Bitcoin’s Parabolic Surge: Is This the Ultimate Business Cycle Breakout?

Bitcoin smashes through resistance as traditional markets wobble—digital gold proving its mettle once again.

The Halving Effect

Supply shocks from April's halving event continue rippling through markets. Miners hoard, institutions accumulate, while retail scrambles for position. Classic scarcity play, just faster and more volatile than any commodity in history.

Macro Meets Crypto

Central banks flip-flop on rate policies, creating perfect storm conditions for alternative assets. Bitcoin doesn't wait for quarterly earnings calls or Fed announcements—it moves at light speed while traditional finance debates PowerPoint colors.

Parabolic or Precarious?

Every 20% dip gets bought aggressively. New ATHs become routine weekly events. The pattern looks familiar to 2017 and 2021, but with one stark difference: real institutional infrastructure now supports the rallies instead of just meme-fueled speculation.

Watch the leverage ratios. When your Uber driver starts explaining perpetual swaps, maybe time to check your risk exposure. The cycle continues—just don't be the one holding bags when music stops.

Where we are now

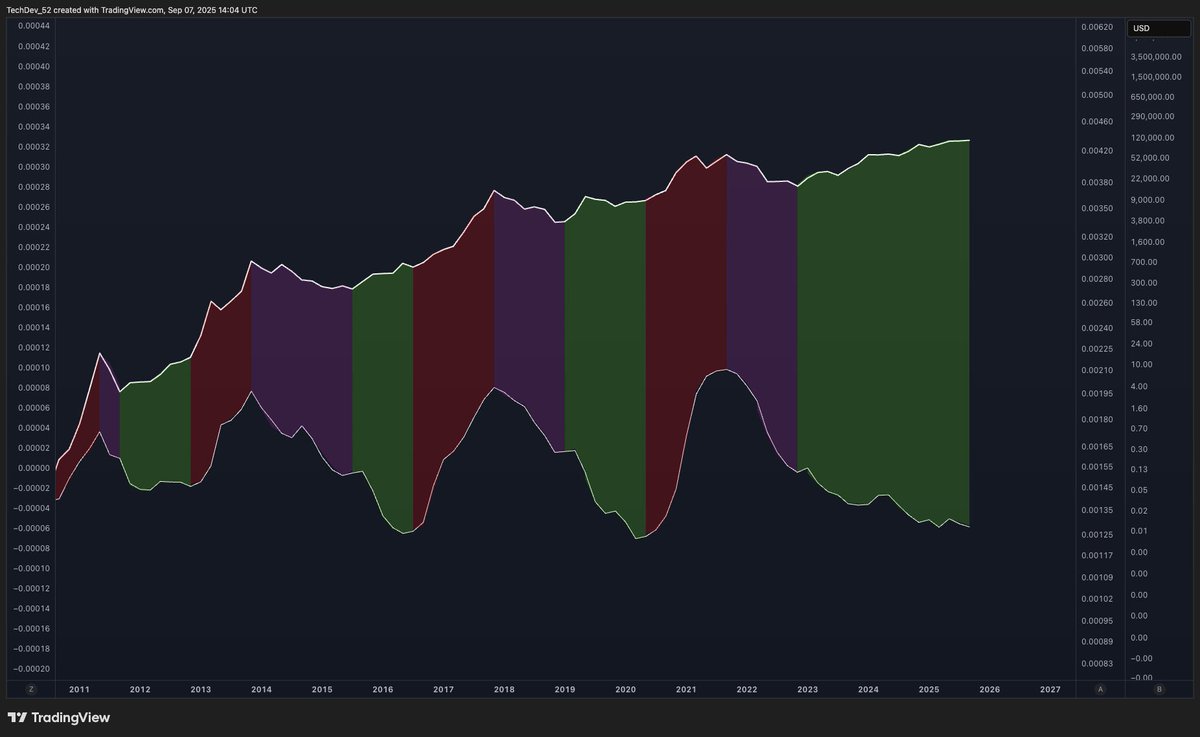

The current section of the chart shows Bitcoin moving within a green “bull ramp” zone, where BTC has been steadily rising even as the business cycle weakens. Historically, this stage often precedes Bitcoin’s strongest parabolic advances. If the business cycle soon flips into recovery, the chart suggests BTC could transition into the red “bull parabola” zone — the phase where both economic expansion and Bitcoin price growth feed off each other.

READ MORE:

Why it matters

This cyclical framework is significant because it connects macroeconomic momentum with Bitcoin’s unique four-year halving rhythm. Past instances of the “bull ramp” phase have served as launchpads into Bitcoin’s most explosive price growth, leading directly into new all-time highs.

The big question

TechDev ends with a simple but weighty question: “Where are we now?” The answer depends on whether bitcoin maintains its grind higher until the business cycle turns positive. If history repeats, the next reversal could align with Bitcoin’s long-awaited parabolic breakout.

![]()