Bitcoin’s Next Frontier: Profit-Taking Surges and Outflows Signal New Discovery Phase

Bitcoin's price action just got interesting—again. As profit-taking metrics spike and capital exits the market, BTC is carving out uncharted territory. Here's what's happening under the hood.

Profit-taking hits critical mass

Whales and retail traders alike are cashing out near local tops—classic bull market behavior. But this time, the outflows tell a sharper story: liquidity is rotating, not retreating.

Outflows dominate—but not where you'd expect

Exchange withdrawals are outpacing deposits by a 2:1 margin. Some call it caution; we call it smart money positioning for the next leg up. (Wall Street would've charged a 2% management fee for this 'insight.')

The discovery phase accelerates

Volatility compression? Broken. Trading ranges? Obliterated. Bitcoin's charting its own path now—with or without mainstream finance's approval.

Bottom line: When weak hands take profits and strong hands accumulate, history suggests we're not at the top—we're at the launchpad. The only question is who blinks first.

SOPR trend hits rare third peak

The SOPR (Spent Output Profit Ratio) Trend Signal, a metric that tracks the average profit margin of coins moved on-chain, has now risen for the third time within the same bull cycle — an unprecedented occurrence. This indicates that within just 12 months, bitcoin holders have seen multiple profitable exit points yet continue to show strong holding behavior.

This metric becomes especially relevant when identifying market shifts. If the SOPR signal’s blue line crosses below its long-term orange trend line, it often flags a transition toward bearish sentiment. As of now, however, the signal remains bullish, indicating that profit-taking has not yet overwhelmed market demand.

Exchange outflows reaffirm long-term confidence

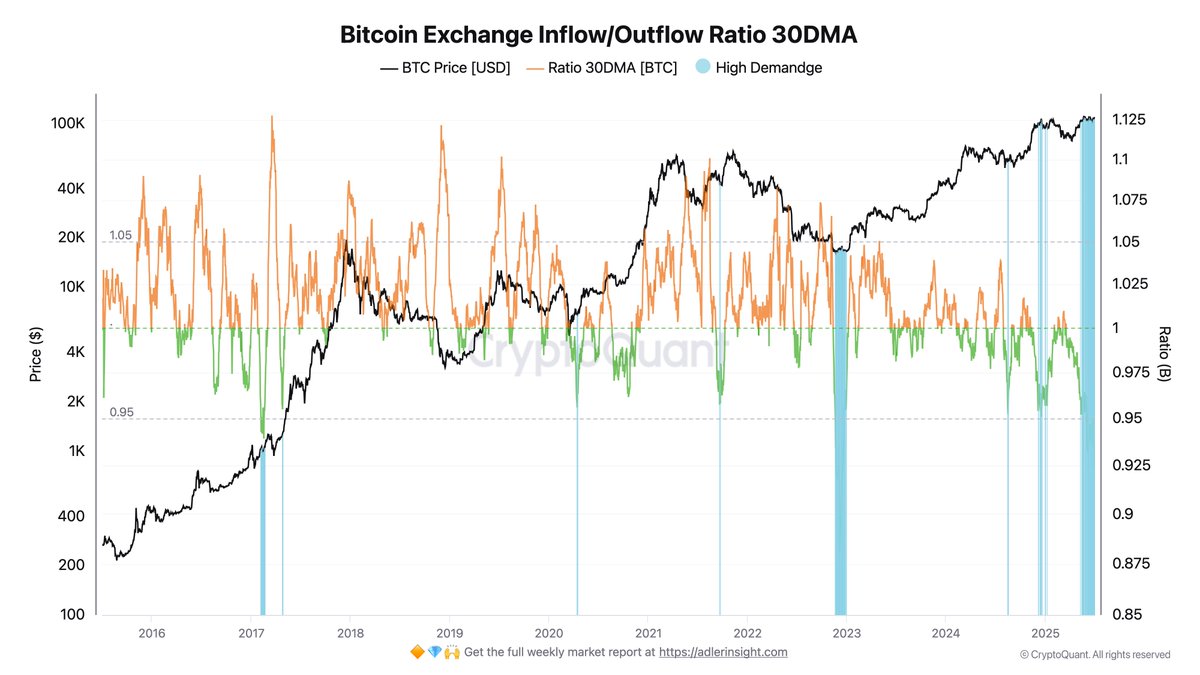

Supporting this trend is the current inflow/outflow ratio for BTC on exchanges, which has dropped to around 0.9 — a level last seen during the 2023 bear market. A ratio below 1 suggests that more Bitcoin is leaving exchanges than entering, a classic signal of accumulation.

READ MORE:

Historically, when this ratio rises above 1.05, it has marked the start of distribution phases or broader corrections. But with long-term holders continuing to absorb supply and outflows dominating, Darkfostthe market remains in a favorable spot-driven demand cycle.

Both indicators — the triple SOPR peak and sustained outflows — point to a market where conviction is growing, not waning. While risks remain, these trends suggest that Bitcoin’s next major MOVE may once again defy conventional expectations.

![]()