🚀 Bitcoin Shatters Records: BTC Bull Token Skyrockets 110% in Epic Rally

Bitcoin just bulldozed through its all-time high—again. The king of crypto isn't just climbing; it's rewriting the rulebook while altcoins like BTC Bull Token ride its coattails to a jaw-dropping 110% surge.

The Domino Effect

When BTC flexes, the market moves. This isn't speculation—it's physics. Liquidity floods into Bitcoin, then spills over into select tokens like a high-stakes game of financial whack-a-mole.

Institutional FOMO Meets Retail Mania

Hedge funds are piling in, but let's be real—they're late to the party. Retail traders who held through the bear market are now laughing straight to the bank (or decentralized equivalent).

The Cynical Take

Wall Street will spin this as 'validation' of crypto—right after spending years calling it a scam. How convenient.

One thing's clear: when Bitcoin runs, it doesn't jog. And right now? It's sprinting while the traditional finance crowd struggles to tie its shoelaces.

Bitcoin Surges to New Peak as Institutional Demand Soars

Bitcoin’s new all‑time high (ATH) of $111,970 beats the record it set on May 22, when it locked in a roughly 50% gain from its April lows.

Fox Business recently broadcast a near-term projection targeting $140,000 if BTC sustains a break above $110,000 – possibly followed by a further bull run toward $170,000. Anthony Pompliano of Professional Capital Management also appeared during the same segment, explaining that purchases by corporations and institutions are massively reducing Bitcoin’s circulating supply, creating the conditions necessary for a potential short squeeze.

Fox Business says it’s the Wild West out there — and there’s not much bitcoin left.

Corporations are buying! 👀 pic.twitter.com/EK7TtiDu2D

— Byte Federal (@ByteFederal) July 9, 2025

The reason behind Bitcoin investors’ Optimism is simple: institutions and large enterprises are buying BTC aggressively, but also strategically. On July 9, US spot Bitcoin ETFs recorded nearly $218 million in net inflows, extending their streak of positive flows to five consecutive sessions. July’s net inflow total now tops $1.18 billion, led by blue-chip issuers BlackRock and Fidelity.

In the meantime, the Tokyo-based energy consultancy Remixpoint has raised the equivalent of $215 million in yen specifically to accumulate 3,000 BTC for its balance sheet.

This growing demand for BTC coincides with an unprecedented supply squeeze in the retail trading sector. On-chain data from CryptoQuant shows that only 2.4 million BTC remain on everyday crypto exchanges – the lowest reading in several years. The last time reserves fell this sharply was in late 2021, just before Bitcoin sprinted to its then-ATH of $69,000.

Earn Free Bitcoin Rewards as BTC Rallies to New Highs

While Bitcoin’s price tag often intimidates newcomers, BTC Bull Token offers a lower-price gateway with a new twist: free Bitcoin airdrops every time BTC sets fresh milestones.

The project will offer the first Bitcoin airdrops when BTC reaches $150,000 and $200,000 for the first time. It’s also planned a special one-time BTCBULL token airdrop for its holders when BTC hits $250,000.

