MSTR Strategy Flashes Rare Reversal Signal - Analysts Bullish on Momentum Shift

MicroStrategy's bold Bitcoin bet just triggered a technical pattern that historically precedes major rallies.

Breaking the Pattern

Traders are scrambling as MSTR's chart flashes a rare bullish reversal signal not seen since the 2023 rally. The stock—often viewed as a Bitcoin proxy—just smashed through key resistance levels with unusual volume.

Institutional Momentum Builds

Hedge funds and crypto-native firms are accumulating positions, betting Michael Saylor's conviction play will outperform pure Bitcoin exposure. The leverage effect works both ways—just ask anyone who held during the 2022 crash.

Timing the Wave

Technical analysts point to converging momentum indicators suggesting this isn't just another dead-cat bounce. The stock typically moves 3-5x Bitcoin's daily price action—making it the ultimate turbocharged crypto play for traditional finance types who still think 'blockchain' is something you buy from IBM.

Whether this marks the start of a new alt-season or just another false alarm for bag holders remains to be seen—but for now, the charts are screaming buy while Wall Street quietly dusts off its 'digital gold' PowerPoint presentations.

Screening for Signals

Market watchers often use Barchart’s tools to filter out noise, especially its Three-Day Losers screener. Unlike a 52-week low list, which can trap investors in prolonged declines, this filter tends to capture fundamentally strong companies experiencing short-term pullbacks. MSTR recently appeared on this list after dropping 1.18% since the start of the week, a modest MOVE considering its volatility.

The reportthat Strategy’s stock remains up over 149% in the past year, meaning even small dips could represent windows of opportunity for bullish speculators. Simply put, a company so tied to the trajectory of bitcoin often responds sharply when traders misprice its momentum.

A Quantitative Case for Reversal

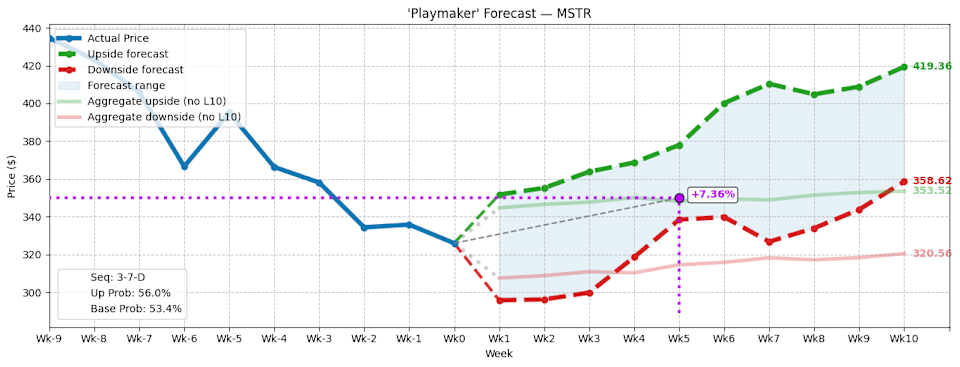

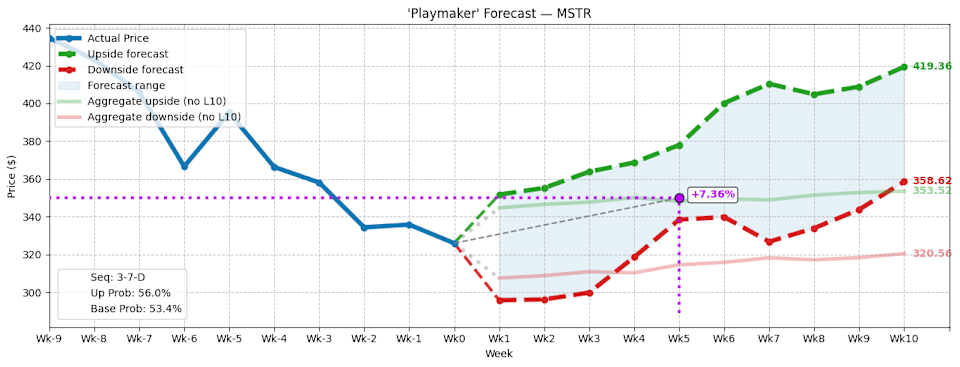

Rather than relying purely on fundamentals, the analysis emphasized quantitative signals. Strategy Inc. is currently trading within a distribution-heavy environment. Over the past 10 weeks, MSTR has posted only three weekly gains against seven weekly losses, a “3-7-D” sequence.

Visit HYLQHistorically, this pattern has flashed just 25 times since January 2019. In the first week after the signal, upside probability was measured at around 56%. More importantly, the weeks that followed typically saw price drift higher than the market’s baseline. Median expectations suggest MSTR could move between $358.62 and $419.36, compared to a baseline drift of $320.56 to $353.52.

For bullish traders, this suggests that the current technical setup may be undervalued by options markets, which tend to price in the more conservative baseline range.

