Altcoins Suck Bitcoin Dry as Correlation Collapse Triggers Market Jitters

Blood in the crypto water—altcoins are feasting on Bitcoin's liquidity buffet while the usual market sync goes haywire.

Decoupling drama

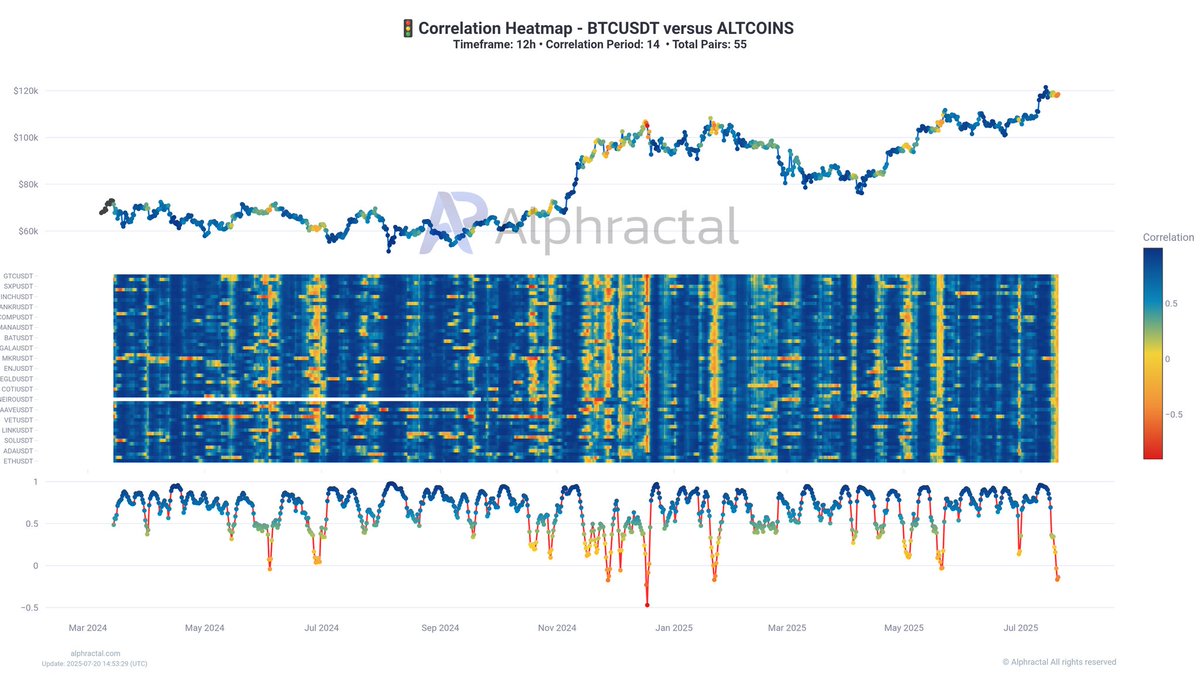

That cozy correlation between BTC and altcoins? Gone. Traders are scrambling as Ethereum, Solana, and memecoins start dancing to their own erratic beats—leaving Bitcoin's dominance looking shaky for the first time in 2025.

Liquidity heist

Alt season used to mean rising tides lifting all boats. Now it's more like altcoins ramming Bitcoin's hull with a financial icepick—draining reserves as retail FOMO shifts to shiny new tokens (because obviously, the 47th Doge spin-off will moon).

Market mechanics in meltdown

When the crypto casino's house rules break down, even degens pause mid-leverage. Watch for cascading liquidations if this decoupling persists—nothing like a good old-fashioned liquidity crisis to separate the diamond hands from the exit-scammers.

Closing shot: Nothing unites crypto like watching leveraged traders get rekt—except maybe the SEC's perpetual confusion about which altcoin counts as a security this week.

Historically, falling BTC-altcoin correlation has preceded periods of intense volatility and mass liquidations, regardless of whether traders are positioned long or short. When altcoins decouple from Bitcoin, it often indicates unsustainable market behavior or shifting capital that eventually corrects sharply.

READ MORE:

Alphractal warns that traders should remain vigilant and use data-driven tools like correlation metrics to navigate current conditions. The charts included in the update illustrate a clear divergence between bitcoin and altcoin positioning, reinforcing the view that short-term profits in altcoins may come with heightened risk.

As liquidity continues to migrate into the altcoin space, market participants should prepare for potential turbulence ahead.

![]()