$1B Floods Into Crypto: Ethereum Steals Bitcoin’s Thunder as Investor Favorite

Digital asset markets just witnessed a tsunami of institutional money—and the tide is turning in Ethereum's favor.

The $1 billion question: Why ETH over BTC?

Traders are betting big on Ethereum's ecosystem overhaul—while Bitcoin maximalists clutch their whitepapers tighter. Layer-2 networks and DeFi integrations are pulling capital like magnets, leaving Bitcoin's 'digital gold' narrative looking... well, heavy.

Wall Street's latest crypto crush proves even bankers get FOMO. (Though they'll still charge you 2% to buy what you could've gotten yourself.)

One thing's clear: When smart money talks, it's speaking in solidity—not Satoshis.

U.S. dominates inflows as other regions diverge

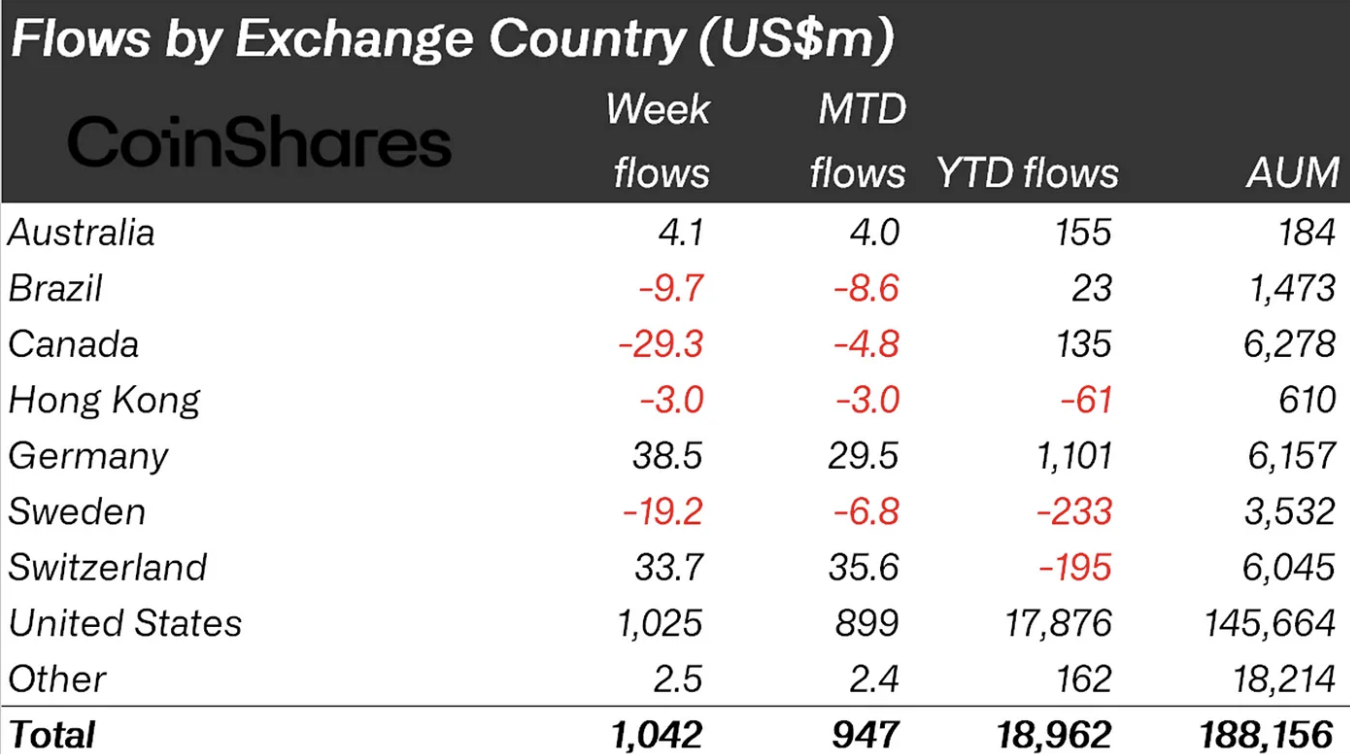

The United States led global flows with $1 billion in net inflows, followed by Germany and Switzerland, which contributed $38.5 million and $33.7 million, respectively. However, the sentiment was more cautious in Canada and Brazil, which saw outflows of $29.3 million and $9.7 million. This regional split indicates growing divergence in how investors are approaching crypto exposure globally.

