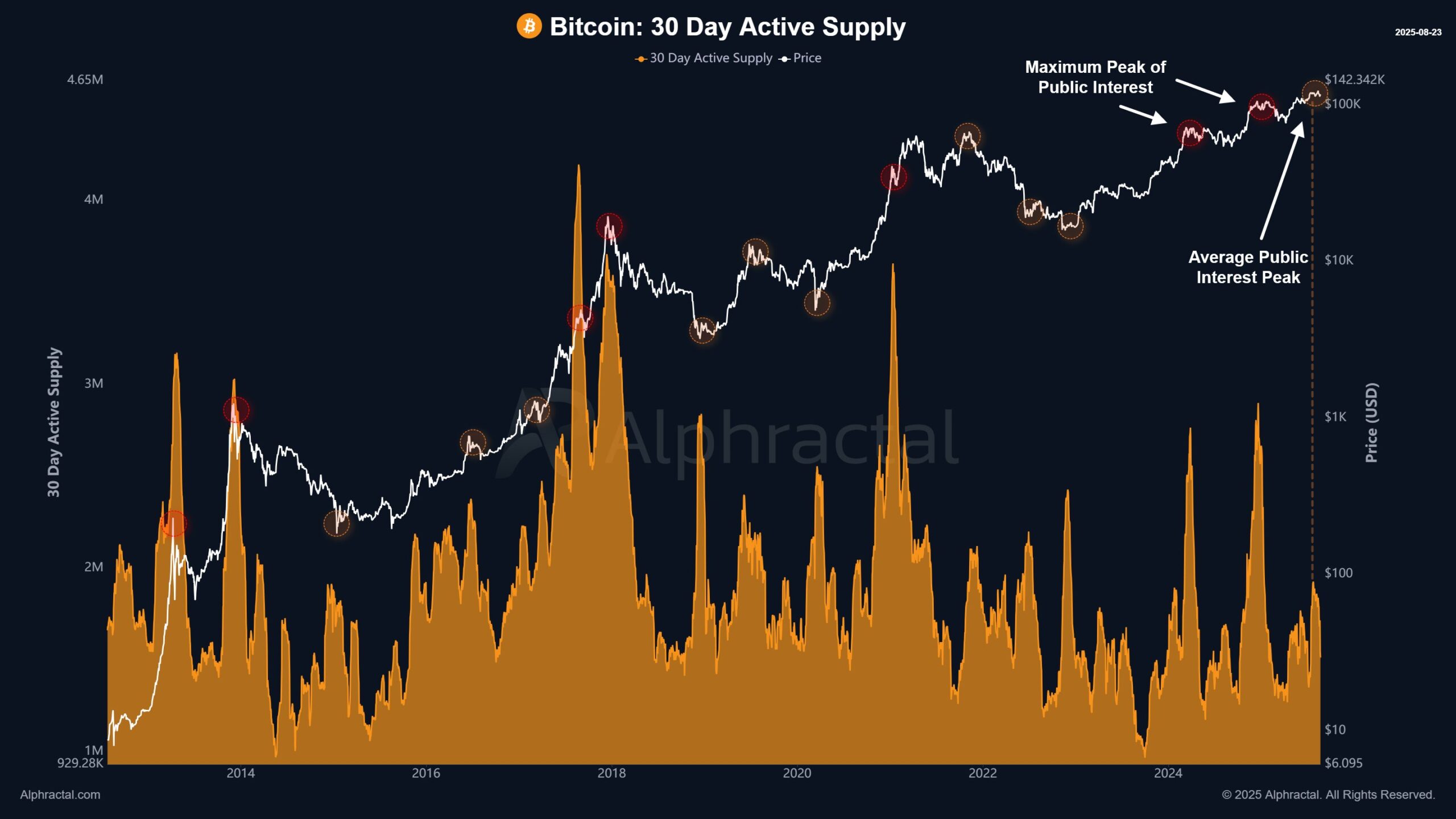

Bitcoin’s 30-Day Active Supply Plummets: The Calm Before Crypto’s Next Big Storm?

Bitcoin's network activity hits eerie quiet phase as 30-day active supply drops dramatically—traders brace for volatility.

The Lull Before the Storm

Market analysts spot unusual patterns: long-term holders aren't budging while short-term speculators vanish. That supply crunch historically precedes major price movements—both up and down.

Whales Accumulate, Retail Fades

Large wallets keep stacking sats while smaller investors cash out or panic-sell. Classic behavior before big breakouts, though traditional finance pundits will likely call it 'irrational' right up until new ATHs hit.

Technical Signals Flash Amber

On-chain metrics suggest coiled-spring energy building. Low active supply typically means reduced selling pressure—perfect setup for explosive moves once catalysts hit.

