Bitcoin Price Surge: The Unstoppable Mirror of Global Money Flow in 2025

Wall Street's latest darling? A decentralized asset that laughs at traditional finance's spreadsheets.

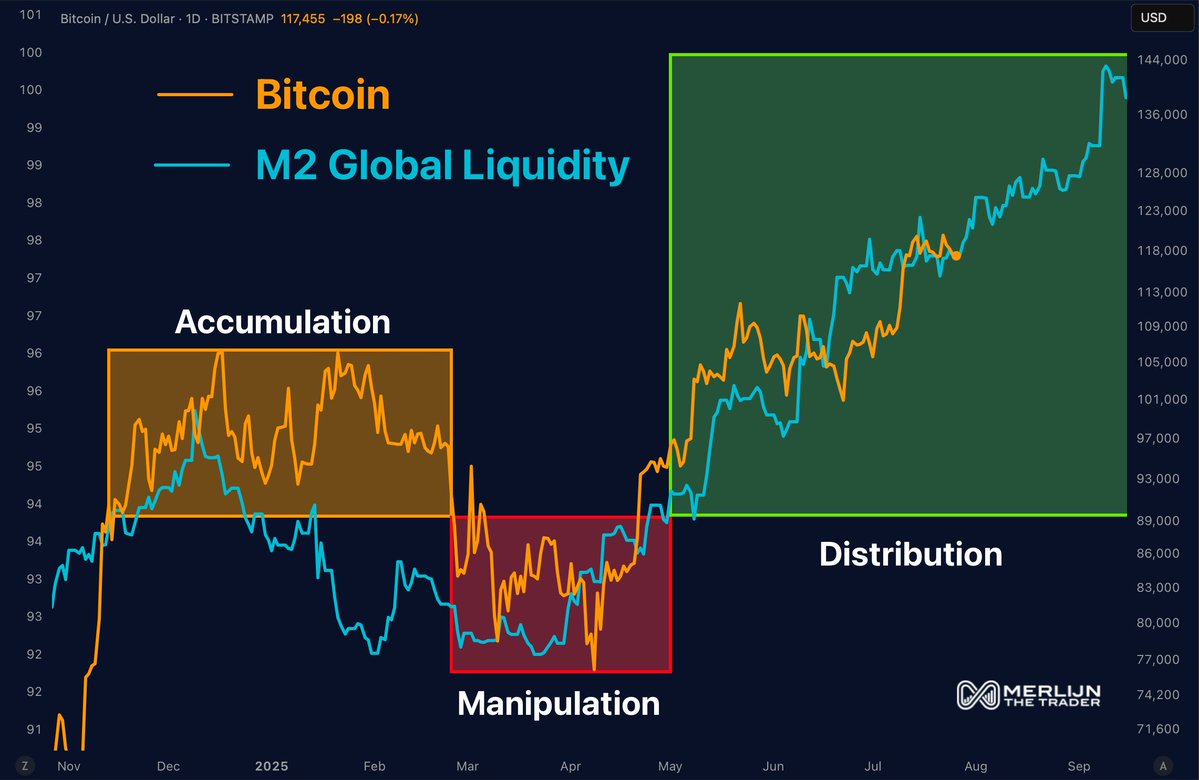

Bitcoin isn't just tracking global liquidity—it's front-running it. Every central bank balance sheet expansion, every institutional FOMO wave sends BTC/USD charts into parabolic overdrive.

The 2025 playbook: Watch money printers, then watch Bitcoin. Rinse. Repeat. (Meanwhile, your bank still charges $25 for wire transfers.)

In his view, as M2 continues to surge, bitcoin may soon break through to new highs. The chart currently shows BTC tracking global liquidity into a potential late-summer rally zone, already testing the $123,000 mark. Analysts are now eyeing $135,000 and even $144,000 as near-term extension targets—assuming M2 doesn’t reverse.

Meanwhile, Daan crypto Tradesanother layer to the technical picture. His liquidation heatmap shows a very narrow risk corridor between $115,000 and $120,000. This tight band, shaped by recent sideways action, means that if Bitcoin dips below ~$115K or breaks above ~$120K, a large batch of liquidations could be triggered. That could create a sudden volatility spike—either upward or downward—depending on which direction hits first.

READ MORE:

The Binance liquidation data reveals dense clusters of both long and short liquidations NEAR these levels, suggesting that traders are heavily positioned on either side. If liquidity pressure continues to rise, the $120K ceiling could give way quickly, unleashing a round of liquidations that fuels a sharp breakout.

In short, global liquidity and Leveraged positioning are converging to set up Bitcoin’s next major move. While short-term consolidation may continue, pressure is clearly building. As Merlijn puts it: “When liquidity floods in, Bitcoin doesn’t wait.”

![]()