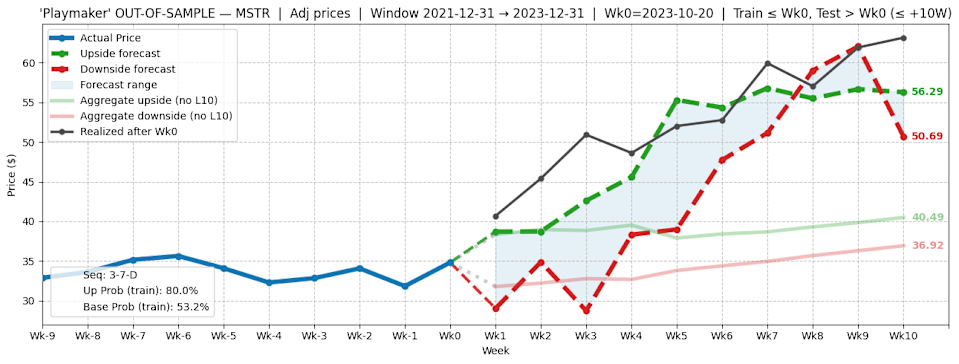

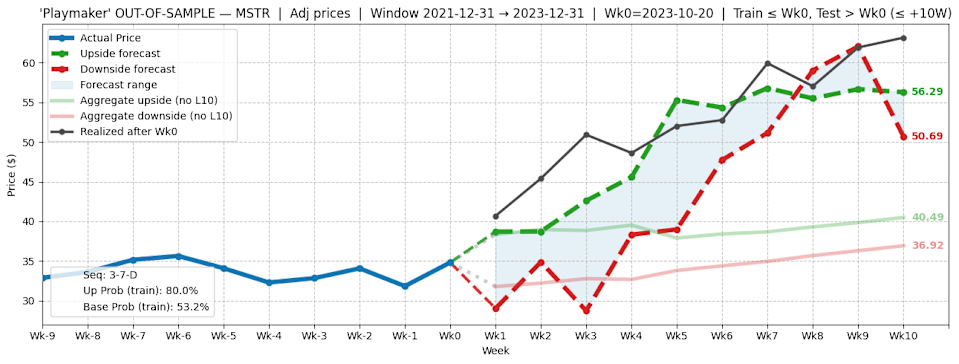

Testing the Signal in Different Environments

One question raised by the report was whether this bullish sequence might only work during euphoric crypto cycles. To test this, analysts ran out-of-sample data between January 2022 and December 2023, a time when crypto markets faced headwinds rather than breakouts. Even then, the same 3-7-D sequence tended to resolve in a strong upside drift, reinforcing the statistical weight behind the signal.

For traders skeptical of short-term narratives, this backtest provided confidence that the reversal setup is more than just noise amplified by Bitcoin’s rallies.

Trading the SetupThe article pointed to one particularly attractive trade: a 345/350 bull call spread expiring October 17. This involves buying the $345 call and selling the $350 call for a net debit of $205. The potential maximum gain is $295 if the stock clears $350, representing a 144% return at expiration. The breakeven sits at $347.05, a level analysts believe is reasonable given the historic behavior of this sequence.

For more aggressive traders, there could be justification to extend the strike to $380, though the conservative spread still offers a rare risk-reward ratio. The opportunity lies in capturing outsized upside while keeping risk capped, a dynamic that many equity traders find compelling in the highly volatile crypto-equity space.

Outlook: Balancing Volatility and Vision

The analysis framed Strategy Inc. as more than just another equity name. For some, it remains a lightning rod in the debate about whether to invest directly in Bitcoin or through corporate vehicles like MSTR. Critics point to dilution, Leveraged debt, and volatility, while supporters emphasize the unique equity-market pathway it provides for institutions unable to hold Bitcoin directly.

This ongoing debate places Strategy in a category of its own: both a speculative bet on Bitcoin’s price and a proxy for the evolution of institutional crypto adoption. As long as this tension persists, MSTR will continue to attract traders looking for asymmetric opportunities.

HYLOQ’s Distinctive Play on Hyperliquid

While Strategy Inc. stirs controversy, the author noted that other equity-linked crypto plays are beginning to emerge. One standout is HYLQ Strategy Corp, which has positioned itself as the “MicroStrategy of altcoins.” Holding nearly 29,000 HYPE tokens, HYLQ offers direct exposure to Hyperliquid, a decentralized exchange known for zero-gas fees, sub-second settlement, and over $2 trillion in lifetime transaction volume.

What differentiates HYLQ is its listing on the Canadian Securities Exchange, a move that brings audited reporting and oversight, something many crypto-related equities lack. With Hyperliquid’s Layer-1 blockchain capable of processing 200,000 transactions per second, analysts see HYLQ as a serious candidate in decentralized trading.

Investors looking for a regulated entry point into DeFi candirectly through Interactive Brokers, making access both simple and transparent. This pathway allows traditional traders to tap into Hyperliquid’s growth while staying within a familiar equity framework.

For traditional investors wary of unregulated altcoin markets, HYLQ provides a rare, regulated gateway into DeFi’s rapid expansion. Just as Strategy offers a pathway into Bitcoin exposure through equity markets, HYLQ positions itself as the structured bridge into the next generation of decentralized finance.

Buy HYLQ

![]()