Trump-Endorsed WLFI Coin Shrugs Off Crypto Crash: The Next Must-Buy Asset?

Defying the broader market bloodbath, the Trump-backed WLFI token is posting gains while rivals bleed out. Political meme coin or legitimate hedge? Crypto traders are placing bets.

Why WLFI isn't following Bitcoin's lead

Most altcoins tanked 20-50% this week—yet WLFI pumped 15% on pure celebrity endorsement fumes. Since when did politics become a fundamental indicator? (Spoiler: since crypto stopped pretending to care about fundamentals.)

The influencer effect vs. real utility

Trump's tweet last Thursday triggered a 72-hour buying spree. Now retail FOMO meets institutional skepticism—Goldman analysts call it 'the most politically correlated asset since Russian ruble futures.'

One cynical truth: In 2025's market, a divisive figure's Twitter feed moves prices faster than any whitepaper. Whether that's depressing or brilliant depends on your portfolio balance.

Defying the Downturn – How WLFI Is Bucking the Trend

WLFI is trading around $0.148 today, up 30% from its Friday low and back to where it was a week ago. Also, one anonymous whale pulled 47.18 million WLFI (worth about $7 million at the time) off Binance this morning – a telltale sign that a big investor is settling in to hold long-term.

The token’s rally didn’t come out of nowhere. It received a boost last Wednesday when World Liberty Financial burned 166 million WLFI tokens that were linked to phishing breaches. That was roughly equivalent to $22 million at the time.

It’s a MOVE that acts like a corporate share buyback – it directly reduces supply, and shows a commitment to the holders who stuck around. The result was an instant uptick in demand (and a price pump).

Also, data shows WLFI whale ownership has shot up by 57% since October, as tokens continue to move off exchanges into cold wallets. This smart-money accumulation – combined with the token burn – explains why WLFI is performing so well right now.