Ethereum sees stronger sentiment than Bitcoin

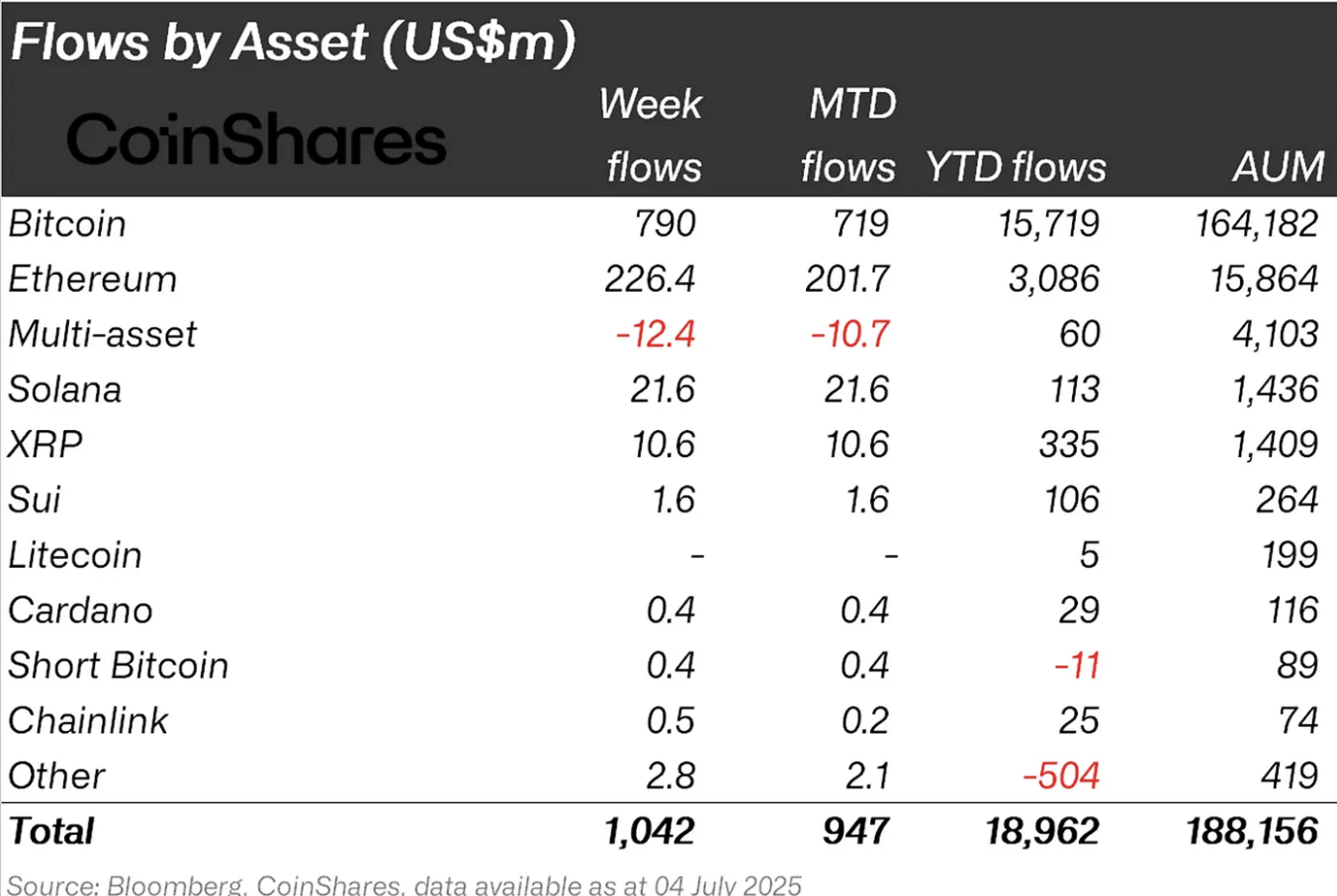

Bitcoin products attracted the bulk of capital with $790 million in inflows. Yet, this marks a slowdown from the previous three weeks, where inflows averaged $1.5 billion. Analysts interpret this moderation as caution NEAR Bitcoin’s all-time highs.

Meanwhile, Ethereum is quietly gaining favor. The second-largest cryptocurrency saw $226 million in weekly inflows, extending its streak to 11 consecutive weeks and bringing its 11-week total to $2.85 billion. On a proportional basis, Ethereum is outperforming, with weekly inflows averaging 1.6% of AuM—double Bitcoin’s 0.8%.

Providers and assets breakdown

Among providers, iShares ETFs led with $436 million in inflows, followed by Fidelity ($248 million) and ARK 21Shares ($160 million). Grayscale, in contrast, saw $46 million in outflows.

By asset class, Bitcoin and ethereum led, while Solana ($21.6 million) and XRP ($10.6 million) posted modest gains. Multi-asset products recorded $12.4 million in outflows, reflecting selective investor focus.

READ MORE:

Outlook

With inflows accelerating and Ethereum showing strong momentum, the trend suggests rising institutional confidence in digital assets—especially in Ethereum’s long-term positioning as a programmable financial layer. If this pace continues, Ethereum could narrow the AuM gap with Bitcoin even further in the coming weeks.

![]()