Altcoin Season Looms: Bitcoin’s Grip Weakens as Rivals Rally

Bitcoin's throne is wobbling. As dominance dips below 50%, altcoins are primed for a historic surge—just as traders max out their leverage with reckless optimism.

The floodgates are open. Ethereum, Solana, and other major altcoins have already begun outpacing BTC’s gains, signaling a classic rotation. Meme coins? Don’t ask—unless you enjoy watching degenerates turn dopamine hits into Lamborghinis.

Regulators are 'monitoring the situation' (translation: scrambling to justify their existence). Meanwhile, Wall Street’s latecomers are still waiting for a 'safer entry point'—good luck with that.

This isn’t just a rally—it’s a wealth transfer. And as always, the smart money moves first while the suits are stuck in committee meetings.

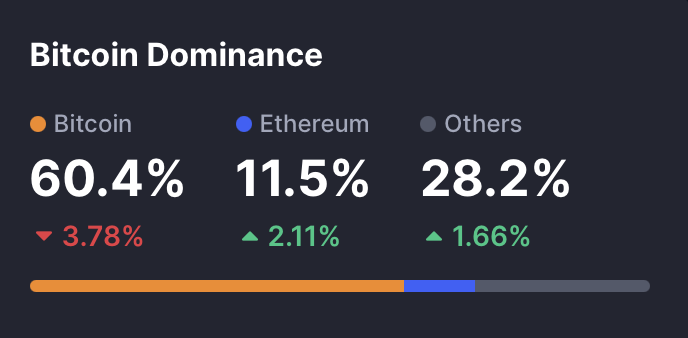

Bitcoin Dominance Retreats as Rotation Builds

Bitcoin dominance fell to 60.45%, down 0.6 points in the past 24 hours and 3.4 points since July 1. This steady decline aligns with a broader capital rotation trend, where investors begin to shift allocations toward altcoins. Though the Altcoin Season Index remains below the 75 threshold that WOULD confirm a full-blown altcoin season, the momentum is unmistakable.

Ethereum Ecosystem Sparks Institutional Interest

Leading the charge is Ethereum and its surrounding ecosystem. ETH has surged 24.6% over the past week, while chainlink (LINK) gained 23.1%. Together, they pushed the Ethereum ecosystem’s market cap to $734 billion—up 3.25% in just 24 hours. This rise coincides with bullish narratives around zkEVM upgrades and real-world asset (RWA) tokenization, which continue to attract institutional capital.

READ MORE:

Speculative Alts and Narratives Fuel Gains

Speculative altcoins in the gaming and AI sectors are also catching wind. GameGPT posted a 43% weekly gain, while Tezos spiked 81.7%—both driven by renewed retail interest in high-risk narratives. While volatility remains high in this sector, the upside shows investors are eager to move beyond the conservative Bitcoin play.

Outlook

The data suggests that while Bitcoin remains dominant, altcoins—especially those tied to Ethereum and emerging tech themes—are gaining traction. If Bitcoin consolidates or pulls back further, capital rotation into altcoins could accelerate and push the Altcoin Season Index into full-season territory (>75). For now, Ethereum and Chainlink remain the clearest beneficiaries of this trend.

![]()