Top Crypto Picks Now as December Rate-Cut Odds Drop to Just 3.5%

Markets pivot as Fed signals stall—digital assets poised for breakout momentum.

Rate Reality Check

With traditional rate-cut hopes fading faster than a meme coin's hype cycle, crypto stands defiant. That 3.5% probability isn't just a number—it's a flashing green light for decentralized alternatives.

Portfolio Pivots

Smart money already rotates into inflation-resistant protocols and yield-bearing tokens. Why chase dwindling fiat returns when on-chain APYs still crush anything Wall Street dares offer?

Timing the Transition

This isn't speculation—it's arithmetic. While traditional finance debates decimal points, blockchain networks compound value 24/7/365. The real cut happened years ago: banks slicing your savings to zero while pretending it's policy.

Fed Rate Cuts Could Redefine the Crypto Market Outlook

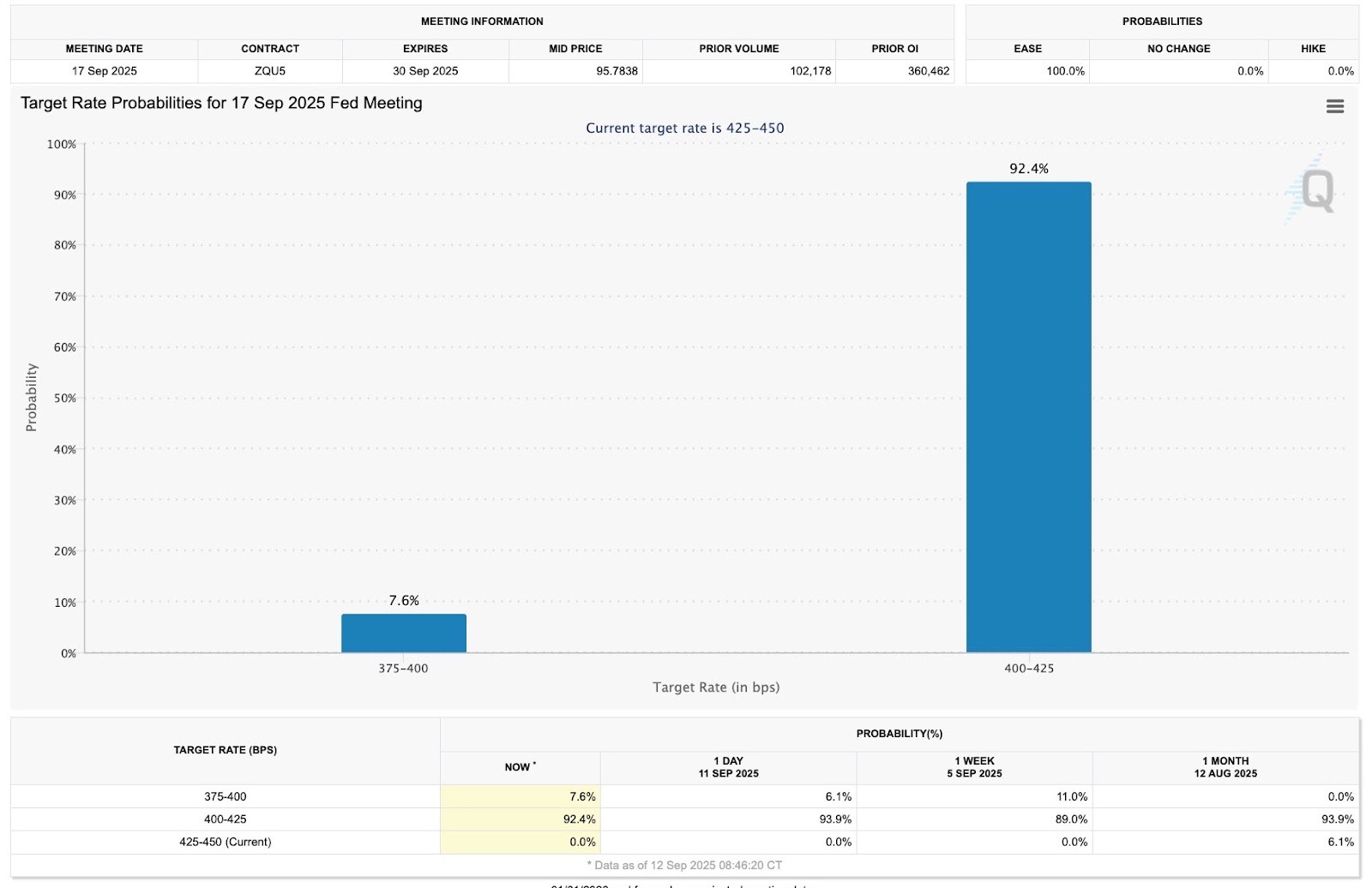

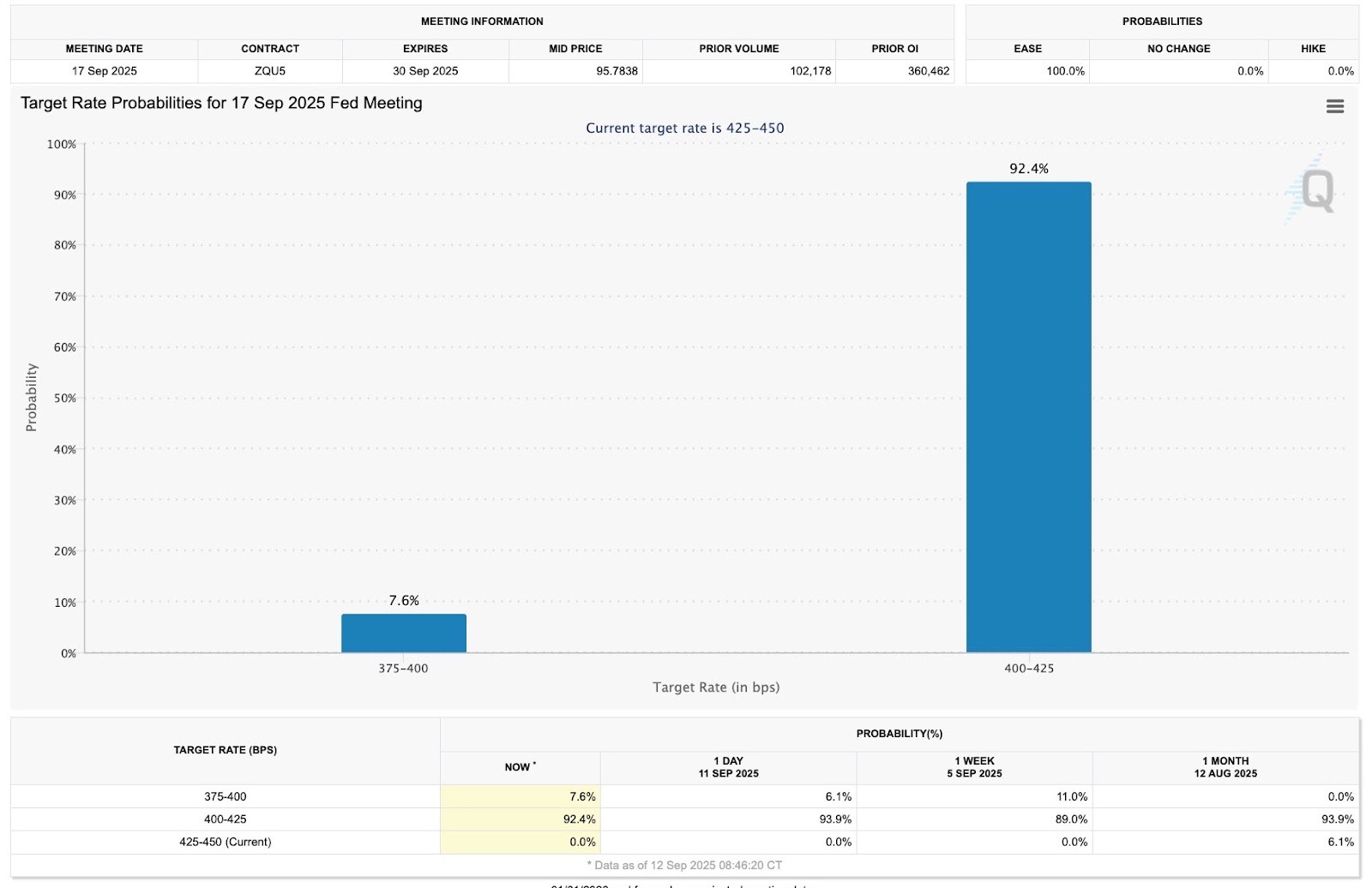

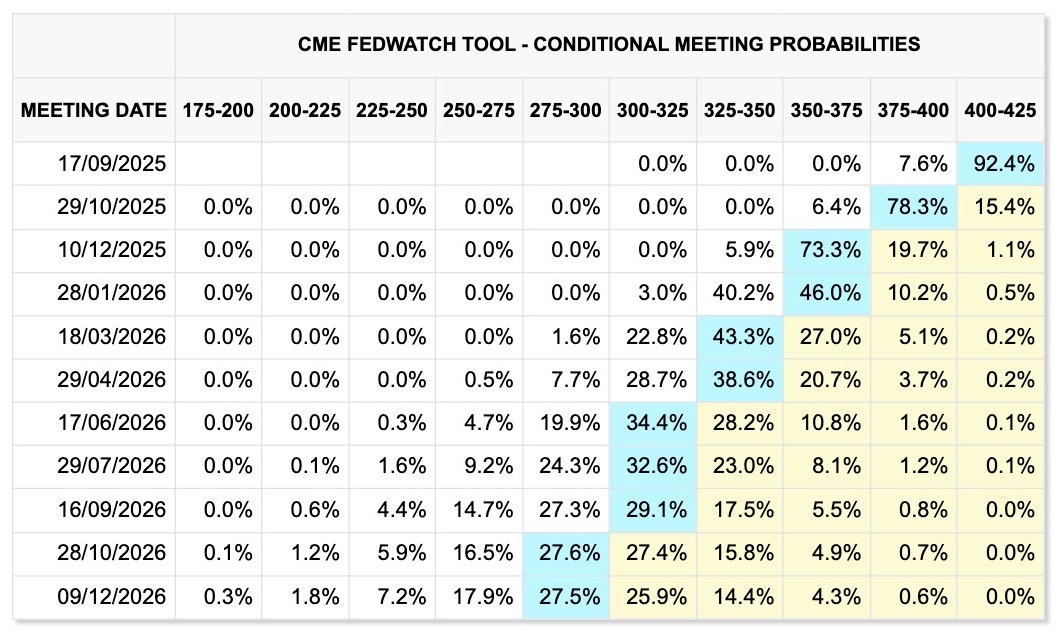

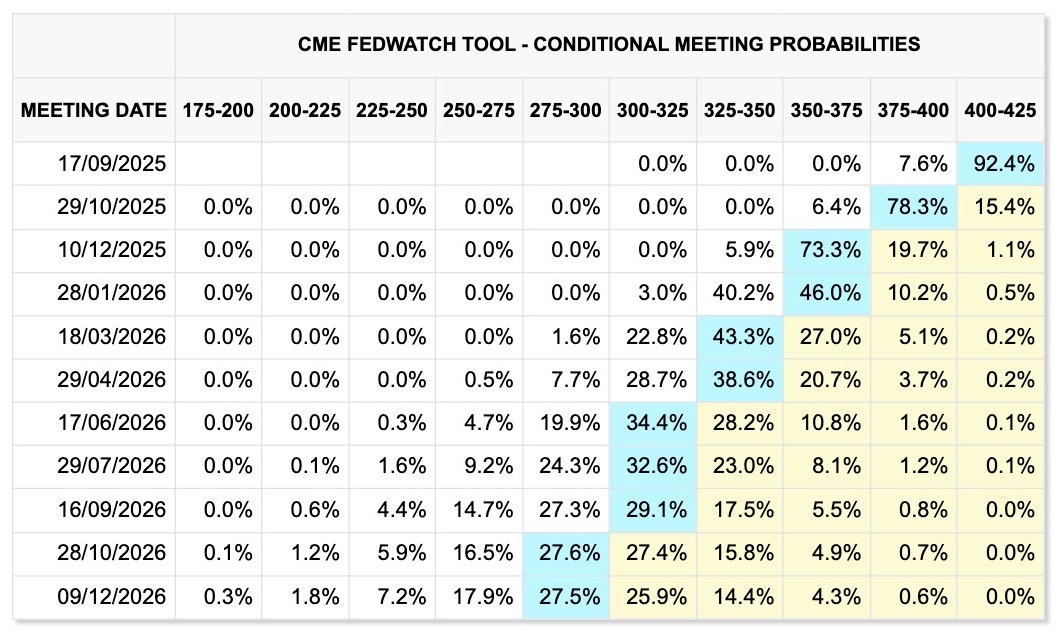

Expectations for a softer Federal Reserve stance have become one of the strongest drivers of market sentiment in recent weeks. Data from CME FedWatch now points to a 93% probability of a single rate cut at the September 2025 meeting, which WOULD take the benchmark range to 4.00-4.25%.

