Crypto Smashes Records: $4.39 Billion Floods In During Historic Week

Crypto just flexed its financial muscles—hard. A tidal wave of institutional money crashed into digital assets last week, marking a watershed moment for the industry.

The $4.39 billion question: Is this the start of a new bull run or just hedge funds chasing the next shiny thing?

While Wall Street debates whether to FOMO in or wait for a pullback, one thing's clear: crypto's liquidity pumps are leaving traditional markets looking downright arthritic. (Take that, bond traders.)

This isn't your 2017 retail frenzy—these are nine-figure checks clearing. The game's changed. Whether you're stacking sats or shorting the hype, buckle up.

Ethereum inflows smash previous records

Ethereum led the market by a wide margin, pulling in $2.12 billion in new capital—nearly double its previous weekly record of $1.2 billion. That figure also means Ethereum’s 2025 inflows have now reached $6.2 billion, surpassing the entire 2024 total. Over the past 13 weeks, these inflows represent 23% of Ethereum’s total assets under management, signaling rapidly growing institutional demand ahead of its major tech upgrades.

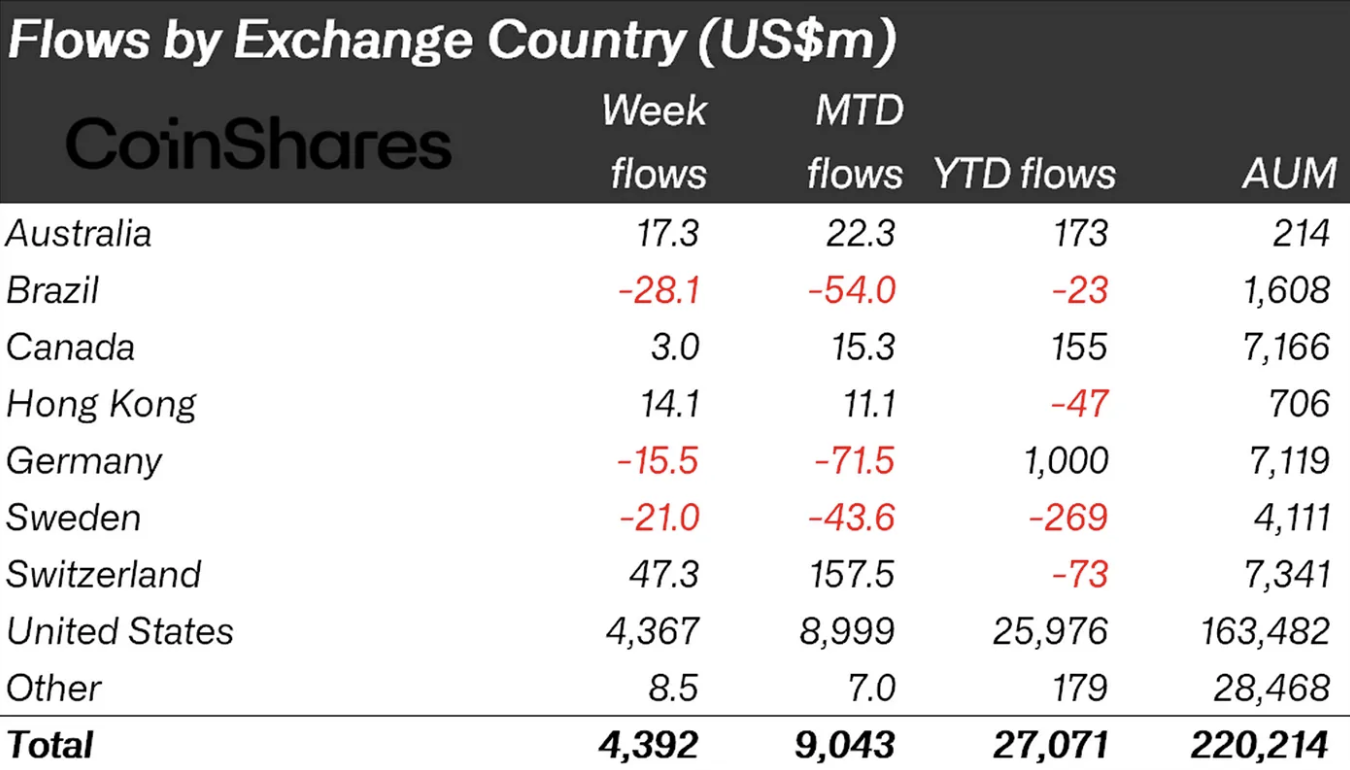

Bitcoinwith $2.2 billion in inflows, down from $2.7 billion the prior week. Still, bitcoin ETPs made up 55% of all BTC spot exchange volume, underscoring their dominance in current trading activity.