Wall Street's Still Playing Catch-Up

Meanwhile, legacy finance continues debating whether Bitcoin's a 'real asset' while missing every major cycle. Their loss—digital gold won't wait for approval committees.

Alphractal noted that the current decline in active supply shows exactly this cooling trend. In other words, Bitcoin supply movements have slowed, reducing immediate volatility and leaving room for market forces to shape the next breakout.

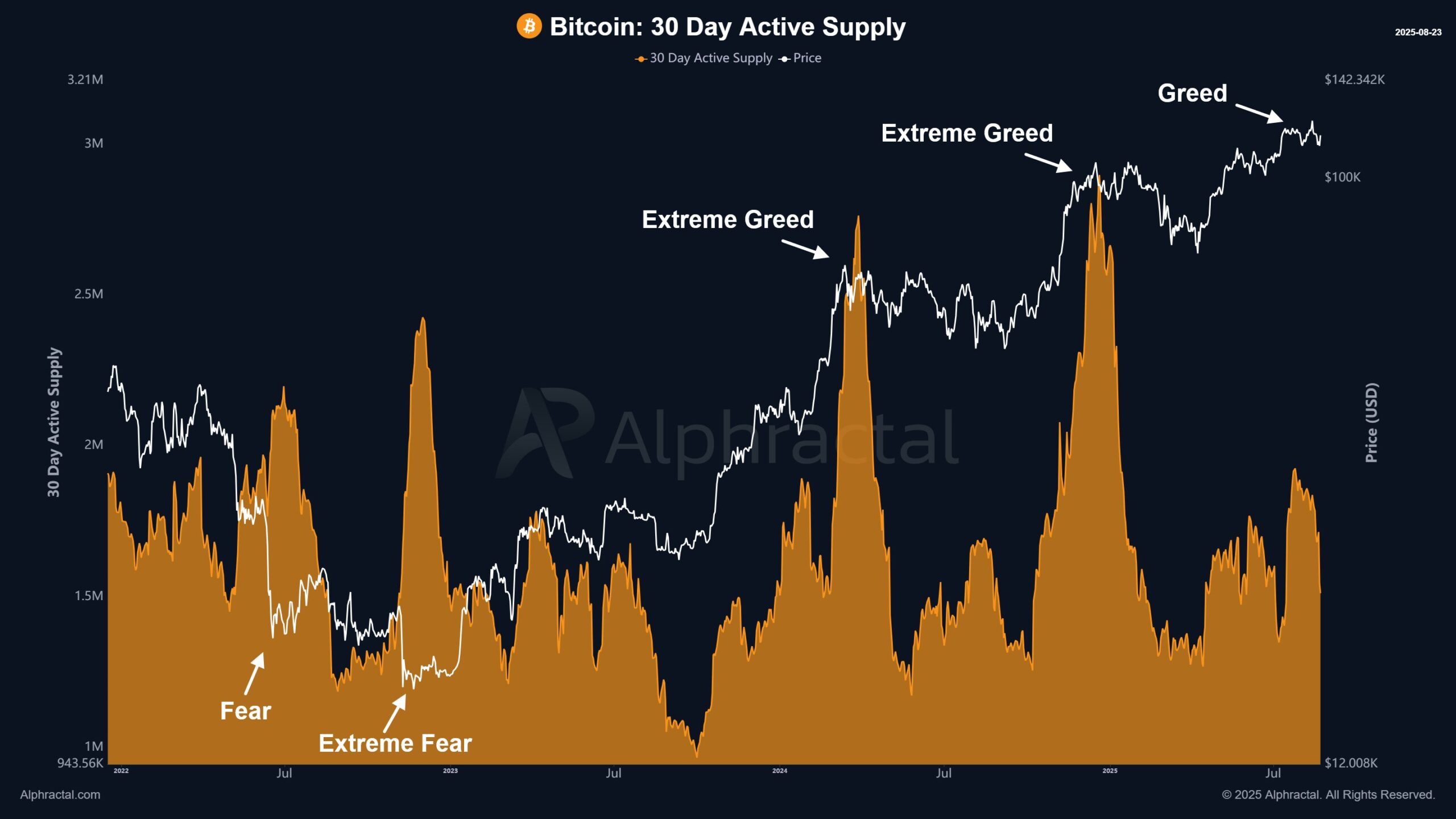

Historically, peaks in the 30-day active supply have aligned with extreme greed phases where rapid price appreciation tempted investors to move coins. Likewise, sharp downturns often appeared NEAR capitulation events, when fear spiked.

The present calm could therefore represent a transitional stage, positioning bitcoin for its next significant directional push.

READ MORE:

With Bitcoin trading above $115,000 and market participants closely monitoring macro factors like Fed policy shifts and ETF inflows, the cooling of active supply suggests that conviction is strong. As Alphractal put it, the market may now be in “reset mode,” awaiting the conditions to drive BTC’s next big move.

![]()