By the time the December meeting arrives, market odds climb to about 92% for two cuts, bringing rates down to roughly 3.50-3.75%. That trajectory would mark a decisive policy turn and an unmistakable signal that the Fed is ready to support growth and ease financial conditions after a long stretch of elevated rates. For crypto investors, such a policy shift is often the spark that ignites the next stage of a bull cycle.

Lower rates typically mean cheaper borrowing costs and greater access to liquidity. In practice, this invites a larger pool of speculative capital into risk assets and makes it easier for institutions and retail investors alike to allocate funds to digital assets.

Historically, the start of an easing cycle has been followed by sustained rallies across crypto markets. Bitcoin has already proven resilient this year, climbing back toward its highs despite global economic uncertainty. Yet many altcoins have not matched that pace and remain well below their potential.

A move toward a 3.50% rate environment could change that. Once liquidity begins to expand and risk appetite increases, capital often flows from bitcoin into mid-cap and small-cap tokens, where the opportunity for outsized gains is greatest.

If the anticipated rate cuts arrive on schedule, the coming months may provide the perfect backdrop for an altcoin surge, making this policy shift one of the most important macro signals for crypto traders to monitor as the year closes.

Best Crypto to Buy Now As Rate Cuts Indicate Growth For Altcoins

Pepenode

Pepenode has built a presale concept that merges entertainment with measurable earning mechanics, creating a platform that appeals to both meme coin enthusiasts and investors who want more than a passing fad.

