Fed Goes Soft? Bitcoin Explodes Every Time Monetary Policy Eases

When the Fed blinks, Bitcoin winks—and then rockets skyward.

New data reveals a striking pattern: every time the US central bank takes its foot off the monetary brakes, BTC stages a major breakout. The correlation's become so predictable, traders now watch Jerome Powell's pressers more closely than halving cycles.

Here's the kicker: these aren't marginal gains. We're talking 3x-5x moves within months of dovish pivots—enough to turn bagholders into Lambo buyers overnight.

Wall Street analysts (the same ones who called crypto 'rat poison' in 2022) are suddenly scrambling to model Fed policy impacts on digital assets. Too bad their risk models still can't account for memecoins.

Next time Powell hints at rate cuts? Watch your portfolio—and your FOMO.

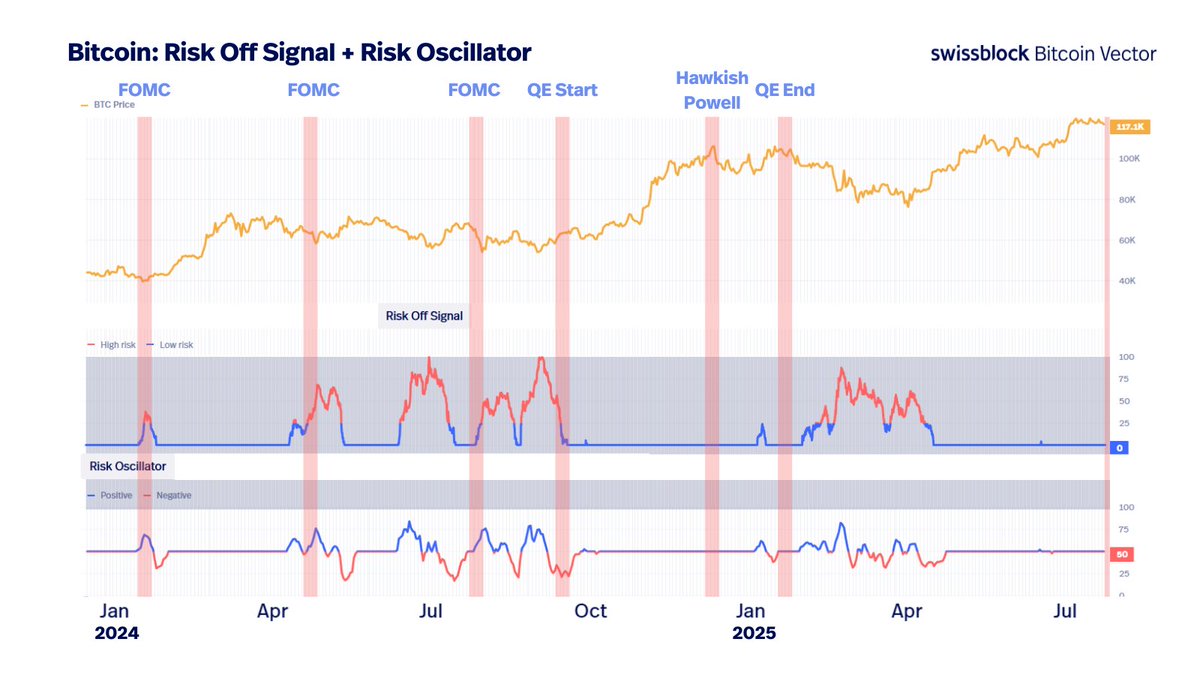

The chart combines Bitcoin’s price with risk-off signals and a risk oscillator, highlighting how low-risk zones often precede breakouts, while high-risk periods tend to coincide with consolidation or drawdowns.

Swissblock’s analysis identifies a recurring pattern: the most sustained Bitcoin upside emerged immediately after QE was introduced. A similar breakout occurred after the March 2024 FOMC meeting when the risk oscillator flipped positive, aligning with a low-risk environment. Conversely, periods flagged as high-risk—particularly during hawkish Fed commentary or QE withdrawal—coincided with Bitcoin corrections or sideways movement.

READ MORE:

The message is clear: macro liquidity leads crypto price action, and traders should watch for signals that QE could resume. “When QE restarts again—expect the same setup,” Swissblock noted, reinforcing the idea that policy shifts can quickly change the market’s risk regime.

As bitcoin hovers above $120K, investors are paying closer attention to the Federal Reserve’s next move. If dovish policy returns and liquidity expands, on-chain risk indicators may once again flip bullish—mirroring the macro-driven rallies of past cycles.

Until then, tracking macro flows and risk levels may offer the best guide to timing entries in an increasingly Fed-sensitive market.

![]()