July’s Crypto Frenzy: Santiment Reveals the Hidden Forces Behind Market Chatter

Crypto's summer sizzle isn't just about price action—Santiment data exposes the narratives actually moving markets. Forget the moonboys; here's what's really driving conversations.

### Whales vs. Retail: The Eternal Dance

Big players keep dropping cryptic tweets while retail traders chase the next shiny meme coin. Some things never change—except this time, leverage ratios suggest one side might get wrecked.

### Regulatory FUD Takes a Backseat (For Now)

Politicians are too busy with reelection campaigns to crush your favorite shitcoin. Enjoy the regulatory vacation while it lasts.

### The AI-Crypto Hype Cycle Spins Faster

Another week, another 'decentralized AGI' project raising $50M on a whitepaper. At least the VC money's flowing again—just don't ask about tokenomics.

Markets move when narratives collide with liquidity. This July, it's not about what's rational—it's about what's viral. Trade accordingly. *[Insert eye-roll about 'institutional adoption' press releases here]*

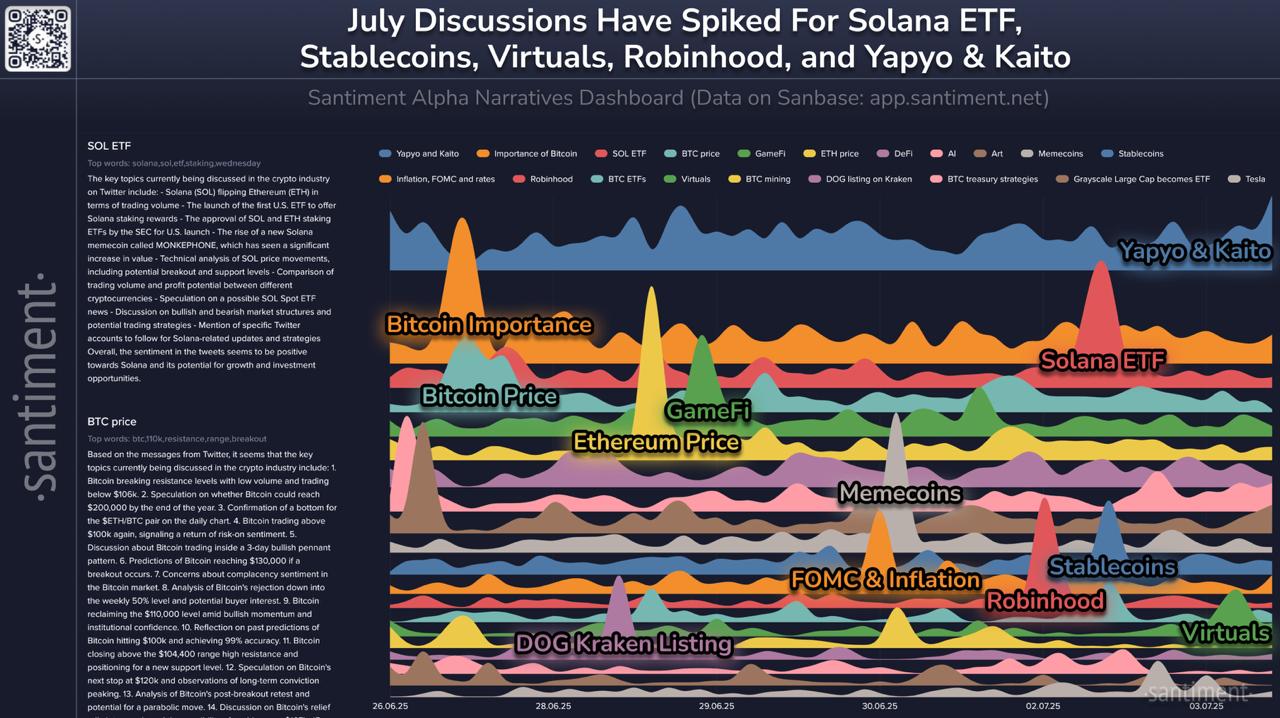

In addition to ETF excitement, stablecoins have re-entered the spotlight, potentially due to recent geopolitical developments and policy debate around digital dollar infrastructure. Meanwhile, Virtuals, a segment associated with metaverse and augmented identity platforms, has gained renewed attention, alongside Robinhood, likely triggered by the platform’s growing crypto trading volume and ETF exposure.

READ MORE:

Interestingly, Yapyo & Kaito—AI-focused bots or crypto-native agent tools—have emerged as new hot topics. Their rise reflects growing interest in AI-enhanced trading or analysis tools within the crypto space, aligning with broader tech adoption trends.

Santiment’s dashboard alsoto track legacy narratives like Bitcoin price volatility, Ethereum fundamentals, memecoins, and inflation-related chatter, though they have seen relatively moderate spikes compared to the newer focal points.

With attention cycling rapidly in crypto, Santiment’s data suggests that narrative rotation is a key driver of short-term volatility and engagement. As ETF approvals and policy shifts continue to unfold, these leading discussion topics may offer a window into evolving market sentiment.

![]()