Its Core feature is a mine-to-earn dashboard where participants simulate the excitement of digital mining through interactive tasks that generate token rewards.

This structure encourages daily engagement and strengthens community ties while introducing a deflationary model that reduces circulating supply over time. Each referral and transaction contributes to controlled burns, aligning the incentives of early users with the long-term health of the token.

Such mechanics can gain extra relevance in the coming weeks as the prospect of Federal Reserve rate cuts fuels a broader appetite for risk assets. When monetary policy turns easier, liquidity often increases and speculative markets see fresh inflows of capital.

Projects that combine a playful narrative with built-in scarcity tend to benefit early because they capture attention quickly while also offering a clear economic framework.

Pepenode’s design makes it easy for newcomers to participate while rewarding the most active community members, a combination that typically drives strong word-of-mouth growth during periods of renewed market optimism.

The project has been covered by creators like ClayBro already, who seem to be quite bullish about its future in the coming weeks, irrespective of rate cuts or other such developments.

With Bitcoin already recovering sharply and investors preparing for a possible rate environment NEAR 3.5% by year end, the project sits at a point where macro momentum and internal tokenomics could reinforce each other.

That alignment of external conditions and well-structured utility gives Pepenode a credible path to sustained traction and a potential increase in value as the crypto market braces for an altcoin rotation.

Buy PepenodeBest Wallet Token

Best Wallet Token powers a multi-chain wallet ecosystem that aims to simplify how users store and move digital assets. The wallet supports major networks such as ethereum and Solana while offering a seamless interface for decentralized finance activity, NFT management and cross-chain transfers.

This compatibility makes it attractive to traders and long-term holders who need reliable access to multiple ecosystems without juggling several applications. The token acts as the engine for user rewards, platform governance and access to premium features that include early participation in selected presales and enhanced staking opportunities.

This kind of practical utility often becomes more valuable when markets anticipate a wave of liquidity. Expectations of a Federal Reserve policy pivot toward lower rates by December have already encouraged investors to look for infrastructure projects capable of scaling with renewed user demand.

If borrowing costs ease toward the projected 3.5% level, a larger pool of retail and institutional participants is likely to re-enter decentralized markets, increasing the need for wallets that can handle assets across chains efficiently.

