Bitcoin Plunges Below $112,000 - Analysts Call It Prime Buying Opportunity

Bitcoin's sharp correction creates what experts are calling a golden entry point—just as traditional markets face another round of inflationary pressures.

Market Reset Creates Strategic Opening

The dip below $112,000 represents a healthy pullback from recent highs, shaking out weak hands while seasoned accumulators increase positions. This isn't a breakdown—it's a breather in a longer bull cycle.

Institutional Accumulation Accelerates

Major funds aren't panicking—they're loading up. The reset allows major players to build positions without pushing prices higher prematurely. Meanwhile, traditional finance continues wrestling with outdated valuation models that completely miss crypto's network effects.

Technical Foundations Remain Strong

Network activity and hash rates continue hitting record levels despite price volatility. The underlying infrastructure grows stronger even during corrections—something stock traders watching P/E ratios will never understand.

Timing beats timing the market. This reset offers precisely what bullish investors wanted: better entries before the next leg up. Sometimes the best trades come wrapped in red candles.

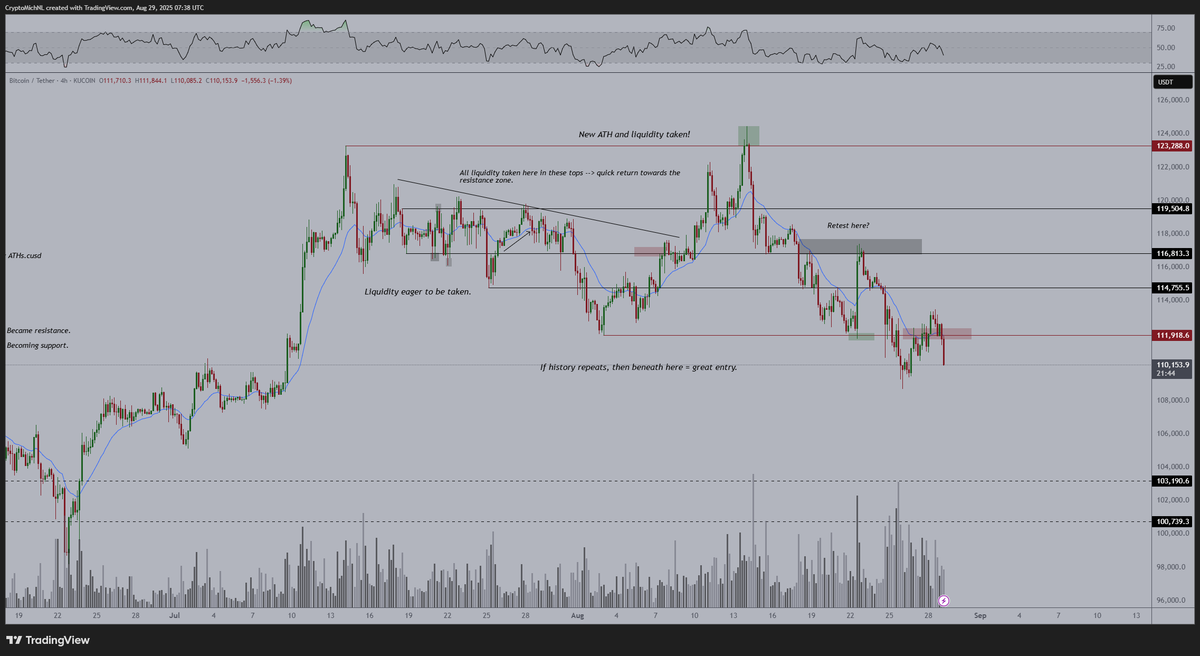

According to van de Poppe’s chart, liquidity levels around $110,000–$108,000 may be tested next if selling pressure continues. Historically, similar retracements have provided attractive entry points before a rebound.

Ethereum’s potential reset is also in focus, as neutral territory could encourage new inflows into altcoins.

READ MORE:

A flush toward lower levels may trigger fresh accumulation phases for both Bitcoin and ethereum ahead of September’s trading cycle.

With volatility heating up, traders are closely watching whether the correction deepens – or sets up the next major rally.

Spot Bitcoin ETFs recorded $219 million in inflows on August 28, ending a six-day streak of outflows that had totaled $1.37 billion. Fidelity’s FBTC led the rebound with $65 million in inflows, though BlackRock’s IBIT saw softer demand.

Analysts say the moves highlight profit rotation among institutions after Bitcoin’s 84% year-to-date rally. ETF assets under management slipped to $145 billion, down from the $151 billion peak in July, reflecting cautious repositioning despite renewed inflows.

![]()