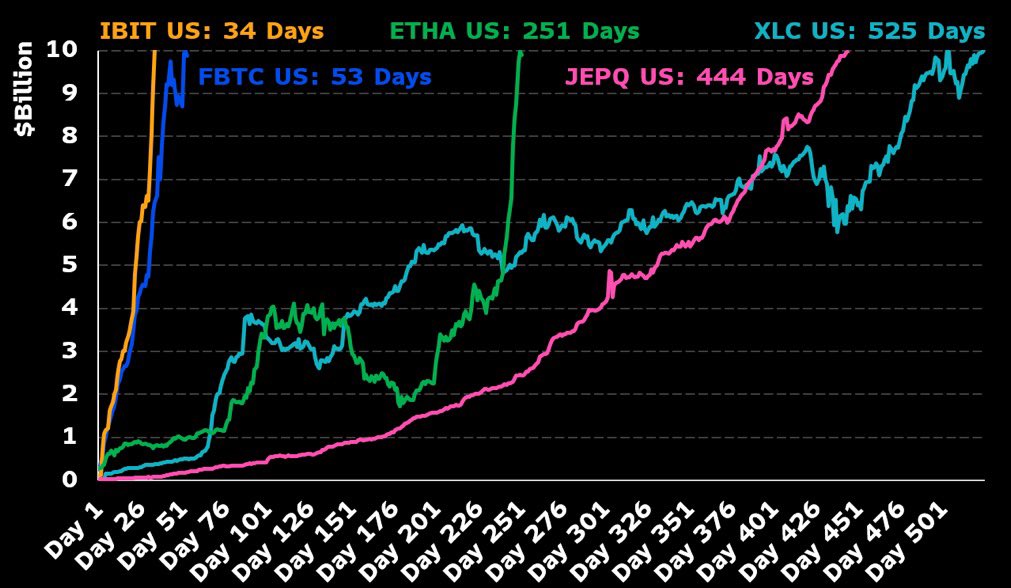

BlackRock’s Ethereum ETF Smashes $10B Milestone – 3rd Fastest in History

Wall Street’s crypto crush hits new highs as BlackRock’s Ethereum ETF rockets past $10 billion in record time.

Move over, Bitcoin—institutional money’s got a new blockchain darling.

The fund’s blistering growth leaves legacy financial products eating dust. (Take that, boomer hedge funds.)

With this pace, even the SEC might have to admit crypto’s not just for ‘degenerates’ anymore.

Ethereum demand surges amid ETF momentum

BlackRock’s success with $ETHA reflects the growing institutional appetite for Ethereum exposure, especially after regulatory clarity and Ethereum ETF approvals earlier this year.

The ETF’s rapid capital inflow signals strong conviction in Ethereum as more than just a digital asset—positioning it as a serious infrastructure LAYER for Web3, DeFi, and tokenized real-world assets.

$ETHA’s explosive growth also comes amid broader strength in the crypto market, with Ethereum’s price hovering near multi-month highs and outperforming bitcoin on several institutional metrics.

READ MORE:

ETF race intensifies between crypto and TradFi giants

BlackRock’s $ETHA now joins $IBIT (iShares Bitcoin ETF) and $FBTC (Fidelity Bitcoin ETF) at the top of the ETF leaderboard, signaling a shift in capital markets where crypto-native funds are scaling faster than legacy sector ETFs.

As Ethereum ETF products continue to gain traction, analysts expect even more inflows in Q3 and Q4, potentially pushing AUM beyond $15 billion by year-end—especially if ETH’s price momentum continues alongside altcoin season.

![]()