Best Wallet Token benefits directly from that dynamic because higher usage of the wallet translates into greater demand for the token itself. By tying governance rights and exclusive features to active participation, the project builds a feedback loop in which adoption drives value.

As Bitcoin leads the market higher and anticipation of rate cuts grows, Best Wallet Token stands to gain from a climate where accessibility and cross-chain flexibility are central to user decisions, setting it up for stronger traction and potential price appreciation.

Buy Best Wallet TokenBitcoin Hyper

Bitcoin Hyper is a LAYER 2 network built to extend the performance of the original Bitcoin chain without compromising its security.

![]()

![]()

By processing transactions off the base layer, it delivers faster confirmation times and lower fees, features that make it practical for applications ranging from everyday payments to complex decentralized finance products.

Developers can build on its infrastructure while still relying on the proven security model of Bitcoin, and users benefit from an environment where transactions settle quickly and cost less. This blend of scalability and reliability has positioned Bitcoin Hyper as a bridge between Bitcoin’s established trust and the growing demand for high-speed blockchain services.

Market conditions over the next few months could magnify that appeal. With CME FedWatch showing high probabilities of rate cuts that could bring US rates close to 3.5% by year end, investors are preparing for an influx of capital into risk assets.

Historically, such periods of monetary easing have been accompanied by strong interest in projects that enhance CORE networks, since they enable broader use cases and attract both institutional and retail adoption.

Bitcoin Hyper’s ability to scale the most recognized blockchain positions it to capture a share of that attention. As liquidity expands, developers and businesses seeking secure yet efficient infrastructure are more likely to build on a Layer 2 platform backed by the Bitcoin brand.

That practical utility, coupled with a macro environment favoring growth, gives Bitcoin Hyper a solid foundation to gain traction and potentially appreciate in value as the market enters its next phase of expansion.

Buy Bitcoin HyperSnorter

Snorter is an AI-powered trading assistant built entirely within Telegram, the platform where much of the crypto conversation already takes place. Its core function is to deliver real-time market analytics, trading signals, and automated tools directly inside a familiar messaging interface.

![]()

![]()

Traders can receive instant alerts, run quick analyses, and even automate certain strategies without leaving the chat environment. This frictionless design eliminates the need for multiple platforms and gives both casual participants and experienced traders an immediate advantage when reacting to market moves.

The project’s native token powers premium features such as advanced analytics, priority notifications, and governance participation, creating a direct connection between token demand and user growth.

The coming weeks may provide a particularly favorable backdrop for Snorter’s utility to translate into value. With strong market expectations of Federal Reserve rate cuts by December and a projected policy path that could bring rates close to 3.5%, liquidity is likely to increase across risk assets.

Such periods historically draw a wave of traders back into crypto markets, driving higher volumes and a greater need for tools that deliver speed and actionable insights.

$3M reached. Blink and you'll miss it. pic.twitter.com/v7RIEAdw3k

— Snorter (@SnorterToken) August 12, 2025

Snorter stands to benefit as new and returning participants look for efficient ways to stay ahead of fast-moving conditions. Each new user who seeks premium features supports demand for the token, reinforcing the LINK between adoption and price. It has raised upwards of $3 million already, and the community seems to continue stocking up on tokens via the presale even after weeks of its presale introduction.

By combining AI-driven analysis with the communication hub most crypto traders already use, Snorter is positioned to capture a surge of attention and activity, giving it a credible path to stronger traction and potential appreciation as the market responds to easier monetary policy.

Buy SnorterConclusion

The possibility of US interest rates falling toward the 3.5% mark by December has quickly become one of the most closely watched signals in global markets. Every stage of a monetary easing cycle tends to unlock liquidity and attract speculative capital, and crypto has historically responded with sharp moves once borrowing costs decline.

Bitcoin’s swift rebound has already drawn capital back into the market and set the pace for what could be the next major rotation into altcoins.

For investors, this environment creates a rare opening to position early in projects that combine clear utility with strong community engagement. Tokens that can capture new users and deliver practical value during an influx of market activity, like the ones mentioned above for instance, are often the ones that lead the next phase of a rally, making this an opportune moment to look closely at the assets highlighted in this discussion.

![]()