Bitcoin-Backed Loan Volume Explodes 10x in 2 Months - Institutions Rushing to Use BTC as Collateral

Wall Street's latest love affair with Bitcoin isn't about buying—it's about borrowing.

The Collateral Revolution

Bitcoin-backed lending volume just exploded tenfold in sixty days. Institutional players aren't just hodling—they're leveraging their BTC stacks like never before. The digital gold narrative gets a financial engineering upgrade.

Why This Matters

Traditional finance finally figured out what crypto natives knew for years: Bitcoin makes damn good collateral. Liquid, portable, and uncorrelated to traditional assets. Banks used to laugh at crypto—now they're building lending desks around it. The ultimate 'if you can't beat them, join them' moment for the suits.

Institutional Adoption Accelerates

This isn't retail FOMO. This is serious money treating Bitcoin as a legitimate financial asset. The tenfold surge signals something bigger than speculation—it's infrastructure being built in real-time. The same institutions that once called Bitcoin a scam now can't get enough of its balance sheet potential.

Of course Wall Street found a way to make Bitcoin boring—by turning it into collateral. But when the traditional finance machine starts running on crypto fuel, you know the game has changed forever.

Best Crypto To Buy Now

Besides BTC, several large-cap and mid-cap altcoins are among the top crypto investments as well.

For instance, Solana has defended a key support level in the monthly timeframe, while perpetual DEX coins like Aster and Hyperliquid are on the cusp of a breakout.

Low-cap presale cryptos are also in high demand among whales that are hunting for outsized returns in the upcoming bull run.

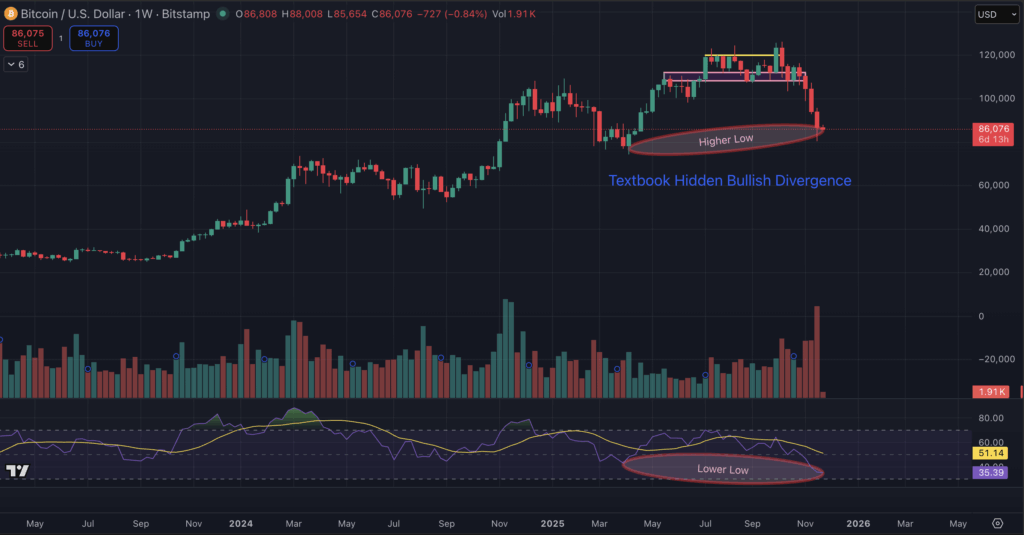

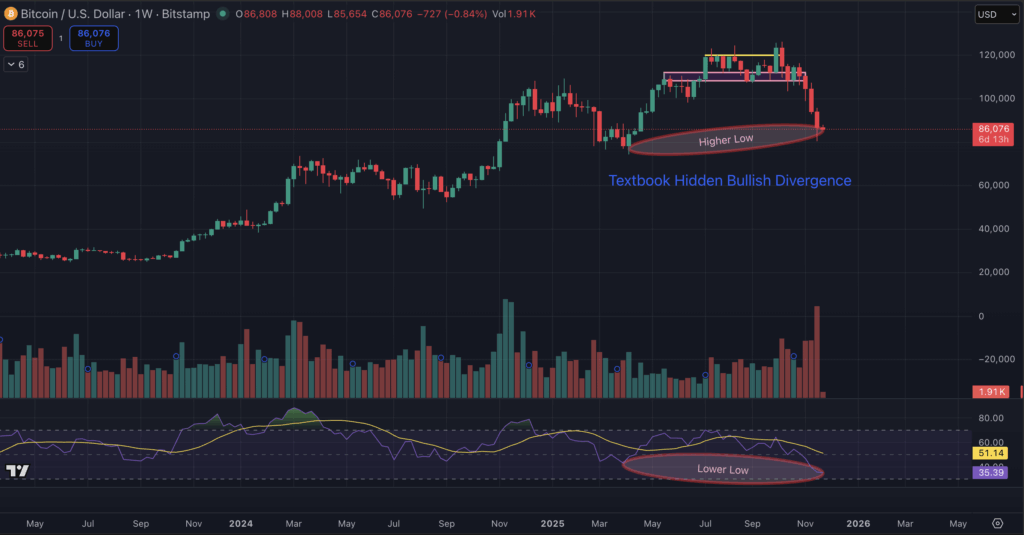

Bitcoin (BTC)

With strong evidence that the bottom is in, bitcoin is back to being among the best crypto to buy now.

