Bitcoin’s Cycle Flips the Script: Altseason Looms—But Brace for a Savage Bear Market Aftermath

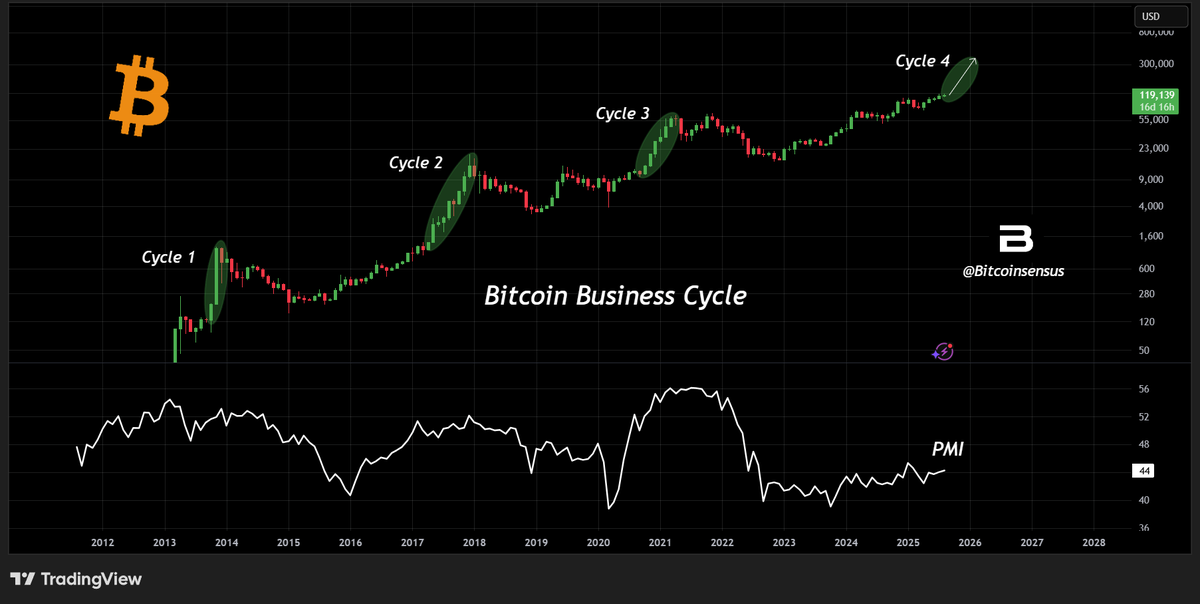

Bitcoin’s business cycle is flashing its classic patterns again—and this time, it’s screaming ‘altseason’ before the inevitable reckoning.

Here’s the playbook: When BTC dominance wobbles, alts rally. But don’t pop the champagne yet. History shows the party ends with a brutal bear market that separates the HODLers from the bagholders.

Smart money’s already rotating—just like clockwork. The catch? Every altcoin moon mission has a re-entry burn. And this cycle’s comedown could be the worst yet.

Remember: Wall Street’s ‘crypto experts’ will still get it wrong. They always do.

However, the same data also carries a warning. When the ISM begins to contract after a run-up, it has historically marked the start of some of the harshest bear markets in crypto. These downturns have drained liquidity from both bitcoin and altcoins, often catching latecomers off guard.

READ MORE:

The latest charts show Bitcoin in what could be the fourth such cycle since 2012. If history repeats, investors may see another surge — but also need to prepare for a potential liquidity squeeze once the economic tide turns.

![]()