10,000 Sleeping Bitcoin Awakens After 14 Years—Market Quake Coming?

Bitcoin's ancient whales are stirring. A whopping 10,000 BTC—dormant since the early days—just changed hands for the first time in 14 years. Was it Satoshi? A forgotten early miner? Either way, the crypto markets are bracing for impact.

Why this matters now

That much BTC hitting exchanges could flood liquidity. Or maybe it's being moved to cold storage—a bullish long-term play. Either way, traders are watching wallets like hawks.

The volatility playbook

History shows massive moves like this often precede price swings. When 1,000+ BTC transactions hit, the market typically reacts within 72 hours. This is 10x that size.

The cynical take

Some hedge fund manager probably just remembered their 2011-era password—right before their yacht payment came due.

Not an Internal Transfer — Possible Trading Intent

Unlike internal reshufflings or wallet migrations driven by security concerns, the pattern of this transaction suggests it may have been executed with trading intent. While the destination address and purpose remain unconfirmed, the structure and timing of the MOVE point to a genuine reactivation of old funds—potentially by an early adopter or miner.

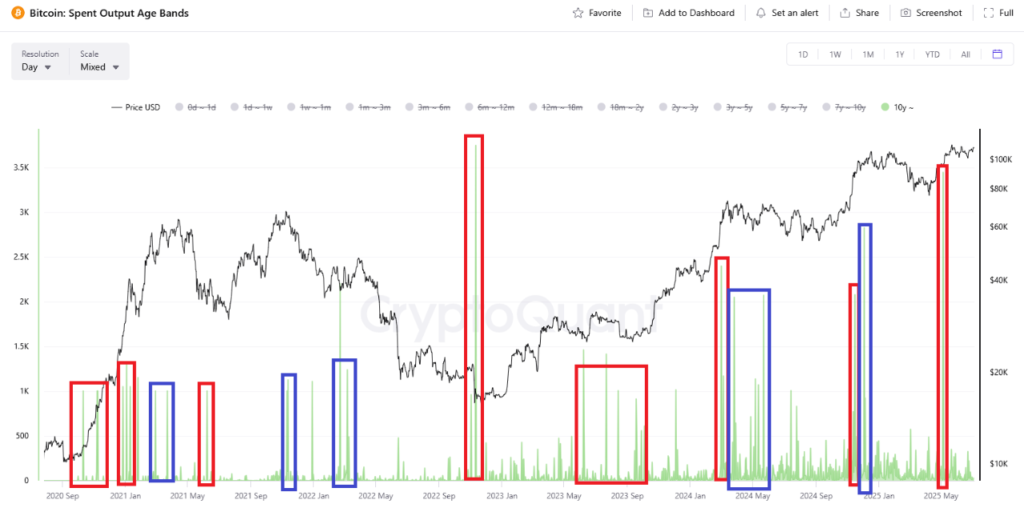

CryptoQuant analysts note that this could be the largest transfer of 10+ year dormant Bitcoin ever recorded. Previously, the biggest such move involved 3,700 BTC during the post-FTX collapse in late 2022—a moment many now view as the market bottom.

Context Matters: Not All Old BTC Moves Are Bearish

Although large transfers of dormant bitcoin often spark panic selling and bearish sentiment, analysts caution against jumping to conclusions. As seen in past events like Mt. Gox wallet restructuring, not all movements signify liquidation.

READ MORE:

“It’s a mistake to interpret all old-holder activity as purely bearish,” the report states. Intent is key, and determining whether today’s transfer was made for security, custodial reshuffling, or actual selling is essential before drawing market conclusions.

Rare On-Chain Signal May Precede Volatility

While the true motive remains unknown, what is clear is that this rare on-chain footprint could become a precursor to increased market activity. Long-term dormant wallets rarely move, and when they do, they often precede heightened volatility or pivotal shifts in market structure.

Traders and analysts will be watching closely in the coming days to see whether this transfer turns into selling pressure—or merely a historical anomaly.

![]()