Market intelligence platform Swissblock is highlighting that the worst of the crypto crash is now in the books, with key indicators showing seller exhaustion. Even technicals like hidden bullish divergence in the weekly timeframe suggest that a bounce back is imminent.

Tom Lee isn’t the only expert currently bullish on Bitcoin. Derivatives data show that traders still expect further gains.

Call interest into year-end continues to dominate put exposure, with the heaviest positioning appearing around the 85k, 120k, 130k, 140k and even 200k levels. At the same time, funding rates have flipped negative, indicating that excess long leverage has already been cleared out

The US Fed also appears poised to cut the federal funds target rate by another 25 basis points in December, in addition to ending its quantitative tightening program. This is expected to lower borrowing costs and bring a flush of new capital into the financial markets, benefiting Bitcoin.

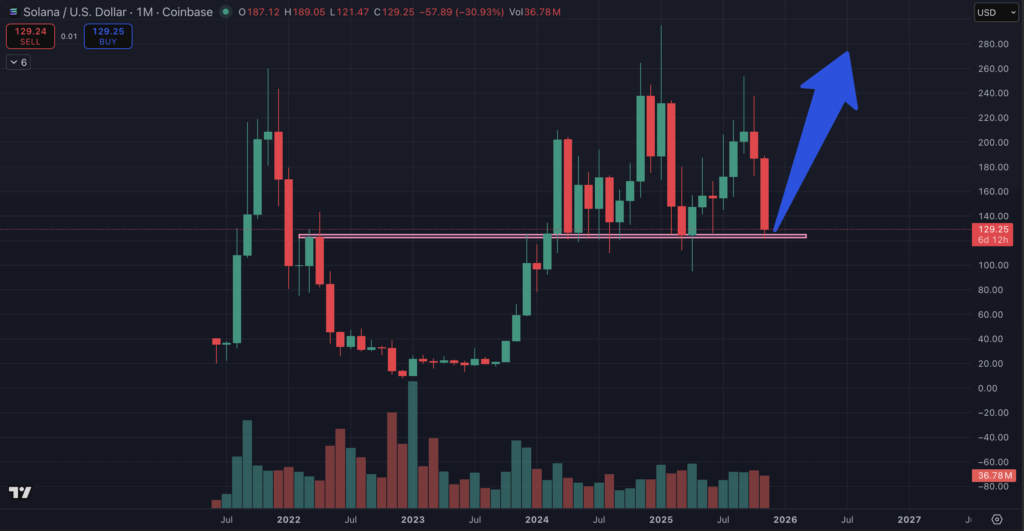

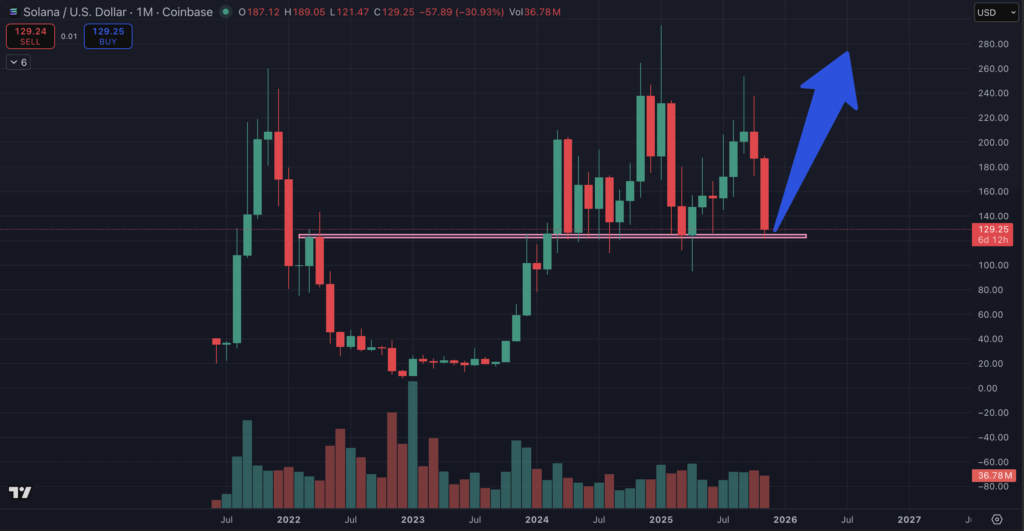

Solana (SOL)

Experts are once again giving a “buy” call on solana (SOL) after it has successfully defended a key support level.

