BlackRock’s Bitcoin ETF On Fire: $403M Floods In During 9-Day Surge

Wall Street's crypto love affair hits new highs as institutional cash piles into Bitcoin ETFs.

BlackRock's spot ETF alone gobbled up the lion's share of inflows—because when the world's largest asset manager sneezes, the market catches FOMO.

Nine straight days of green. $403 million fresh off the printing press. Traders scrambling to front-run the next wave of boomer money.

Meanwhile, gold ETFs quietly hemorrhage assets. Coincidence? Or proof that digital scarcity beats shiny rocks in the 21st century?

(Bonus jab: Somewhere in Connecticut, a hedge fund manager just allocated 0.0001% of his portfolio to 'diversify'—and called it innovation.)

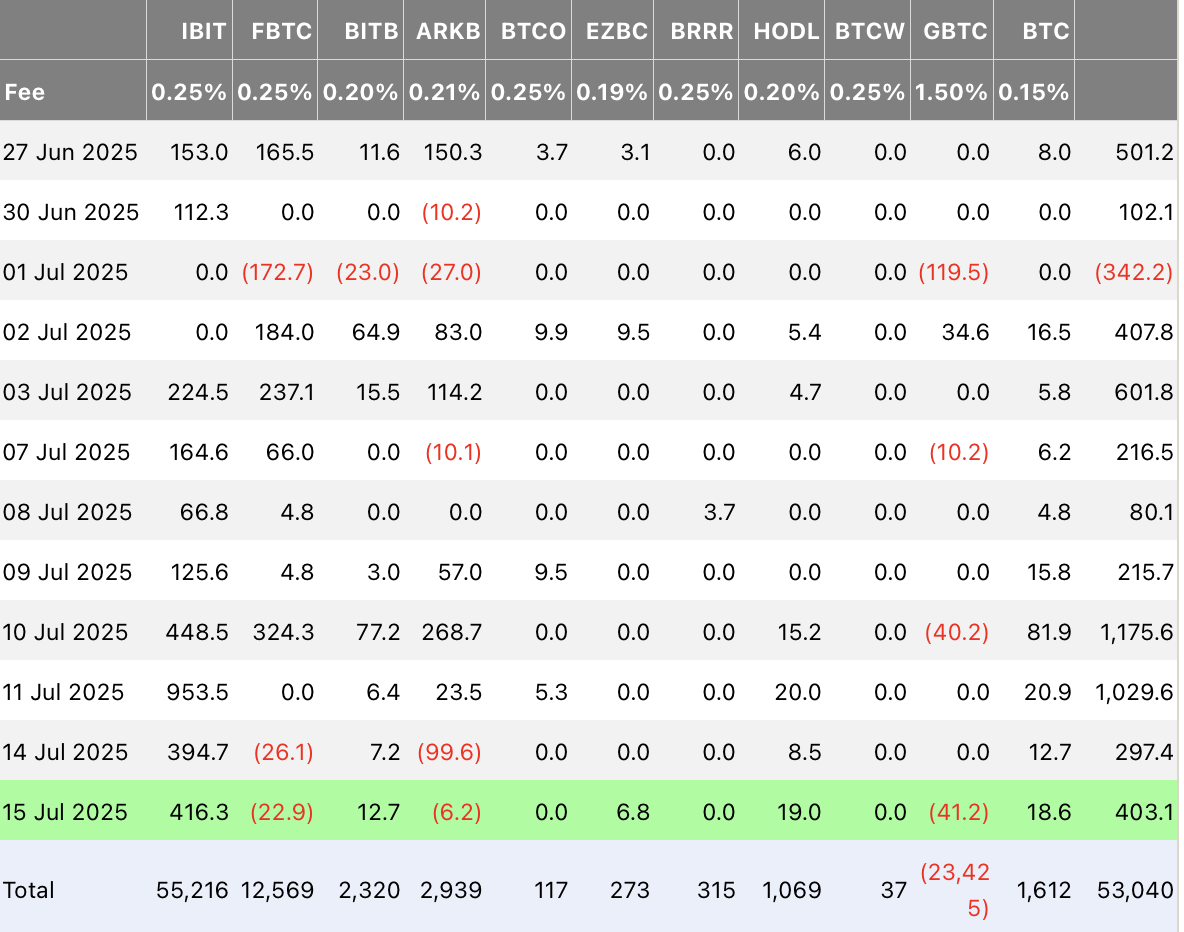

Cumulatively, spot Bitcoin ETFs have attracted $53 billion in net inflows since launching earlier this year. In just the last nine trading days, $4.4 billion has poured into these funds. Since April, the sector has seen nearly $17 billion in capital inflows, signaling growing institutional confidence in Bitcoin as a long-term asset.

READ MORE:

This sustained demand comes as Bitcoin trades near all-time highs, bolstered by a mix of macroeconomic uncertainty, rising institutional participation, and Optimism around regulatory clarity. Analysts suggest the ETF momentum could persist if Bitcoin continues to hold above key psychological levels, potentially setting the stage for another leg higher in 2025.

![]()