Dollar’s Decline Hints at Explosive Bitcoin Rally—Here’s Why

The greenback stumbles—and crypto traders are licking their chops.

When the dollar weakens, Bitcoin tends to roar. Now, market data suggests the stage is set for a major move—just as Wall Street starts pretending it 'always believed' in digital assets.

Inverse correlation on steroids

Historically, BTC and the USD Index (DXY) move like seesaws. With the dollar looking vulnerable—thanks to the Fed's flip-flopping and that one inflation report everyone overanalyzes—Bitcoin’s primed to capitalize.

The institutional FOMO factor

Hedge funds that mocked crypto in 2022 are now quietly accumulating. Nothing screams 'bull market' like suits chasing performance after the retail crowd already front-ran them.

Watch the charts, ignore the 'stablecoin' jargon, and remember: in finance, being early is the same as being wrong—until suddenly you're a genius.

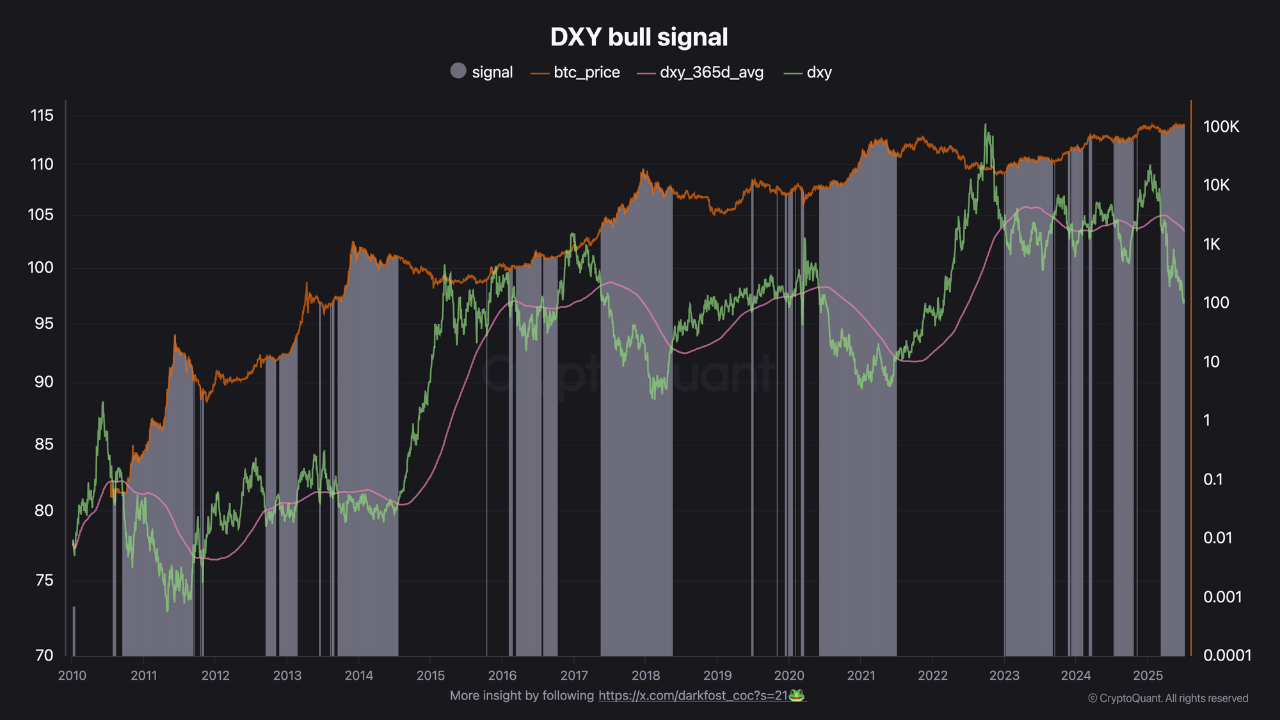

Historically, Bitcoin has performed well during extended DXY downturns. The report includes a chart illustrating that whenever the DXY trades below its 365-day moving average, Bitcoin has entered either an early bull phase or a period of sustained euphoria.

READ MORE:

Despite the technical setup, Bitcoin’s price has yet to fully reflect this macro tailwind. At the time of writing, BTC remains in consolidation territory NEAR $109,000, even as liquidity indicators suggest increasing capital inflow potential.

This disconnect, CryptoQuant suggests, may not last. If historical patterns hold, the weakening dollar could soon catalyze a major MOVE in Bitcoin. For market participants tracking long-term trends, the DXY’s current slump is not just a data point—it may be an early signal that liquidity is returning to crypto, priming Bitcoin for a renewed surge.

![]()