Binance Netflow Reveals Stark Altcoin Divergence: Who’s Pumping, Who’s Dumping?

Binance's netflow data just dropped a truth bomb—altcoins aren't moving in lockstep anymore. While some tokens hemorrhage value, others defy gravity. Here's the breakdown.

The great altcoin schism

Exchange wallets tell all. Whale movements and retail FOMO are carving deep trenches between winners and losers. No more 'rising tide lifts all boats'—this is Darwinism in action.

Liquidity wars heat up

Market makers are playing 4D chess with order books. Some alts get liquidity injections while others get ghosted—because nothing says 'decentralized' like selective bailouts.

One coin's breakout is another's death spiral. Welcome to crypto's new era of brutal selectivity—where fundamentals finally matter (just kidding, it's still mostly vibes).

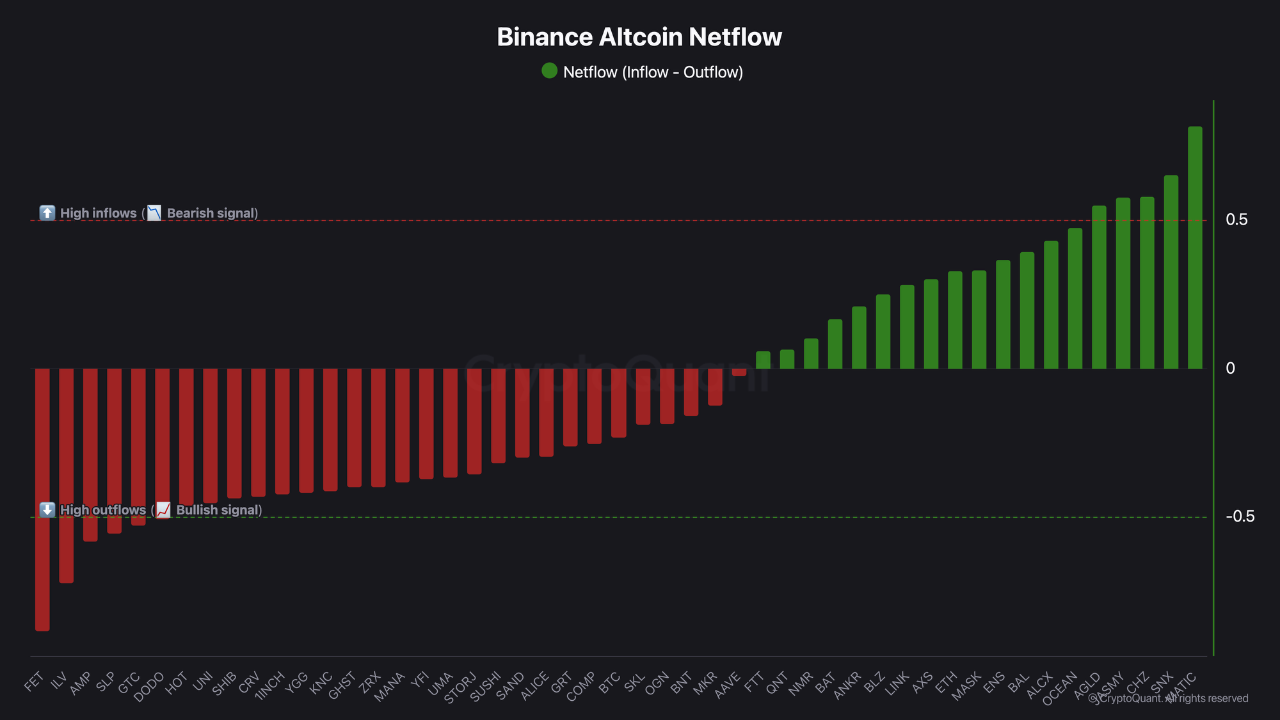

Altcoins With Inflows May Be Facing Distribution

On the other hand, tokens such as Polygon (MATIC), Synthetix (SNX), Chiliz (CHZ), ASMY, and AGLD are seeing notable net inflows to Binance. These movements often precede distribution events, with investors transferring assets to centralized exchanges in preparation for selling.

This shift may cap short-term upside for these tokens and could even signal bearish setups if inflows persist.

READ MORE:

Netflow Patterns Offer a Valuable Trading Signal

- Tokens with outflows (e.g., FET, ILV): Reduced sell pressure, higher probability of price appreciation.

- Tokens with inflows (e.g., MATIC, SNX): Elevated sell pressure, weaker bullish setups or downside risk.

CryptoQuant emphasizes that exchange netflows remain one of the more reliable on-chain indicators for anticipating directional momentum, particularly when combined with price action and volume analysis.

![]()