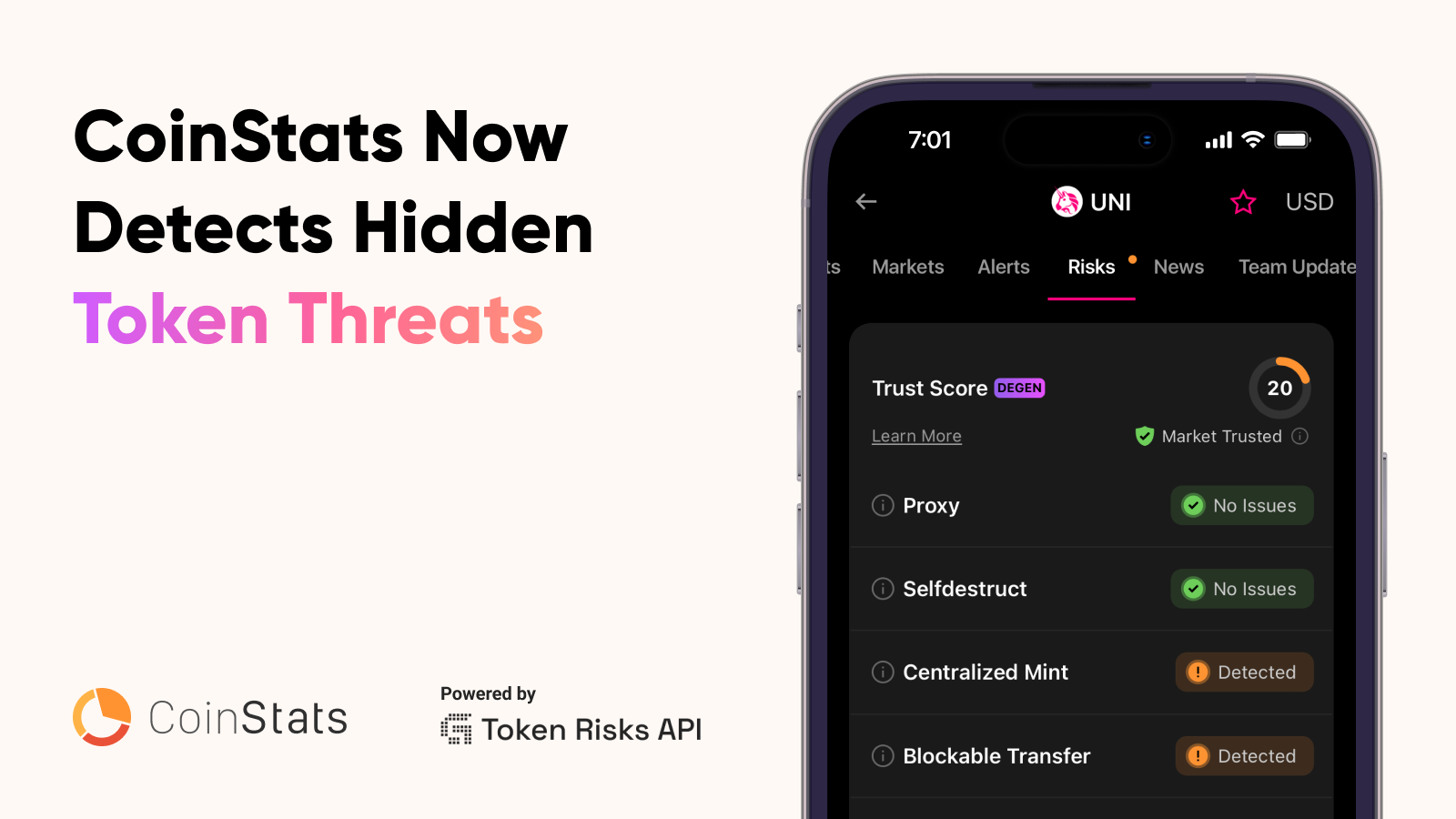

CoinStats has integrated Glider Token Risk, a breakthrough scanning technology from elite cybersecurity firm Hexens. The tool gives traders instant visibility into 22+ smart contract risks before they buy. Now live across the CoinStats platform.

The timing is critical. Over 74,000 scam tokens launched in 2024. These tokens drained nearly $10 billion from traders. And 94% of these malicious tokens contained exploit logic from day one.

Revolutionary Approach to Token Security

Glider Token Risk doesn’t just skim the surface. It decomposes contract logic, breaking down every function, path, and dependency. This DEEP analysis reveals threats that others miss. Think of it as an X-ray for tokens, showing the bones of a contract before you trade.

With this integration, CoinStats becomes more than a portfolio tracker. It’s now an education tool, security guard, and BS detector all in one app.

The scanner identifies 22 risk categories. The most common threats include:

- Blockable transfers (59% of analyzed tokens)

- External calls during transfers (29% of tokens)

- Balance manipulation (25% of tokens)

- Centralized minting (21% of tokens)

- Hidden fees (10% of tokens)

- Centralized burn capabilities (9% of tokens)

- Upgradeable contracts (9% of tokens)

- Blacklists/Whitelists (5% of tokens each)

- Pausable transfers (7% of tokens)

Additional risks include cooldown mechanisms, transfer fees, and other exploit patterns. Basically, if it smells like a rug, it gets flagged. Each risk comes with clear explanations, giving traders actionable insights without needing technical expertise.

This integration addresses a critical market gap. Education is the first line of defense. Glider Token Risk isn’t about blind trust in risk scores. It’s about clear and actionable insights into the tokens that traders interact with.

Not every low-trust project is a scam, and not every scam looks suspicious. By exposing the risks coded into smart contracts, the tool helps traders make smarter, safer decisions.

Glider Token Risk works across major EVM-compatible chains. At the moment, these include: Ethereum, BNB, Base, Polygon, Arbitrum One, Optimism, Avalanche C Chain, Blast, Linea, Mantle, Polygon zkEVM, Arbitrum Nova, Celo, Cronos, Gnosis, Moonbeam, Moonriver, Abstract, Ape, Berachain, Bit Torrent, Frax, Memecore, Sonic, Sophon, Swellchain, Taiko, Unichain, World, XAI, and XDC.

The feature is live for CoinStats Degen plan subscribers on iOS, Android, and web. The new pre-trade ritual is simple. Search for any token in CoinStats. Navigate to the Risks tab. Get instant analysis with detailed breakdowns.

Hexens is an elite Web3 cybersecurity firm trusted by industry leaders, including Polygon, Lido, EigenLayer, and others. The team behind Hexens created Glider, a one-of-a-kind smart contract analysis engine powering advanced threat detection. With deep expertise in smart contracts, protocol audits, and incident response, Hexens helps secure the future of decentralized systems.

CoinStats is the leading platform for cryptocurrency portfolio management, tracking over $100 billion in assets. It simplifies managing multiple wallets and exchanges, helping users monitor and manage their portfolios more efficiently. The platform supports 120 blockchains, 300 wallets and exchanges, and over 1,000 DeFi protocols. It integrates seamlessly with leading platforms like Binance, MetaMask, Coinbase, Phantom, and more.