Crypto Project Funding Trends: Healthier Valuations Despite Lower Capital Inflows

Capital flows tighten but valuations hold strong—crypto's funding landscape defies traditional logic.

Venture dollars slow while project quality surges. Investors chase fewer deals but demand better fundamentals. The era of easy money fades, forcing builders to prioritize substance over hype.

Smart money pivots toward sustainable models. Teams now face tougher scrutiny on tokenomics and real utility. The market matures while weak projects get filtered out.

Lower funding volumes mask a crucial shift: quality over quantity. VCs deploy capital more selectively, backing teams that solve actual problems rather than chasing speculative moonshots.

Traditional finance types still don't get it—they see reduced inflows as bearish while missing the sector's quiet evolution toward actual value creation. Maybe they're too busy counting their management fees.

While funding volume is lower, analysts argue the change has produced a healthier market dynamic. Lower initial valuations for new tokens have contributed to more stable price action after launch, avoiding the extreme boom-and-bust volatility that characterized prior years.

READ MORE:

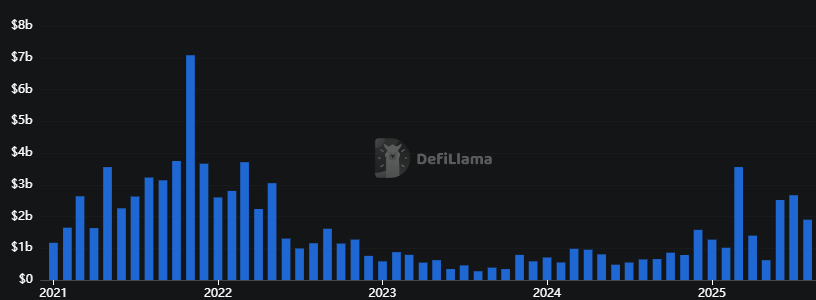

Charts compiled by DeFiLlama illustrate the trend. Monthly raises peaked above $7 billion in early 2022, but have since fallen to far smaller figures, with occasional spikes in 2025. Despite this, analysts suggest the moderation is ultimately constructive, giving both projects and investors a more sustainable environment.

According to Daan Crypto Trades, the lower entry valuations leave more room for upside potential once projects prove their utility. For market participants, this means a healthier balance between risk and reward, and for the crypto ecosystem, it signals a maturing approach to capital allocation.

![]()