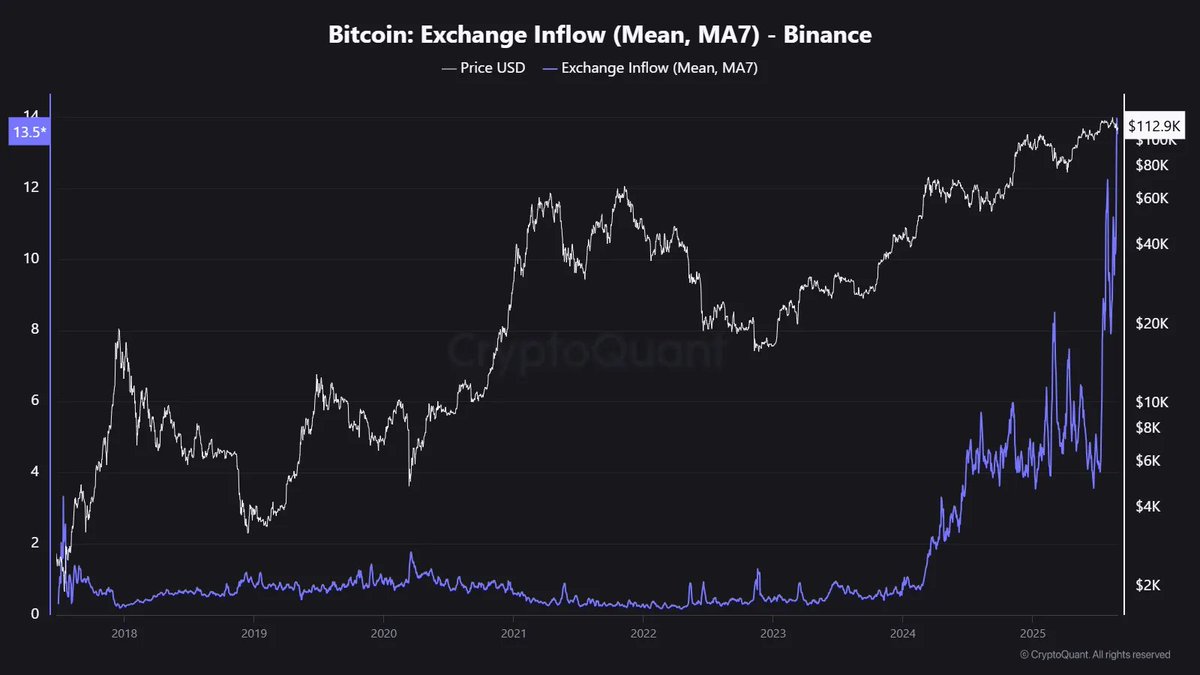

Binance Exchange Inflows Reveal Shift Toward Whale Activity, CryptoQuant Data Shows

Whales are making waves at Binance—and the tides are turning.

Big Money Moves In

CryptoQuant's latest data reveals a seismic shift in exchange inflows. Forget retail FOMO—this is institutional capital parking itself at the world's largest crypto exchange. Whale wallets are dominating deposit volumes, signaling a maturation of market participation that sidelines the average investor.

Liquidity Follows Size

Large inflows typically precede major price movements. When whales accumulate, markets notice. Their activity often serves as a leading indicator for broader trends—retail traders just get the leftovers after the smart money has already positioned itself.

Because nothing says 'democratized finance' like a handful of anonymous wallets controlling the market's direction—just your regular decentralized revolution, brought to you by centralized whales.

Traditionally, Binance has been viewed as a retail-heavy exchange. However, this latest surge suggests that institutional players and large holders now dominate inflow activity. Since February, mean deposits have grown exponentially, pushing the metric to its highest levels on record.

READ MORE:

Analysts say the trend makes sense. Binance remains the world’s largest crypto exchange by volume, giving whales the deep liquidity they need to execute massive trades without excessive slippage.

With Bitcoin trading above $112,000, whale inflows may become an increasingly important factor in market dynamics heading into the next cycle.

![]()