🚀 Bitcoin Open Interest Explodes to $42B—Funding Rates Scream ’Buy the Dip?’

Futures traders just went all-in on crypto's big bet. Bitcoin open interest just punched through $42 billion—while perpetual funding rates flash classic FOMO signals. Here's why the market's either primed for liftoff... or a brutal squeeze.

The leverage casino is open for business

When derivatives traders pile in this hard, they're either geniuses or bagholders in training. Those juicy positive funding rates? Basically a tax on overconfidence. Remember kids: the market takes money from the impatient and gives it to the ruthless.

Wall Street's playing with crypto's matches again

Institutional money can't resist a good volatility fix—even if it means overpaying for the privilege. Meanwhile, retail traders are probably leveraging their grocery money. What could go wrong?

This isn't financial advice, but someone's about to learn why we don't chase green candles in a market that eats greed for breakfast. Trade safe—or at least entertain the rest of us when you don't.

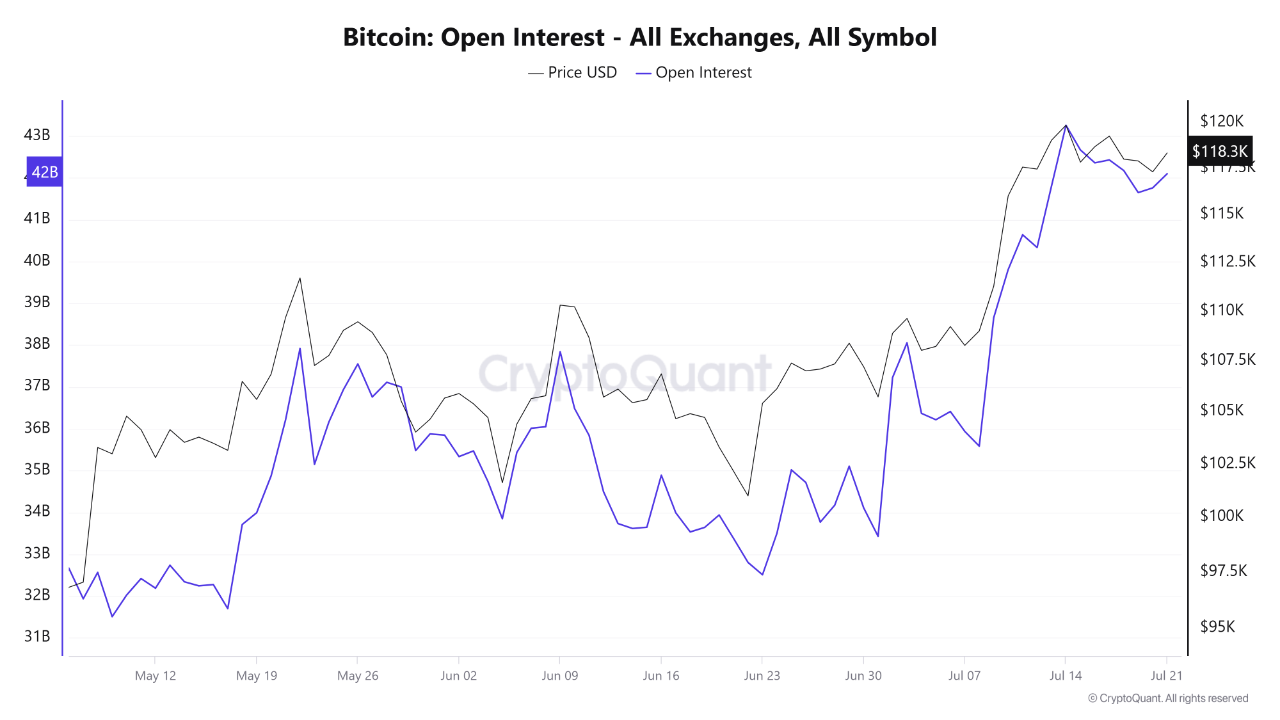

High open interest signals market momentum

Open interest in Bitcoin futures reached a recent peak of $43 billion and now sits just slightly lower at $42 billion—still well within historically elevated territory. This reflects a large volume of outstanding contracts, indicating strong participation in the derivatives market. As BTC trades near $118,300, the growing open interest suggests traders are positioning aggressively ahead of a potential move beyond the $120K resistance.

