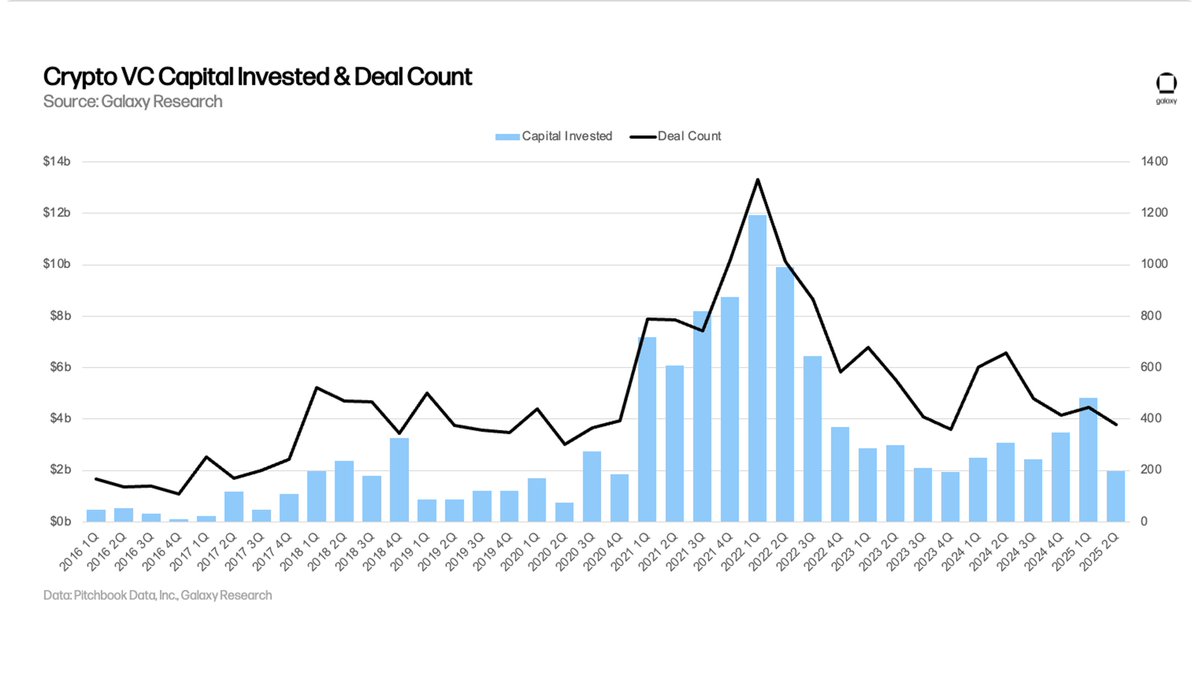

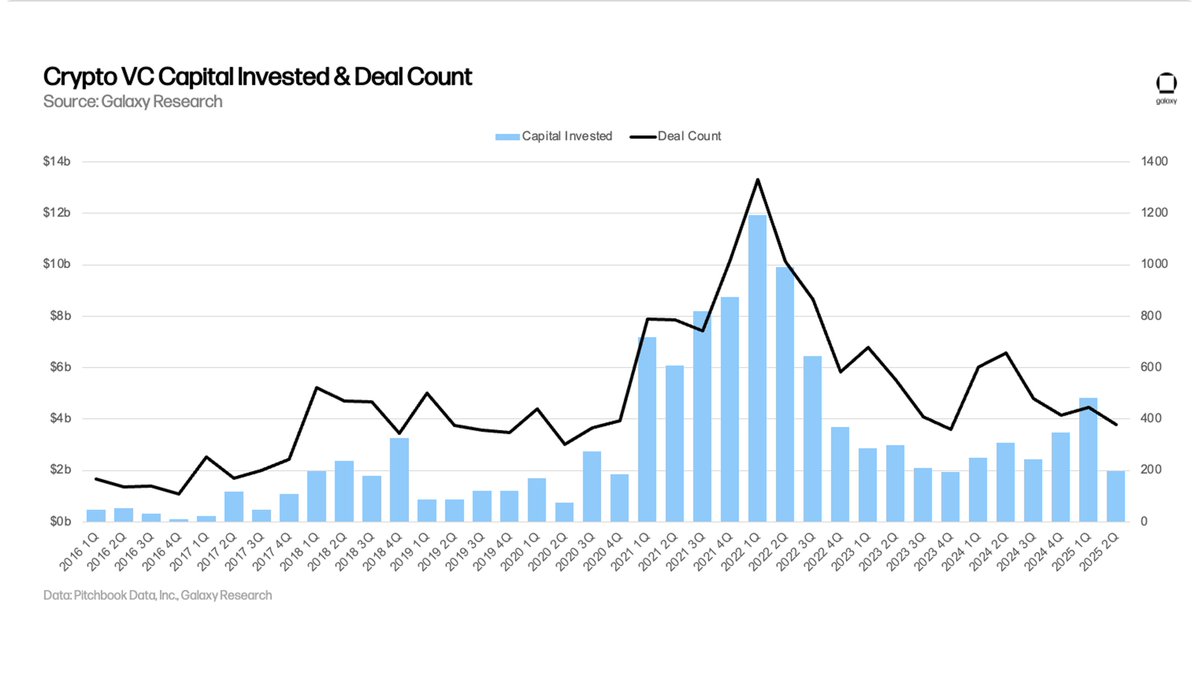

Crypto Venture Funding Plunges to Second-Lowest Level Since 2020—Here’s Why It’s Actually Bullish

Venture capital's playing scared—and missing the biggest opportunity since the internet.

The Smart Money's Sitting This One Out

Funding's dried up to near-historic lows. Traditional VCs are clutching their pearls while builders keep building. They're too busy worrying about last cycle's ghosts to see the absolute rocketship being built right under their noses.

Building Through the Silence

Real innovation doesn't need champagne-popping funding rounds. The best protocols are cutting fat, bypassing middlemen, and shipping faster than ever. No bloated budgets—just pure, unadulterated code.

Wake-Up Call for the Suits

When funding freezes, only the strong survive. We're watching natural selection play out in real-time. The projects emerging from this drought? They're lean, mean, and built for the next parabolic run. Meanwhile, traditional finance is still trying to figure out how to short innovation—good luck with that.

Analysts suggest that the weak venture environment reflects a combination of regulatory uncertainty, tighter liquidity conditions, and investor preference for profitability over speculative growth. While capital remains available, it is increasingly concentrated in projects focused on infrastructure, tokenization platforms, and AI-integrated crypto applications.

READ MORE:

Despite the slowdown, Galaxy noted that historically, periods of muted venture funding often precede the next wave of market expansion. With Bitcoin and ethereum prices stabilizing, many expect capital flows to re-accelerate once clarity around regulation and broader adoption strengthens.

![]()