Crypto Sentiment Holds at 53 as Altcoin Rotation Ignites Market Frenzy

Market sentiment sits squarely neutral at 53—neither euphoric nor fearful—while capital floods into alternative cryptocurrencies.

Rotation Rampage

Altcoins are stealing the spotlight as traders pivot from established giants to emerging contenders. The shift's creating waves across exchanges—volume spikes, liquidity churn, and that classic crypto volatility are back with a vengeance.

Traders are chasing momentum, dumping recent gains into newer narratives while the big caps catch their breath. It's the same old story—everyone's hunting for the next moonshot while pretending this time it's different.

Just another day in digital asset paradise—where 'diversification' means betting on everything that isn't Bitcoin and hoping the music doesn't stop.

Sentiment lifts but caution lingers

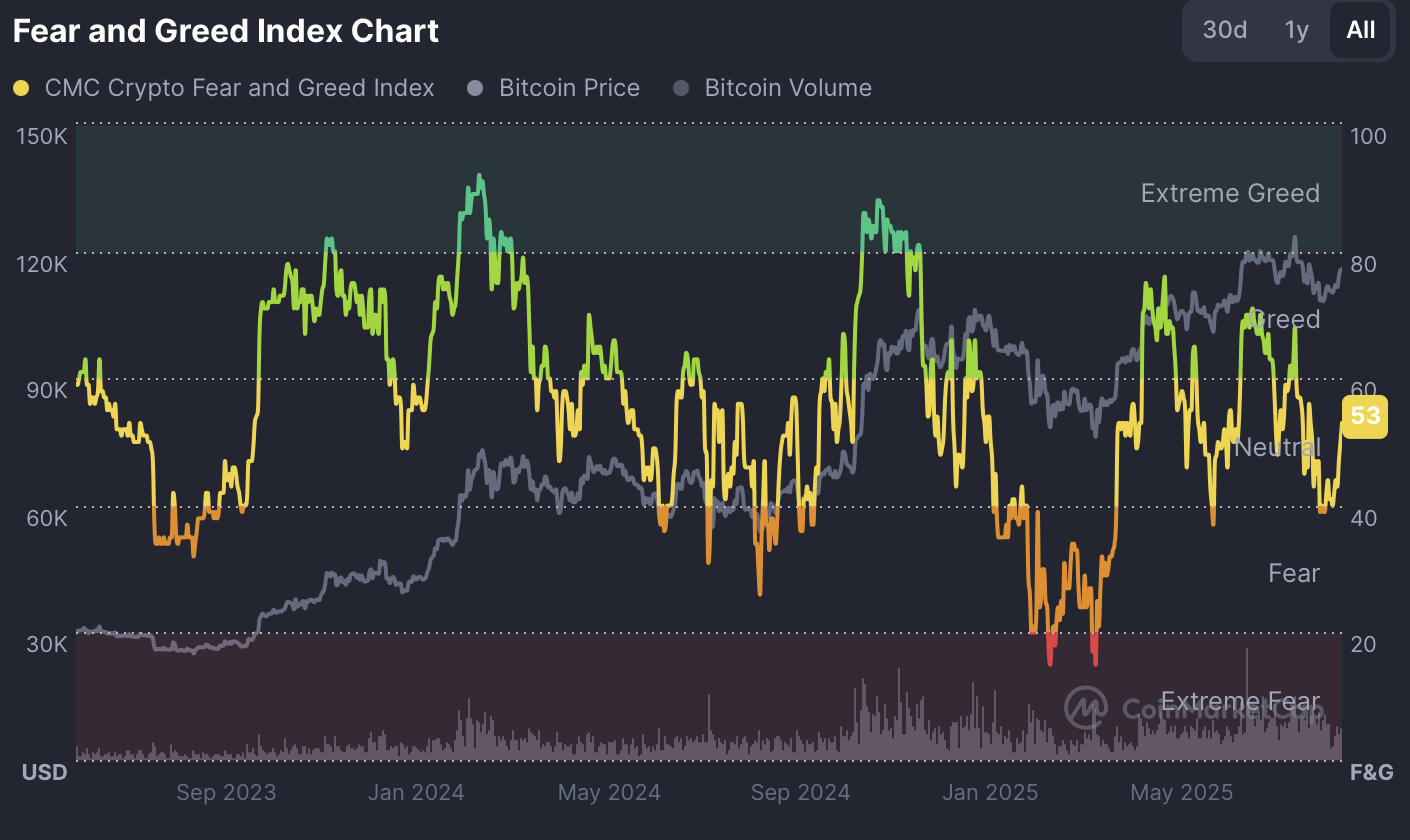

The index’s rise from 41 last week to its current level suggests a notable improvement in risk appetite. While still below last month’s greed reading of 63, the market has exited the lower-neutral band for the first time since August. Analysts see this as a neutral-leaning-bullish setup, supported by ETF inflows and growing altcoin participation.

