XRP Dominates Korean Crypto Trading as Investors Favor Altcoins Over Bitcoin

XRP just flipped the script in Korea's crypto markets—traders are dumping Bitcoin for altcoin action.

The Shift to Alts

Korean investors aren't playing it safe anymore. They're chasing bigger returns beyond Bitcoin's sluggish moves. XRP's leading the charge, grabbing market share while BTC watches from the sidelines.

Market Dynamics at Play

Local exchanges show XRP volumes surging past Bitcoin's—proof that when yields compress, risk appetite expands. Traders want movement, not digital gold gathering dust.

Regulatory Side-Eye

Meanwhile, Korea's Financial Services Agency keeps issuing warnings about 'volatility risks.' Because apparently, stable returns come from... government bonds? Please.

Bottom line: When XRP outperforms Bitcoin in a major market, it signals a broader altseason brewing—and traditional finance is still trying to short the top.

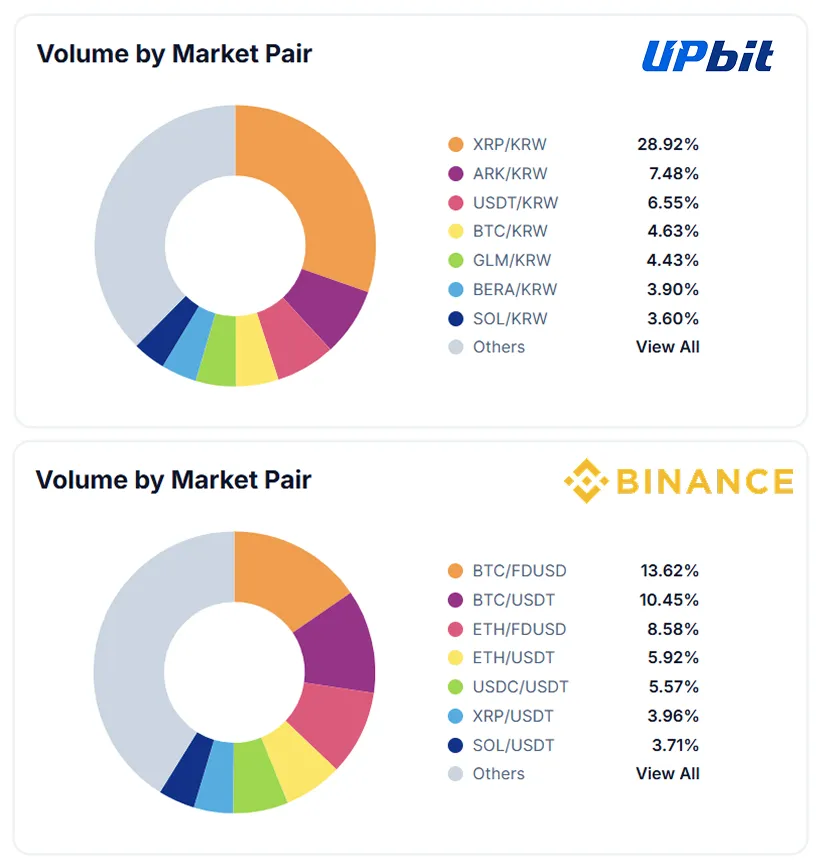

The trend diverges from global platforms such as Binance, where Bitcoin and ethereum dominate volumes. On Binance, BTC/USD and BTC/USDT together make up over 24%, with Ethereum pairs and stablecoin trading also taking significant shares. XRP, meanwhile, accounts for less than 4% of Binance volume, a sharp contrast to its dominance in Korea.

READ MORE:

Cyclop noted that Clearpool’s expansion into the Korean market with PayFi aligns perfectly with this demand shift, given the country’s appetite for stablecoins and yield opportunities. With XRP acting as a beta play for new projects, South Korea’s trading behavior is increasingly shaping the altcoin landscape.

![]()