READ MORE:

U.S. drives volume, altcoins gain momentum

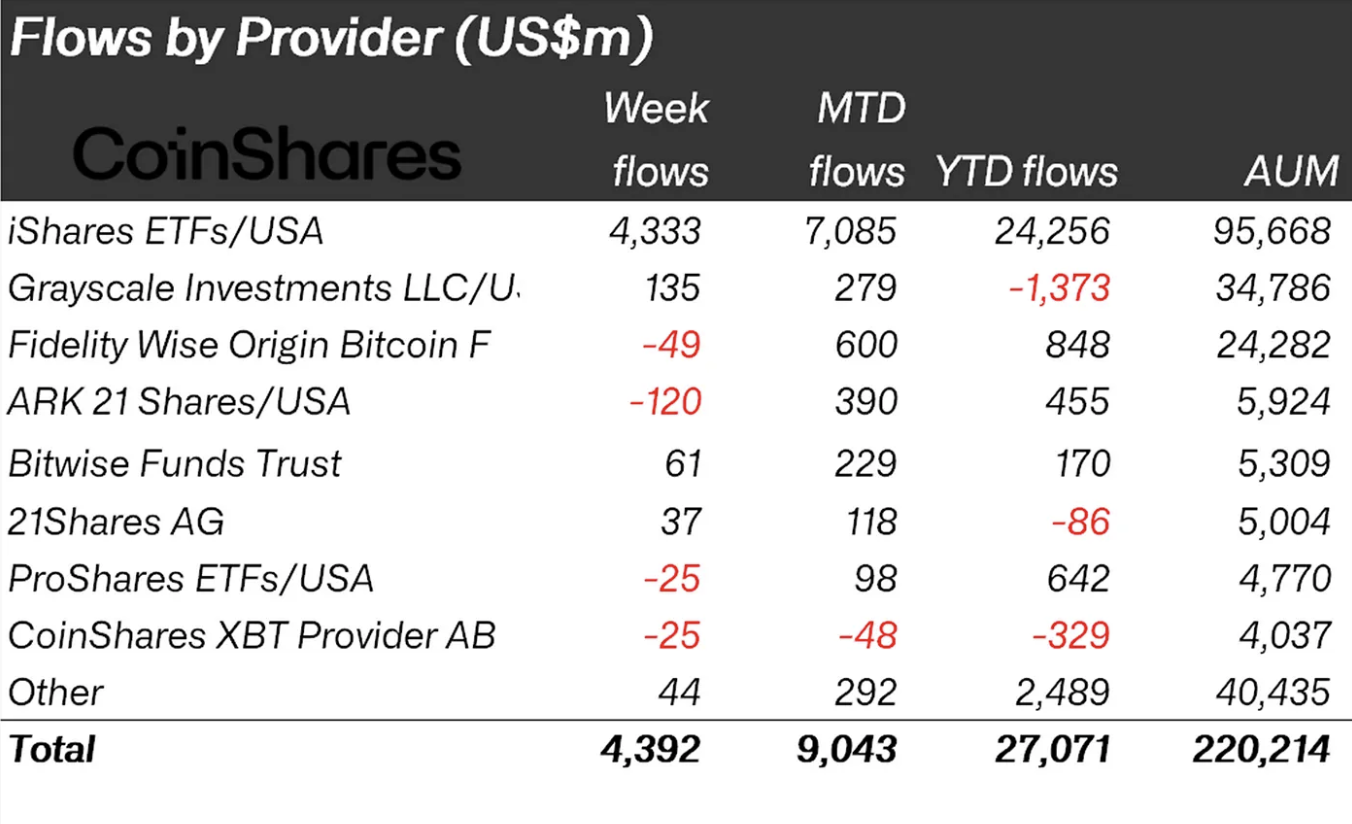

The United States accounted for the lion’s share of last week’s activity, recording $4.36 billion in inflows. Switzerland, Hong Kong, and Australia also saw modest gains, with inflows of $47.3 million, $14.1 million, and $17.3 million respectively. Brazil and Germany, by contrast, posted outflows of $28.1 million and $15.5 million.

Beyond Bitcoin and Ethereum, several altcoins also recorded strong interest. Solana brought in $39 million, XRP followed with $36 million, and Sui attracted $9.3 million. This continued altcoin inflow trend suggests investors are diversifying beyond just the top two assets as Optimism builds across the broader digital asset market.

![]()