Corporate Treasuries Go Crypto: Public Companies Now Hoard $100B+ in Digital Assets

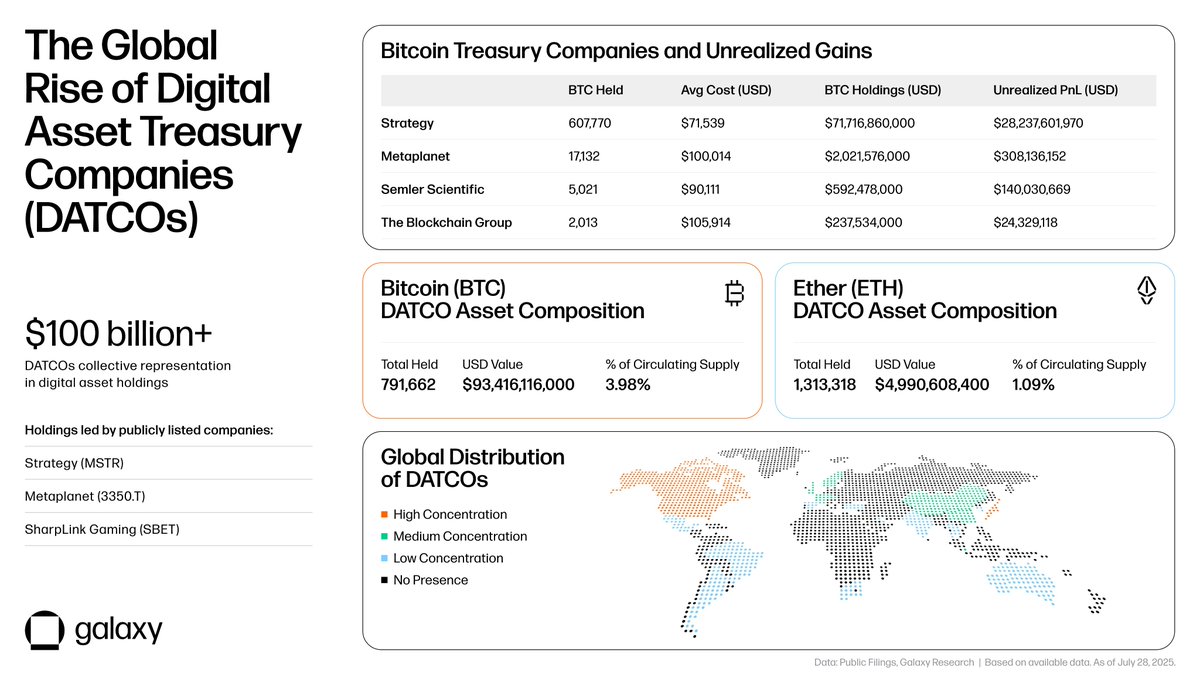

Wall Street’s old guard never saw this coming. Public companies—once allergic to crypto’s volatility—are now stuffing their treasuries with Bitcoin, Ethereum, and more. The total? A staggering $100 billion and climbing.

Why the shift? Three words: yield, inflation, and FOMO. With bonds offering laughable returns and cash rotting from inflation, CFOs are gambling on crypto’s upside. Even the most conservative boards are whispering about ‘digital asset allocation strategies’ now.

The kicker? These aren’t just tech firms. Automakers, healthcare giants, and even your grandma’s favorite blue-chip stock are quietly building positions. Because nothing says ‘modern treasury management’ like praying Elon Musk doesn’t tweet something stupid before earnings call.

Will it last? Who knows. But for now, corporate America’s balance sheets are looking more like a degenerate crypto trader’s portfolio—and they’re oddly okay with it.

Thisa major evolution in financial strategy. Some of these companies treat crypto as a core reserve asset, similar to gold, while others are taking a more active approach — staking Ethereum to earn yield or raising capital through equity sales or SPAC mergers specifically to acquire more tokens.

While many of these firms are based in the U.S., thanks to easier access to public markets, the DATCO model is rapidly gaining ground globally. This expansion is adding liquidity to crypto markets but also increasing exposure to volatility. In several cases, company stock prices trade at multiples of their crypto holdings, a premium that could vanish quickly if markets correct or regulatory scrutiny intensifies.

READ MORE:

Galaxy’s data shows around 160 public companies now hold BTC, with over 35 firms managing digital asset positions worth more than $120 million each. As crypto’s role on corporate balance sheets grows, so do concerns about valuation risks and potential regulatory shifts that could reshape how digital assets are treated in financial reporting.

![]()