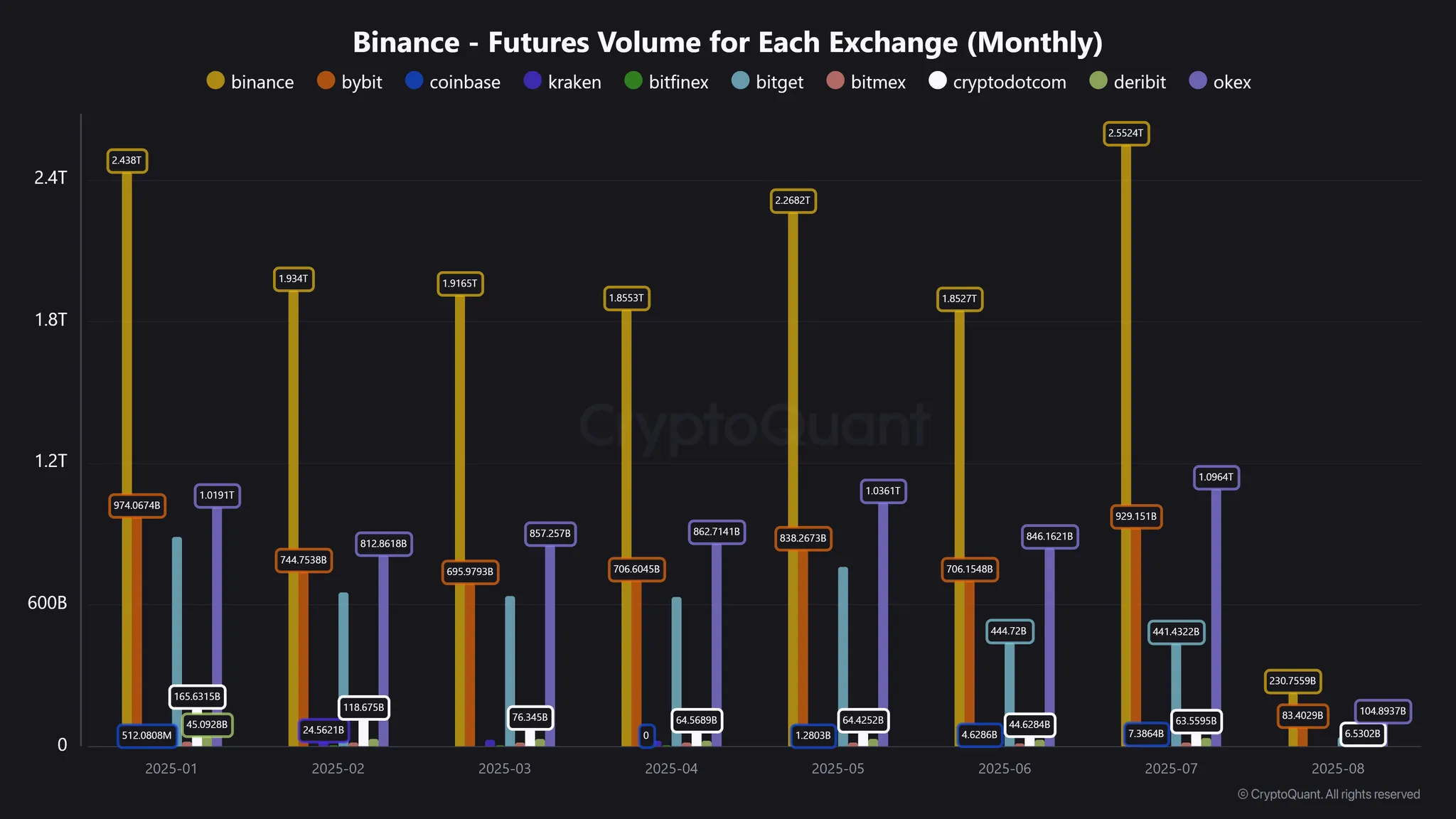

Binance Crushes Futures Competition with Record $2.55T July Volume—Here’s Why It Matters

Binance just flexed its dominance—hard. The exchange's futures market saw a staggering $2.55 trillion in July volume, leaving rivals in the dust. Here's how they're rewriting the crypto rulebook.

### The Volume Tsunami

That $2.55 trillion figure isn't just a number—it's a statement. While traditional finance grapples with paperwork and compliance theater, Binance's engine hums at warp speed. Retail and institutional traders alike are voting with their wallets.

### Liquidity Begets Liquidity

Deep order books and razor-thin spreads create a flywheel effect. More traders attract more liquidity, which in turn pulls in—you guessed it—more traders. Meanwhile, legacy exchanges are still charging $25 per futures contract like it's 1999.

### The Cynic's Corner

Let’s be real—some of that volume is surely wash trading and leverage junkies chasing 100x. But in crypto, even the smoke and mirrors can’t hide raw momentum. Binance isn’t just winning; it’s redefining the game while Wall Street plays catch-up.

Bybit logged $929 billion in volume, while OKX posted $1.09 trillion, both strong numbers but still far below Binance’s tally. Binance alone accounted for more than 50% of the total monthly volume across all major centralized futures exchanges, highlighting its central role in the current market cycle.

The spike comes amid a flurry of altcoin breakouts and Bitcoin’s recent moves toward the $115K resistance level. Analysts suggest that institutional traders and high-frequency bots are returning to the market as volatility and volume rise, with Binance remaining the preferred venue due to its selection of new listings and low latency infrastructure.

READ MORE:

Looking forward, Binance’s performance may continue to lead the sector if market volatility persists. The exchange’s rapid onboarding of trending tokens and expansive leverage options keep it attractive for traders seeking short-term opportunities.

As August gets underway, trading volumes are already showing a dip from July’s peak, but Binance remains comfortably ahead of its competition. With momentum building in derivatives and spot markets alike, the platform’s lead looks secure for now — especially if bitcoin resumes its push toward a new all-time high.

![]()