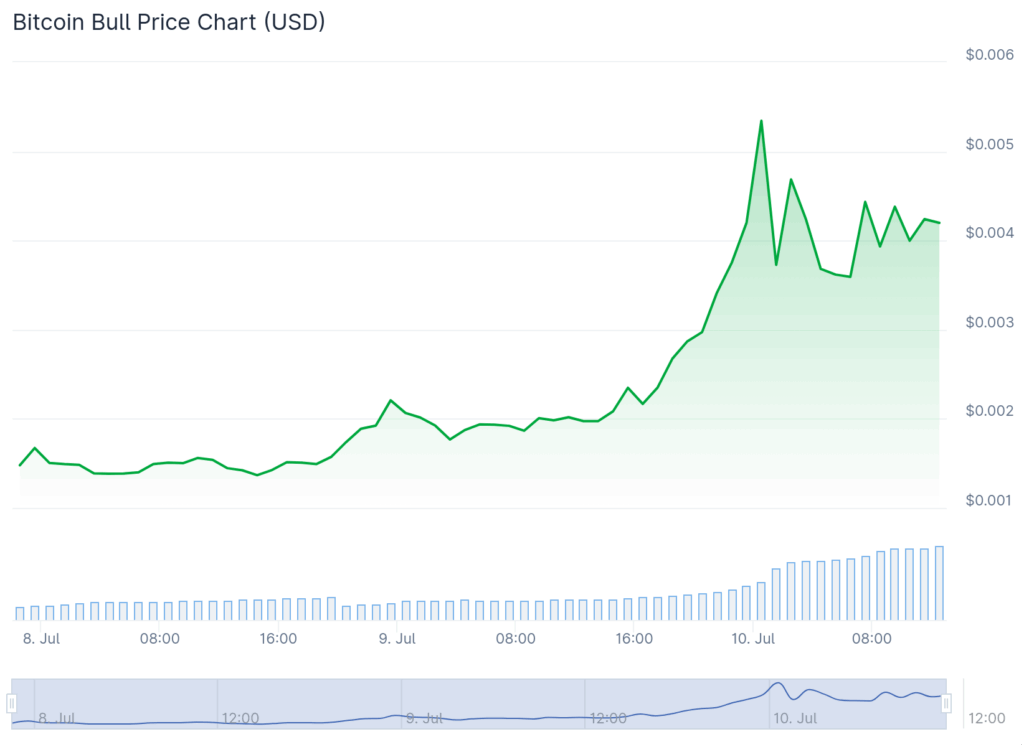

After successfully raising $8.44 million in its own presale, the BTCBULL token debuted well above its listing price – and now trades around $0.004.

The BTC Bull Token project also features a token burn mechanism, which creates long-term deflationary pressure. Beginning when Bitcoin first reaches $125,000, $175,000, and $225,000, BTCBULL will burn a portion of its circulating supply.

For investors chasing passive income, the proposition is straightforward: hold the BTCBULL token and let the market’s appetite for Bitcoin do the heavy lifting.

Looking further ahead, long-term price targets for Bitcoin vary from $500,000 to well over $1 million, as concerns about the debasement of fiat currencies continue to rise. If any of these predictions come true, BTC Bull Token’s tiered reward structure means BTCBULL holders will receive multiple airdrops of BTC while also benefiting from a decreasing token supply.

Bitcoin Hyper Raises $2M to Boost BTC With Layer 2 Speed

Bitcoin Hyper, the first Layer 2 for Bitcoin to utilize the Solana VIRTUAL Machine, has secured $2.2 million in its top-trending presale – which is scheduled to continue through several more stages before it closes.

The project wants to transform Bitcoin from a passive store of value into a fully programmable network capable of hosting DeFi protocols, NFT marketplaces, and meme coins – all while inheriting Bitcoin’s security through a non‑custodial bridge.

Behind the scenes, users will lock BTC in a smart contract on the Bitcoin base chain and receive wrapped BTC on Bitcoin Hyper’s L2, where transactions settle at Solana-level speeds and fees.

Zero-knowledge proofs will secure the bridge, ensuring that wrapped tokens can always be redeemed one-for-one.

Bitcoin Hyper’s staking portal currently offers a high-APY reward of up to 362%, although this rate will decrease as more holders stake their HYPER coins. It’s worth noting that early supporters have already staked more than 145 million tokens.

Considering its current momentum, the Bitcoin Hyper presale could easily surpass the $3 million milestone within the next few days. Early buyers can secure HYPER at $0.0122 before the price increases in the next sale round.

Looking ahead, Bitcoin Hyper’s launch is aligning with a major political development, as Elon Musk recently announced the formation of the pro-Bitcoin “America Party” after high-profile disagreements with President TRUMP over the latter’s fiscal policy decisions. This has placed a spotlight on new solutions that make Bitcoin more useful in daily life – setting up major opportunities for the Bitcoin Hyper project throughout the rest of 2025.

![]()