Arthur Hayes: Bitcoin Could Hold $80K Floor With Liquidity Boost

Bitcoin's $80K threshold becomes the new battleground as market liquidity determines its fate.

The Liquidity Lifeline

Former BitMEX CEO Arthur Hayes positions the $80,000 level as Bitcoin's critical support zone—but only if market conditions cooperate. His analysis suggests improved liquidity could transform this psychological barrier into a durable foundation.

Market mechanics trump technical analysis when the big players start moving. Central bank policies, institutional flows, and that ever-elusive 'risk-on' sentiment create the tide that lifts all crypto boats—or sinks them.

Wall Street's favorite game: pretending they understand decentralized money while chasing the same old liquidity patterns. Bitcoin might break the traditional financial mold, but it still dances to the Fed's tune when the music gets loud.

The $80K question isn't about charts—it's about whether the money printers can outpace the skeptics.

JPMorgan’s MSTR Warning Came at the Perfect Time

JPMorgan published a warning on Strategy last week, underlining that the company faces delisting risk from MSCI after an announcement the index published on October 10.

MSCI won’t issue a final ruling until 15 January 2026, but the real takeaway from JPMorgan’s warning was something else. It exposed the root cause of the recent Bitcoin selloff – and potentially even the catalyst that sparked the October 10 $19 billion liquidation event. Most retail traders were unaware of MSCI’s plans, and thus had no idea why smart money, ETFs, and Bitcoin OGs had been dumping BTC since October.

JPMorgan told us why, and that clarity has since settled the market.

Meanwhile, the analyst Frank A Fetter underlined that the ETFs’ cost basis is $82,500, signalling this may be a key area for institutional players to step back in and start accumulating BTC.

So with JPMorgan’s report providing clarity for retail and BTC testing a key institutional buying zone, market dynamics here could certainly favor a bullish rally in the days and weeks ahead. But what do the price charts say?

BTC finds support at the average ETF cost basis, which also happens to be the true market mean. Confluence! pic.twitter.com/gYsVpDkP0J

— Frank (@FrankAFetter) November 23, 2025

BTC Price Prediction: Analyst Targets $97K This Week

Bitcoin is on the cusp of breaking above a trendline resistance level that has held for 2 weeks. Analyst Captain Faibik suggests that a break of this bearish structure will fuel a 10-12% bullish rally this week, with his price chart displaying a target of $97,500.

$BTC Bulls haven’t broken the trendline Yet..!!

If bulls successfully reclaim the trendline, we could see 10–12% bullish Rally this week..📈#Crypto #Bitcoin #BTC #BTCUSDT pic.twitter.com/f1RP0G8MGO

— Captain Faibik 🐺 (@CryptoFaibik) November 24, 2025

That said, Bitcoin and Mondays haven’t gotten along well recently. The analyst Killa XBT noted that BTC has fallen on every Monday for the past 8 weeks. And as the saying goes, “never trust the weekend pumps.”

$BTC

Since 126K, every single Monday BTC has dropped 8/8 times.

Will this time be any different or will we run the same script? pic.twitter.com/M6xz4fRPEV

— Killa (@KillaXBT) November 24, 2025

There is, therefore, a possibility that BTC gives back its weekend gains and retests key levels between $80,000 and $83,000 this week – but that outcome isn’t guaranteed.

The market finally has clarity on what caused the October crash. ETFs began buying again on Friday, and catalysts such as the upcoming crypto market structure bill and the end of quantitative tightening create a brighter outlook for BTC and the broader market.

So with all of this in mind, our Bitcoin price prediction leans bullish. We anticipate relief from the recent challenging market conditions, driven by the developments outlined above. While Monday selling cannot be ruled out, a reclaim of $90,000 and a push toward $97,000 this week is certainly plausible.

But even while Bitcoin struggled in recent weeks, several other altcoins have continued to gain ground – and one that’s flown under the radar is Bitcoin Hyper, a Bitcoin LAYER 2 undergoing a presale. Its combination of early-stage status and initial momentum has sparked exciting speculation about upside potential. Let’s explore what it’s all about.