Despite the recent downtrend, SOL successfully retested the $120 to $128 support range in the monthly timeframe. A monthly close above this range WOULD invalidate all potential bullish scenarios, paving the way for a rally to $200 and beyond.

The newly-launched spot Solana ETFs are also providing a considerable boost to the SOL price. While Bitcoin and ethereum ETFs continue to face persistent outflows, Solana products are still attracting fresh capital on a daily basis.

Experts believe that SOL will be one of the top-performing assets once the broader market outlook improves, which should also pave the way for another explosive rally in Solana meme coins.

Hyperliquid (HYPE)

Hyperliquid (HYPE) is back to its bullish ways, forming a 6.28% green daily candle on Sunday.

Despite the FUD regarding the upcoming token unlocks, prominent institutions and whales are buying HYPE.

For instance, market intelligence platform Nansen reveals that Pantera Capital is accumulating Hyperliquid. Meanwhile, the company’s buyback scheme is still absorbing nearly $5 million worth of coins daily, creating a deflationary supply.

While everyone’s scared of the $HYPE unlock,

🟢 @PanteraCapital isn’t, they’re buying (+51.7K)

🟢 Fresh wallets just aped $3.9M

🟢 Buybacks still absorbing $5M/day

If this is distribution, it’s the cleanest exit-to-entry flip we’ve seen all year pic.twitter.com/sLuDiyPmyO

— Nansen 🧭 (@nansen_ai) November 24, 2025

Similarly, Onchain Lens reveals that a whale is steadily building up a massive HYPE spot position. It currently has $8.3 million worth of Hyperliquid and is clearly anticipating a new uptrend.

Sidelined investors can still afford to exercise patience. However, a flip of the $32 resistance would be an excellent “buy” signal, especially if Hyperliquid secures a monthly close above it.

Bitcoin Hyper (HYPER)

Investors looking for outsized returns are rushing to accumulate Bitcoin Hyper (HYPER), one of the best crypto to buy now in the low-cap sector.

Smart money investors are fully taking advantage of investing early in a new layer-2 coin, which tend to have multibillion-dollar valuations. For instance, another Bitcoin layer-2 coin, Stacks (STX), reached a peak market cap of over $5 billion.

Whales appear to be positioning early as well, with several recent six-figure purchases coming in around $650k, $500k and $300k. Behind such strong demand, it is no surprise that the Bitcoin Hyper presale has already raised over $28.3 million in short order.

Hyper News 🚨

A rollup without builders is just code. Bitcoin Hyper is aligning developers early—bringing Solana-grade execution to Bitcoin’s security LAYER and working with partners to shape workflows and infrastructure.

With a focus on docs, APIs, and transparency, Hyper… pic.twitter.com/dgI9bjE1fg

— Bitcoin Hyper (@BTC_Hyper2) November 10, 2025

Top analysts are already impressed with Bitcoin Hyper’s use case. Powered by zero-knowledge architecture and the Solana VIRTUAL Machine, it guarantees a performant, highly scalable and programmable layer-2 chain within the Bitcoin ecosystem.

It could soon become the hotbed for new DeFi apps, payment protocols and even meme coins. With HYPER at the Core of it all, early buyers could benefit massively, especially in the long term.

Several top crypto influencers are already calling it the next 100x crypto.

Buy Bitcoin Hyper

Best Wallet (BEST)

Best Wallet (BEST) completes our list of best cryptocurrencies to buy.

BEST has also been one of the most successful presale coins of the year, raising over $17.4 million in short order. With its presale ending in just 4 days, the hype and FOMO have reached a fever pitch, despite the broader market uncertainty.

BEST is the native token of the Best Wallet app, a new multi-chain, no-KYC and anonymous crypto wallet.

With BEST, buyers are investing in a project that aims to capture 40% of the $11 billion non-custodial wallet market. The app continues to record over 250,000 monthly active users and 630% MoM growth rate.

However, Best Wallet isn’t just a crypto storage solution. Instead, it is a one-stop shop for all things Web3 and offers derivatives and futures trading, an NFT gallery, an in-app crypto news feed, a staking and presale aggregator and even a crypto debit card that can be used anywhere that Mastercard can be used.

BEST holders will have significant perks, including higher staking rewards, reduced transaction fees and early access to new cryptocurrencies.

Considering the growing interest in utility coins and the token’s low market cap, BEST is being widely regarded as the next 10x crypto.

Buy Best Wallet Token

Check out more picks for the best crypto to buy now in our extended list.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

![]()