Historically, spikes in open interest coincide with increased price volatility. A build-up of leveraged positions—especially in tight market conditions—can lead to rapid liquidations when prices swing sharply.

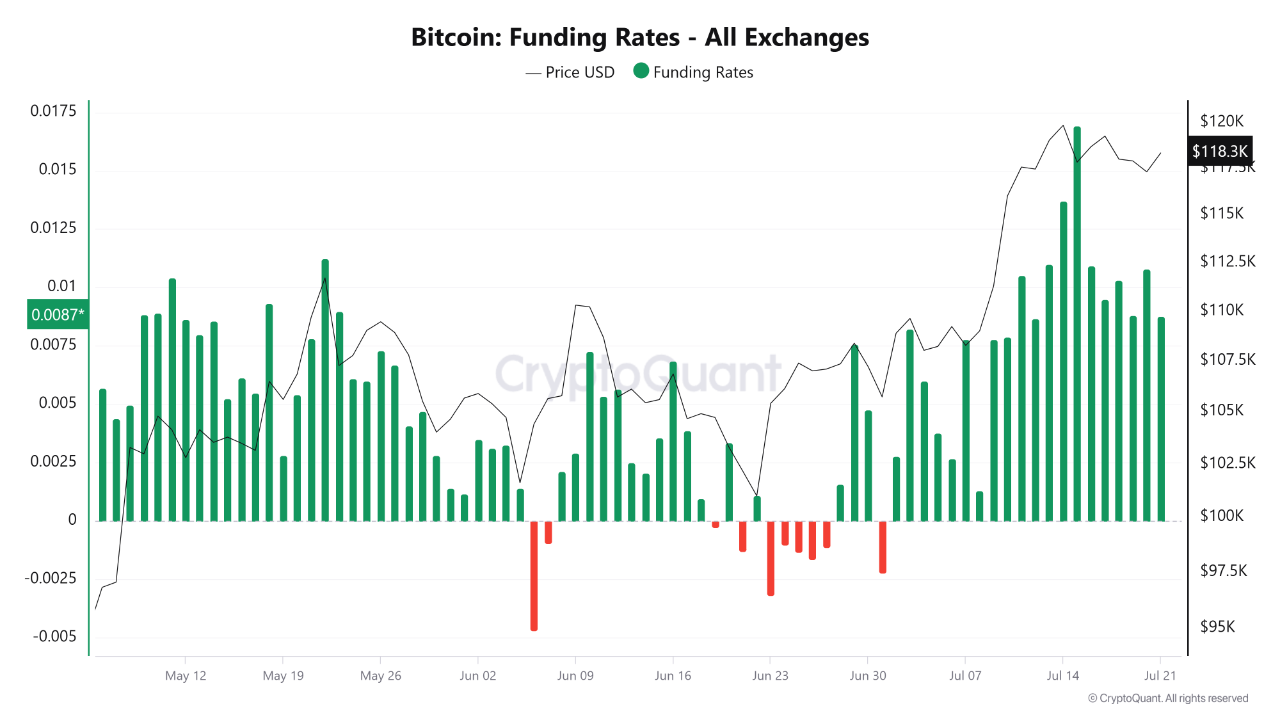

Rising funding rates reflect bullish bias

Funding rates across exchanges are trending higher, confirming that long positions are currently dominating. The more traders are willing to pay to maintain bullish bets, the more upward pressure there is on funding levels. CryptoQuant notes that elevated funding, when combined with high open interest, often reflects excessive optimism.

This dynamic signals a market in “greed mode,” where traders chase momentum. However, it also raises caution flags, as crowded long positions are vulnerable to sudden corrections or liquidation cascades if the price unexpectedly dips.

READ MORE:

Leverage risk builds as traders chase the rally

The current setup—high open interest and elevated funding—suggests traders are aggressively deploying leverage to ride the rally. While this can amplify short-term gains, it also increases downside risk. A sudden MOVE against the dominant trend could trigger widespread forced selling and rapid position unwinds.

CryptoQuant analysts warn that exchanges may need to intervene by adjusting margin requirements or temporarily restricting activity if volatility surges. For now, Bitcoin remains near $118K, but derivatives data hints that the next big move—up or down—may come swiftly.

![]()