Whales Gobble Crypto, Ethereum Flashes Bullish Signals, and Market Sentiment Gets a Reality Check – July 2025

Crypto's deep-pocketed players are making big moves again—just as Ethereum's charts scream 'buy.' But don't break out the champagne yet: retail traders are getting whiplash from the latest sentiment swing.

Whale Watch: The 1% Are Loading Up

While Main Street panics, crypto's megaholders are quietly accumulating. Classic.

Ethereum's Make-or-Break Moment

Technical indicators hint at a major breakout—or one brutal fakeout. ETH's been here before.

Sentiment Rollercoaster: From Greed to Fear in 48 Hours

Turns out 'number go up' isn't actually an investment thesis. Who knew?

Bottom Line: The market's primed for volatility—whether you're a diamond-handed HODLer or just here for the memes, buckle up. (And maybe ignore that VC whispering 'this time it's different' at the yacht party.)

Santiment: Stable Start to July, But Divergence Underneath

Santiment highlights that July began with modest gains for Bitcoin (+2.5%), while altcoins like Ethereum (+6%), Uniswap, Pepe, and Arbitrum posted stronger returns. The firm suggests this reflects continued capital rotation into risk assets as global liquidity conditions improve.

Santiment advises monitoring traditional markets like the S&P 500 and Gold for signals that may spill over into crypto, especially when those markets are also rallying.

Bitcoin’s MVRV Ratio Suggests Profit-Taking Risk

Santiment’s MVRV data shows that bitcoin traders are, on average, in profit, placing the asset in what the firm calls “slight danger territory.” Long-term holders are up 18%, and short-term holders are up 2.8%. Although not yet extreme, Santiment warns that if the ratio moves toward the +30% range, risk of a pullback increases.

The report recommends aligning trade horizons with MVRV levels—short-term traders still have room to operate, while long-term investors may want to wait for better entry points.

READ MORE:

Whales Accumulate Despite ETF Outflows

One of Santiment’s most bullish findings is the continued accumulation by Bitcoin whales. Over the past week, wallets holding 10 to 10,000 BTC added more than 25,000 BTC, and over the last three months, that figure rises to 160,000 BTC.

This accumulation has occurred even as spot Bitcoin ETFs recorded their first net outflow in 14 days, totaling $342.2 million. Despite the streak break, Santiment emphasizes that 85% of trading days since mid-April still saw net inflows, underscoring sustained institutional demand.

Ethereum vs. Bitcoin: Signs of a Long-Awaited Breakout?

Santiment highlights a notable move on the ETH/BTC trading pair, where ethereum gained 3.5% in just a few hours. This strength, rarely seen in recent years, could mark the beginning of a capital rotation toward ETH.

Their MVRV data also suggests Ethereum is less overheated than Bitcoin. Short-term ETH holders are barely in profit (+1.2%), and long-term holders remain underwater. This gives Ethereum more upside potential before entering speculative risk zones.

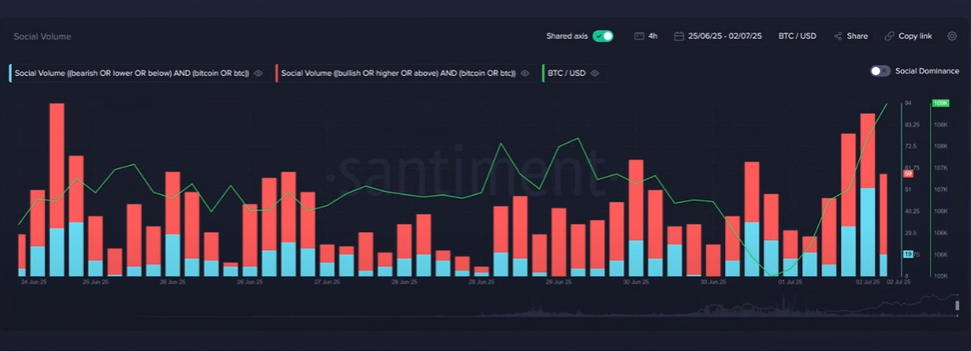

Sentiment Watch: Bitcoin and XRP Near Euphoria

Santiment flags rising social sentiment for Bitcoin and XRP as a potential red flag. These assets are currently experiencing the highest levels of crowd excitement in weeks, which historically precedes short-term corrections. By contrast, Ethereum and solana remain in neutral sentiment territory, signaling more balanced risk-reward dynamics.

Santiment encourages using sentiment divergence to adjust portfolio exposure—trimming overly euphoric assets while rotating into undervalued ones with quieter narratives.

READ MORE:

Solana, Development Trends, and Short-Squeeze Setups

The report names Solana as a “sneaky pick” due to its solid fundamentals and relatively muted social buzz, which could prime it for a low-expectation rally.

Additionally, Santiment lists Ethereum, Chainlink, Cardano, and Internet Computer among the most actively developed projects, based on GitHub activity. High development signals continued technical progress and long-term viability.

On derivatives markets, negative Bitcoin funding rates suggest traders are heavily shorting BTC. Santiment views this as a bullish contrarian signal, as prolonged bearish positioning often sets the stage for short squeezes.

Conclusion: Santiment Sees Room for Rotation

Santiment concludes that while Bitcoin shows strength, its rising MVRV and euphoric sentiment pose near-term risks. Meanwhile, Ethereum and Solana offer healthier on-chain setups, whale support, and lower social hype—conditions that often precede outperformance.

The firm recommends a data-first approach: monitoring MVRV, sentiment scores, ETF flows, and whale behavior to guide decisions in a market full of noise.

![]()