Bitcoin Hyper Raises $28.3M via Presale With 301 Buyers in 24 Hours

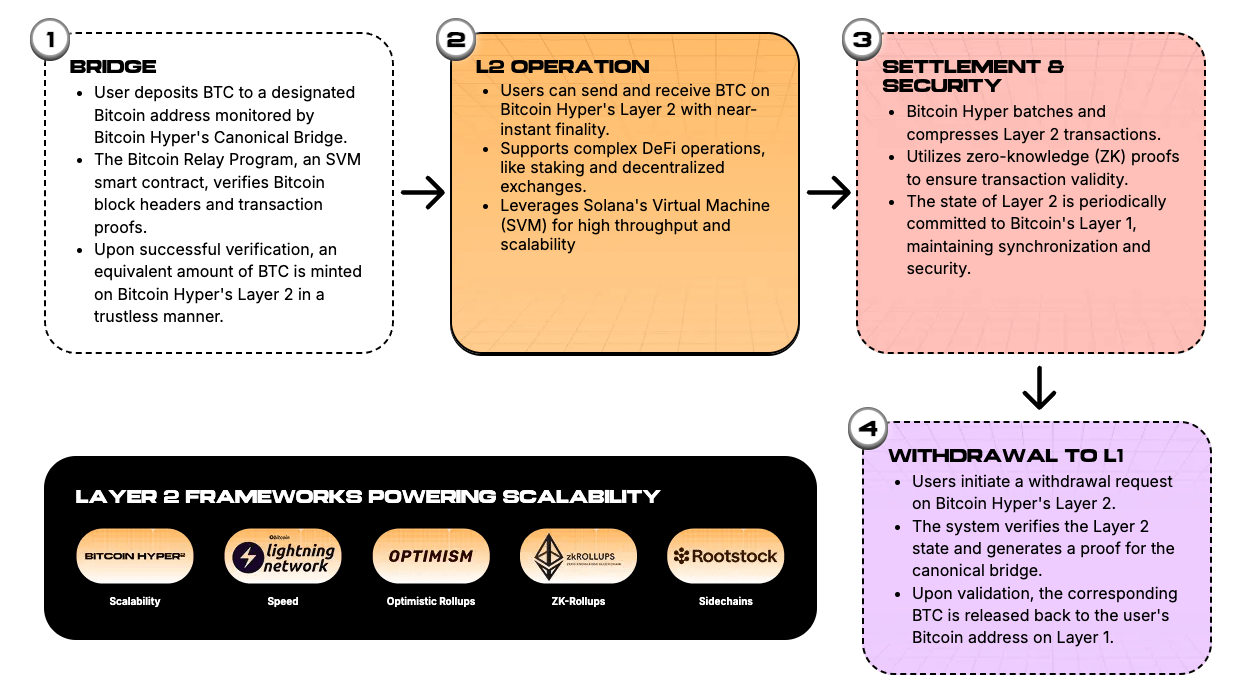

It’s no secret that Bitcoin has a speed problem. The network can handle only 7 transactions per second (TPS), while Layer 2 solutions like Stacks, Rootstock, and Starknet can handle a couple of hundred TPS at best.

While these Layer 2s offer improvements, they remain significantly slower than modern blockchains like Solana, which can process 65,000 TPS. That’s where Bitcoin Hyper comes in – it’s the first-ever Bitcoin Layer 2 built using the Solana VIRTUAL Machine, delivering Solana-grade speed and smart contract support.

This setup also makes Bitcoin Hyper interoperable with Solana, enabling developers to seamlessly port their apps and tokens to the network.

What Bitcoin Hyper is building could fundamentally change how and by whom Bitcoin is used, which is why it’s building such huge momentum. Its presale has raised $28.3 million so far, with 301 new buyers joining the project in the last 24 hours alone.

Top industry analysts have also started to take notice of HYPER, with Borch Crypto recently calling it the “best crypto presale of 2025.”

What Bitcoin Hyper represents is something rare: an opportunity to get in early on a cryptocurrency with potential to reshape how a $2 trillion asset is used.

It’s not just built on HYPE – and its presale success, even at a time when the broader market struggles, indicates deep investor conviction. This is why HYPER could outperform as Bitcoin leads the broader market higher in the coming months.

Visit Bitcoin Hyper Presale

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

![]()