Bitcoin Hyper – The New Layer-2 That Boosts Bitcoin’s Capabilities

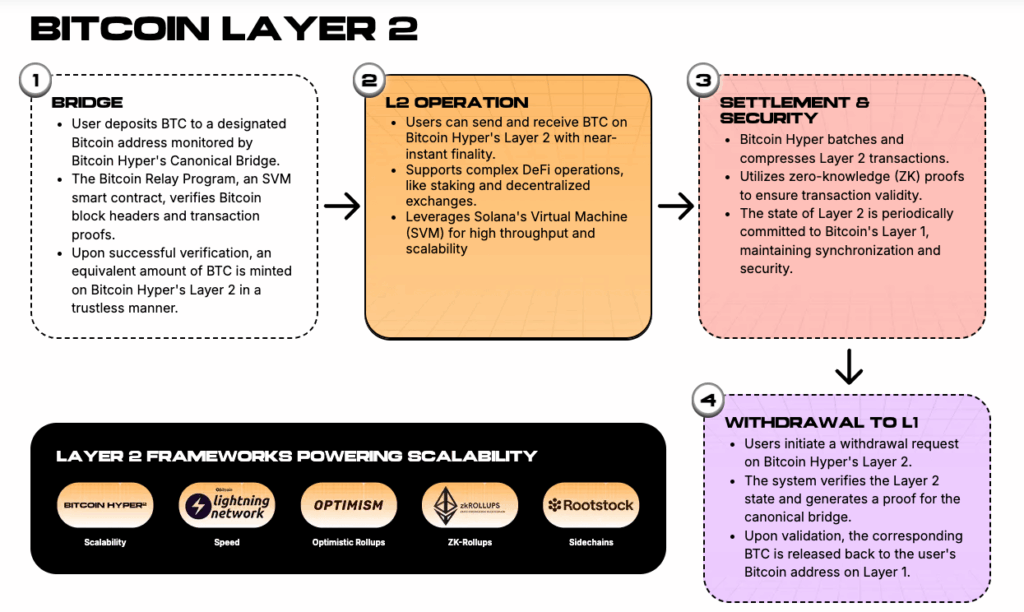

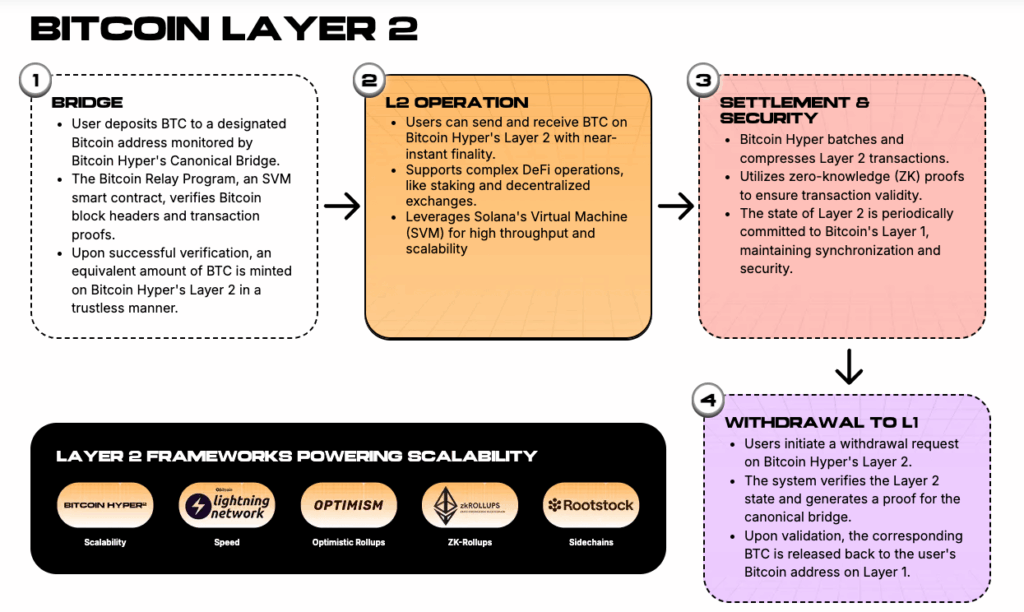

While WLFI dominates the headlines, bitcoin Hyper is tackling a different challenge entirely: unlocking Bitcoin’s potential beyond being just a speculative asset and store of value. It’s a Layer-2 scaling solution that essentially adds on Solana’s speed to Bitcoin’s security.

Bitcoin Hyper processes transactions off-chain using a modified version of the Solana VIRTUAL Machine (SVM) – in turn achieving faster speeds and near-zero fees. These transactions are then securely batched and settled back on Bitcoin’s mainnet, giving you the benefits of both Solana and Bitcoin.

For developers, this is huge. They could theoretically build fast, complex dApps – like DEXs, lending protocols, and NFT marketplaces – using Solana’s Rust-based tools, but secured by the Bitcoin blockchain. It finally lets Bitcoin compete in the DeFi space and other top Web3 verticals.

The project’s HYPER token is key to this new ecosystem, serving as a staking and governance token, as well as for paying network fees. Holding it is also essentially a bet on Bitcoin becoming a more programmable, versatile blockchain. That makes it a different investment proposition than a more PolitiFi-oriented token like WLFI.

Is HYPER the Best Crypto to Buy Right Now?

The Bitcoin Hyper presale offers a classic early-bird setup. It started back in July, has already raised over $28.4 million, and is selling HYPER tokens at $0.013325 apiece. But that price is set to jump in less than 24 hours.

That’s because the presale uses a multi-stage model, so the HYPER price climbs every few days. This model rewards the earliest investors with the lowest cost basis, which could pay off handsomely if the token succeeds after its Token Generation Event (TGE) and subsequent exchange listings.

You can buy HYPER during the presale with ETH, SOL, BNB, USDT, USDC, or a bank card – no minimum investment required. And the second you own HYPER, you can stake it for rewards. The current APY is approximately 41%.

In the end, determining if this is the best crypto to buy comes down to what you’re betting on: WLFI’s political connection or Bitcoin Hyper’s Layer-2 vision. Both represent two very different types of infrastructure – but given HYPER’s pre-launch status, it might offer a better risk profile for those betting on cross-chain innovation.

Visit Bitcoin Hyper PresaleThis publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

![]()