Altcoin rotation strengthens

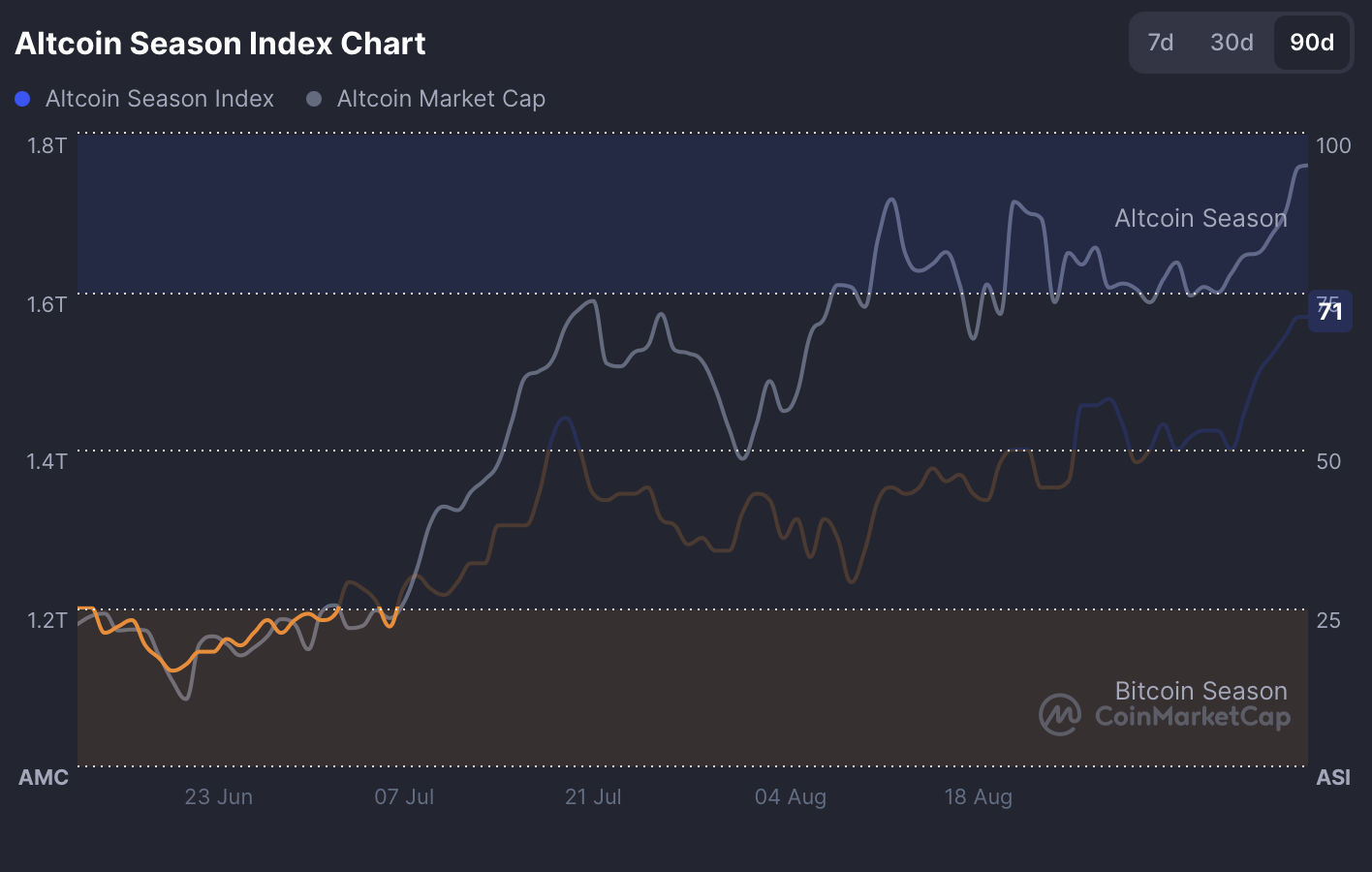

Rotation into altcoins has accelerated sharply. The Altcoin Season Index surged to 71, up 34% in a week and closing in on the 75 threshold that signals a full-blown “altseason.” At the same time, Bitcoin dominance slipped to 56.72%, down 1.1% on the week, as ethereum and other large caps gained ground.

Derivatives markets point to healthier conditions too, with open interest falling 6.7% in 24 hours, suggesting leverage is unwinding and reducing short-term volatility risks.

Still, there are signs of froth. The TOTAL2 index (altcoin market cap excluding Bitcoin) shows an RSI of 78.68, flashing short-term overbought conditions.

Institutions drive inflows, retail stays wary

The institutional narrative remains firmly bullish. Spot Bitcoin and Ethereum ETFs pulled in $1.05 billion of inflows on September 12, while Tether unveiled USAT, a U.S.-regulated stablecoin initiative led by former White House official Bo Hines. Both developments underscore the growing foothold of traditional finance in digital assets.

But retail concerns linger. FTX-linked wallets moved $45 million in solana (SOL) to exchanges, fueling sell-side risk, while scrutiny over reserves at exchanges such as Gate continues to cast a shadow.

READ MORE:

The bottom line

The crypto market sits at a delicate crossroads. Sentiment has turned cautiously optimistic, with altcoins clearly benefiting from capital rotation and institutional flows reinforcing the bullish case. Yet overbought technicals and legacy risks remind traders that momentum can still reverse quickly.

![]()